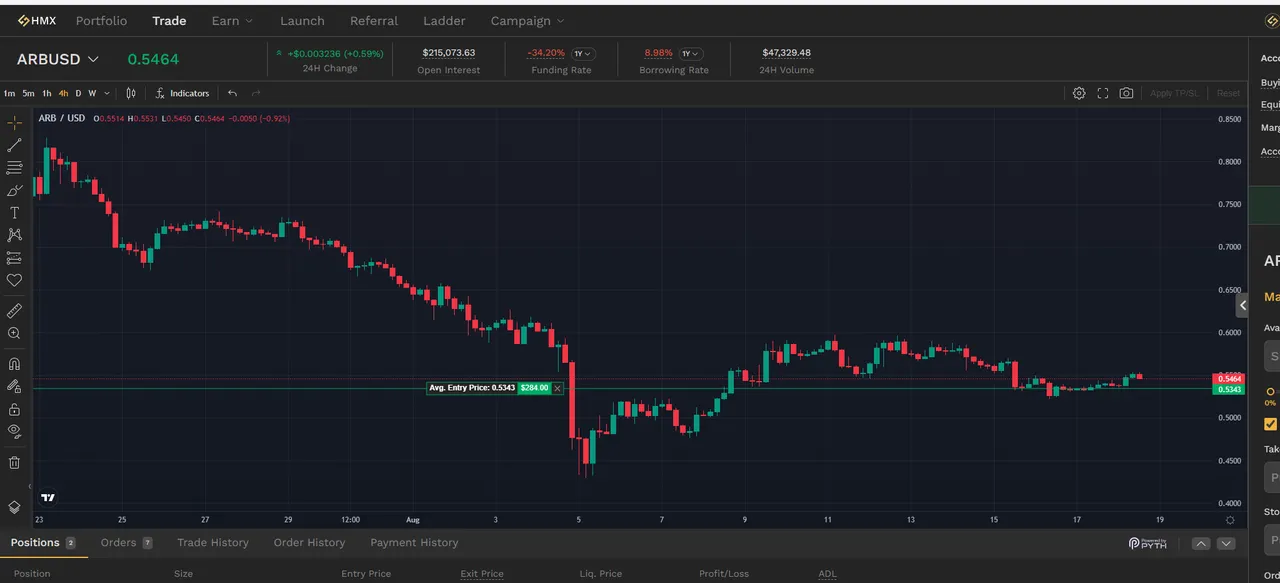

Decided to sell some arb and open a long futures position in it for now instead against wUSDM and btc collateral as the funding rate pays a nice 34% a year to hold long so why not switch the position over for a bit and get paid as long as the rate remains in favor of holding long arb it might as well be getting paid 34% on top of what ever arb decides to do and likely the funding rate will reverse at some point and it will make more sense to switch back and then maybe go short to earn the funding fee on short arb vs the long position that would be held which would make it market neutral and accrue at the funding rate for income and that could be used to buy additional btc collateral with so the positions can be expanded and expand you bitcoin holdings as well or usdc or which ever collateral you decided to use. Futures can help hedge your portfolio as well as take advantage of funding rates in your favor to replace long or short positions held a different way like by borrowing and lending. Do which ever offers the best risk to reward on the capital.

Maybe the proceeds of some of the carry trades like that could be good to add into the SPS dao and earn some fees on the capital we have. The capital could be deployed into market neutral trades and make substantial fees by hedging its holdings as part of its treasury management strategy.