A typhoon brought the temperature down a few degrees last weekend, but Obon - when the spirits of the Japanese ancestors return and people visit family graves and temples - brought back the sweltering heat and humidity. If any stray ancestors came my way it would have been through the air-conditioner duct as I spent most of the week like a hermit in his cell, shut in my room with the air-conditioner ON. I'm a modern hermit, mind you; one that likes a few mod-cons such as air-conditioners and beer-stocked fridges, oh and a supply of Chianti flown in from Italy, and tonic water to make myself a Chianti spritzer or two to see me through the afternoon...

Anyway...

This week at home has been a most opportune time to review my Hive growth strategy and adust some of my goals for the rest of 2025...

I say "opportune" because my free week happened to coincide with LEO's massive price spike from around 0.0165 Hive back in May to over 1.1 Hive this week, or around $0.23 per token. Blimey!

Unstaking LEO

Last week, I unstaked all 3,648 of my LEO tokens, hoping to catch the spike before the sell-off! A few weeks ago it would have been amazing to think that 1 LEO would ever be worth MORE than 1 HIVE. (Of course, the inLeo crowd are sure it's going to be worth more than a dollar pretty soon - and I hope they are right, but I'm not banking on hopium.)

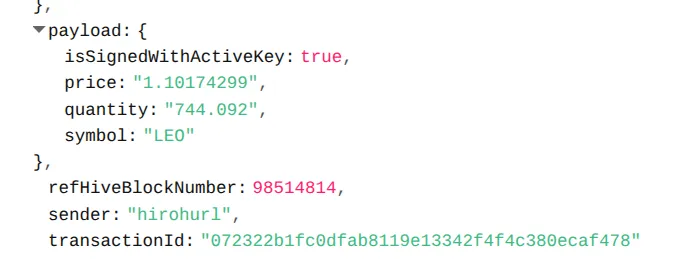

The cooldown period when you unstake LEO is 28 days in four transactions, with the first quarter becoming liquid seven days after you unstake, so not too bad. My first quarter went liquid a couple of days ago when one LEO was still over 1 HIVE and so I SOLD the whole lot as quickly as I could. Here's the biggest batch that I sold from that session:

It seems only right to make hay with LEO when the Sun is in the constellation of Leo.

Selling LEO = A Change of Strategy - Funding the Flywheel

On 1st January I set myself a target of 10,000 LEO by the end of the year. I had no idea that the token would pump and hadn't set a price target for selling the token. However, when a token increases in value by over 1,300% it seems like a good time to take profits, at least on 25% of my stash - let's see what next week brings when the next 25% goes liquid...

What did I do with the loot? I put it into a bunch of liquidity pools, with the intention of creating a "flywheel."

Liquidity Pools

From now on, I want to use selected Tribaldex liquidity pools for yield farming, and then convert my earnings into a HBD to reduce volatility while collecting 15% per annum (provided the witnesses don't lower the rate). That is the GOAL of the flywheel, to build up HBD savings.

For the time being however, I need to build up my liquidity pool holdings before I start yield farming. These are the pools that interest me:

- LEN:LENM

-SwapHive:PWR

-SwapHive:CENT

-CENT:POB

-CENT:BEE

-SwapHBD:CENT

The liquidity pools will also be topped up with mined tokens via LENM, LEOM.

Delegations

Another part of the flywheel will be delegations. I want to add LEO.VOTER to my list of delegaton targets so that I can start earning back LEO again.

Outside Flywheel Feeders

The flywheel will also be fed by Bitcoin backed loans, which will be paid off by profits from affiliate marketing that come to me in crypto. See this blog post for more info on Bitcoin backed loans:

@hirohurl/using-bitcoin-to-borrow-usdt

Let's see if all this will help speed me on the way to 120k HBD - and $1,500 per month in interest earnings!

Cheers!