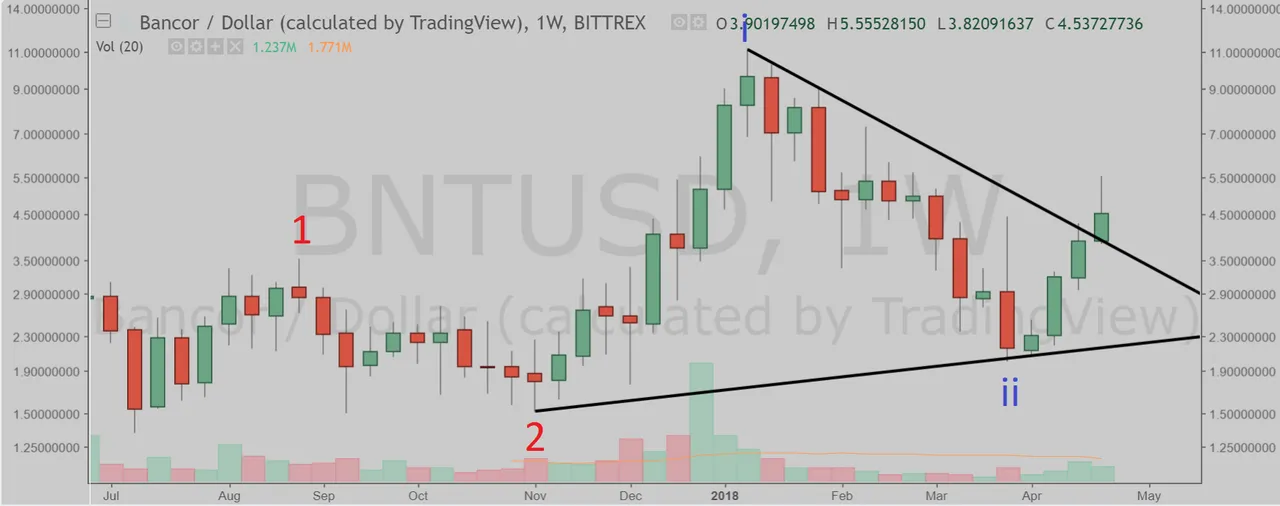

Bancor (BNTUSD) has broken out of the triangle pattern in the daily chart.

(Chart courtesy of Tradingview.com (log scale))

Elliott Wave Analysis

In Elliott Wave terms, Bancor began a wave one advance on November 12, 2017. The red wave one (blue sub-waves i-ii-iii-iv-v) finished on January 10 this year, and the red wave two (blue sub-waves a-b-c) correction ended on March 30. If this wave count is correct, Bancor should be heading next towards the January 10 peak in the red wave three.

(Chart courtesy of Tradingview.com (log scale))

Looking at the weekly chart, I believe Bancor is currently in the red wave three (blue sub-wave iii). The red wave three began on November 12, 2017.

(Chart courtesy of Tradingview.com (log scale))

Funnymentals

Bancor is a decentralized liquidity network that provides users with a simple, low-cost way to buy and sell tokens directly through their wallets. Crypto Beadles published a good video earlier this month about the project and what to expect.

(Sources: https://about.bancor.network/ and YouTube)

If you think this analysis is correct, upvote this post (min $0.01) and upvote the comment (min $0.01) "Bancor will takeout the January 10 peak"

If you think this analysis is wrong, upvote this post (min $0.01) and upvote the comment (min $0.01) "Bancor will drop below the March 30 low".

If you think Bancor is in a range, upvote this post (min $0.01) and upvote the comment (min $0.01) "Bancor will stay in a trading range between the March 30 low and the January 10 peak until June 2".

You can upvote the comment until 3 PM EST April 30 and you can upvote only one comment. 50% of SBD from this post will be distributed equally to the winners. The winners will be determined by the price action (which one happens first).

Bonus

I will be sending one Trophy Token (@trophy-token) to everyone who manages to get these crypto contests right seven times in a row. If/when you accomplish this, please contact me at Steemit Chat with your BitShares address.