In early December I posted the 5 Reasons I Sold My Cryptos and at the time I copped a bit of flak about it. Among other things I was accused of selling the Doomsday scenario and I’d have to admit that I was a bit unpopular amongst Crypto-Bulls at the time. 7 weeks later and a lot has happened since. I have more followers now and there have been a few people telling me they wished they’d seen my old post earlier. Such is life.

Source

Anyway, I’m rested up from the holiday period now and have been focusing more on writing here on STEEM. I’m feeling a bit more optimistic about the Crypto market too. I thought it was a good time to go back and have a look at those Risks I had identified and see if they’re still relevant. You might need to go back and read that old post HERE as it will explain the Risks and put the below comments into context.

Source

Bitcoin Cash has had a few attempts at flipping SegWit Bitcoin and yet remains in the shadows. I had been concerned about the higher BTC fees and the possibility of BCH making inroads but they aren’t getting a lot of traction with exchanges and with the Lightening Network apparently just around the corner this risk seems reduced. Also reduced is the knock on risk of BTC bringing down the whole alt-coin market. I have recently written about Ethereum getting more trading pairs on many exchanges and potentially taking over the role of Gateway Crypto as BTC falters and this gives the rest of the alt-coin market some redundancy if BTC does fail. Overall these Risks are still present but they are lessenned.

I still do have some concerns about Tether and Bitfinex. As the market has contracted over the last month or so I have been on the lookout for any news of Tether refusing redemptions back to US Dollars, but nothing so far. I did raise an eyebrow when I saw that Bitfinex was requiring $10K USD deposit for new accounts and wondered if that was a cash flow related decision but I consider this current correction to be a reasonable test of Tether solvency. If it has survived this long it might survive long enough to reach the next Crypto rally. I currently consider this to be the new #1 Risk though, so keep an eye out.

I feel for those investors who got caught up in this Ponzi, but from a broader market perspective I am very glad this Ponzi has inevitably collapsed as it takes one of the risks out of the picture. I do think the collapse of BitConnect may have badly impacted on broader market sentiment, but it wasn’t as bad as I feared and I believe it has now been priced in. It is always good to see bad market errors get flushed out like this and so this is actually good news.

Source

In early December the SBD Pump really had me spooked. It didn’t make sense and one of my Golden Rules is that if you don’t understand what’s happening in a market then GET OUT. I was concerned SBD was being used for Safe Haven demand by insiders but I have been watching it closely (even writing about it) and due to correlations with the broader market I have come to the conclusion that this is not Safe Haven demand, but Speculative Excess and possibly Manipulation. Now that doesn’t mean it’s a good thing as Speculative Excess can cause big market volatility and Risk in its own right, while Manipulation is unethical. Regardless I am redefining this Risk and discounting it heavily.

Source

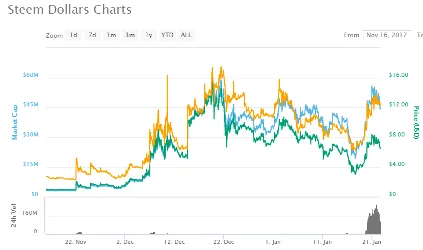

We did finally have the overdue correction with Bitcoin and others having 50%+ drops after hitting highs in December. Going back over my old post I did have a good laugh when I read this snippet again :-

BTC is possibly going to go on and double its price in the next month but it’s going to do it without me on board.

It actually did almost double from the time I wrote the post, but BTC and others have now pulled back to be lower than it was when I wrote it. So the History of big price corrections has played out and the current Technical Analysis suggests we are into a new consolidation phase where sentiment is shaken, but not broken. If it was going to crash harder than it has already then I’d expect it to have happened by now. If you have a look at the volume spike on January 18 that could be the capitulation low, but we had similar volume on December 22 so we might get 1 more. I’m looking for that big volume spike and a sharp reversal to the upside.

Overall, out of the 5 Risks I identified in December, only 1.5 of them are still in play so I see that as a very encouraging thing. It has been debateable whether I should have identified a 6th Risk as being a Regulatory Crackdown. My personal opinion is that Banning Crypto would be a totally counter-productive move by any Government. I’m not saying they won’t try, but I think any country which Bans Crypto will be left behind and will only succeed in driving Crypto underground, while those countries who embrace it will prosper. I think some of the smarter Governments are figuring that out and are instead trying to work out how to tax it or otherwise benefit from this new phenomenon.

Source

If we have a quick review of the last 7 weeks we have what I would consider a pretty classic blow-off top happening on December 17 with Bitcoin hitting an All-Time-High of nearly $20K USD, followed by a pre-Christmas correction as people took some profits. Then we had a fresh wave of optimism for the New Year, followed by some FUD caused by a rogue South Korean politician who spooked the market with the threat of a ban. The South Korean public responded with disapproval and now we have South Korea trying to apply some taxes to exchanges, which they are going to LEGITIMISE in the process. This is actually somewhat bullish. There is an old adage in markets that suggests you are near the low when a market sells on any news, good or bad. I think that might be happening now and we are only trending lower due to Weaker Sentiment and Technical Traders who are following the downtrend while ignoring Fundamentals.

Source

As a result of all this, I am moving some of my Fiat Reserves back into Crypto this week. I think there is a reasonable chance we’ve either seen the low, or we are about to see it and the current market setup looks like an opportunity to buy some good alt-coins at a discount. I am still wary of Bitcoin, but I do have some research to do regarding the timing of the Lightning Network implementation. I concede that there could be some uber-bullish news for BTC coming out soon but don’t hold your breath. Stay tuned for some more information on that front.

DISCLAIMER – This information is for general information only and should not be taken as financial advice. I am not a financial adviser and I encourage all readers to seek independent financial advice before investing in any Cryptos

https://www.pinterest.com.au

https://www.projectsmart.co.uk

https://coinmarketcap.com

https://bitcoinwisdom.com

https://thornleyfallis.com

https://www.reddit.com