Recently we have been seeing a few countries like India and Russia debating the way forward for how taxes will actually be calculated for Bitcoin and cryptocurrency in general. While some have chosen to be more hands off, others have chosen a more aggressive tax policy. The thing is, with cryptocurrency like Bitcoin where the government doesn't know if you own it or not. Economics needs to be used to realistically find out what people would be willing to pay.

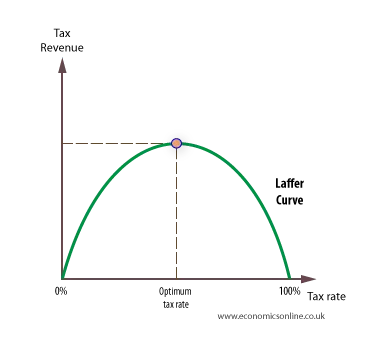

In economics there's the idea of tax policy as needing to be handled very softly. Basically there is a point where if you tax too much, people will go to lengths to hide money and not pay at all. So hypothetically if you make the tax lower in some situations, you would actually make more money overall. This type of thought especially needs to be transferred over into tax on cryptocurrency.if it isn't I believe that governments are going to have a bigger problem than expected.

Obviously no one wants to pay taxes, but if we are getting double taxed or going to pay a high capital gains tax no one is actually going to pay. Benjamin franklin said there are only two things certain in life, death and taxes, so it is unrealistic that countries like the United States would ever just completely not tax it. However there is a value to paying taxes , which would be to moving some of your gains to the stock market which is a safer investment over a long period of time. The key is to diversify and not hold all your assets in crypto so if one market is hurting you don't lose everything.

So what options does the government actually have in taxing crypto, or rather what would I recommend they do? First of all if Bitcoin is being used as a currency, in exchange for goods, only sales tax should apply. If money is pulled directly into dollars, pounds, euros ect. Then there should be something like an alternative money tax similar to sales tax. Something like 5-10 percent , no more. If the rate is any higher people will do what they have done since the beginning of modern civilization, hide money.

There is also a possibility that those who don't want to pay a high tax rate, will migrate to other countries in order to pay a lower one. Countries that are tax havens or have very low taxes will benefit with the influx of new money and there will be little that the countries people are leaving can do about it. You're still technically supposed to pay taxes even if you move to another country if you are an American citizen, but with no way of actually enforcing it, it's near impossible to collect. Ultimately they will just be missing out on revenue that could have been made by making a smarter long term decision.

After all is said, no matter how you feel about taxes , even though they could definitely be appropriated better. There is a marginal benefit to them SOMETIMES. However countries that don't adapt to lower tax plans for crypto will soon find out what happens.