From Coindesk

With all the panic selling following the Chinese government's renewed crackdown on bitcoin exchanges, it's important to remember that the country is no longer the trading hub it once was. All else equal, that means the market may take less time to recover from the latest sell-off than from the one that took place in 2013 (you know, when the People's Bank of China suddenly declared that bitcoin was not a currency and ordered payment processors to stop accepting it).Read more: https://www.coindesk.com/china-shmyna-bitcoin-trading-way-distributed-now-anyway/Just a reminder of how bad the fallout from that that really was, during the three years it took bitcoin to recover from those bombshells, it lost nearly half its value, dropping from an all-time high of $1,150 to under $500.

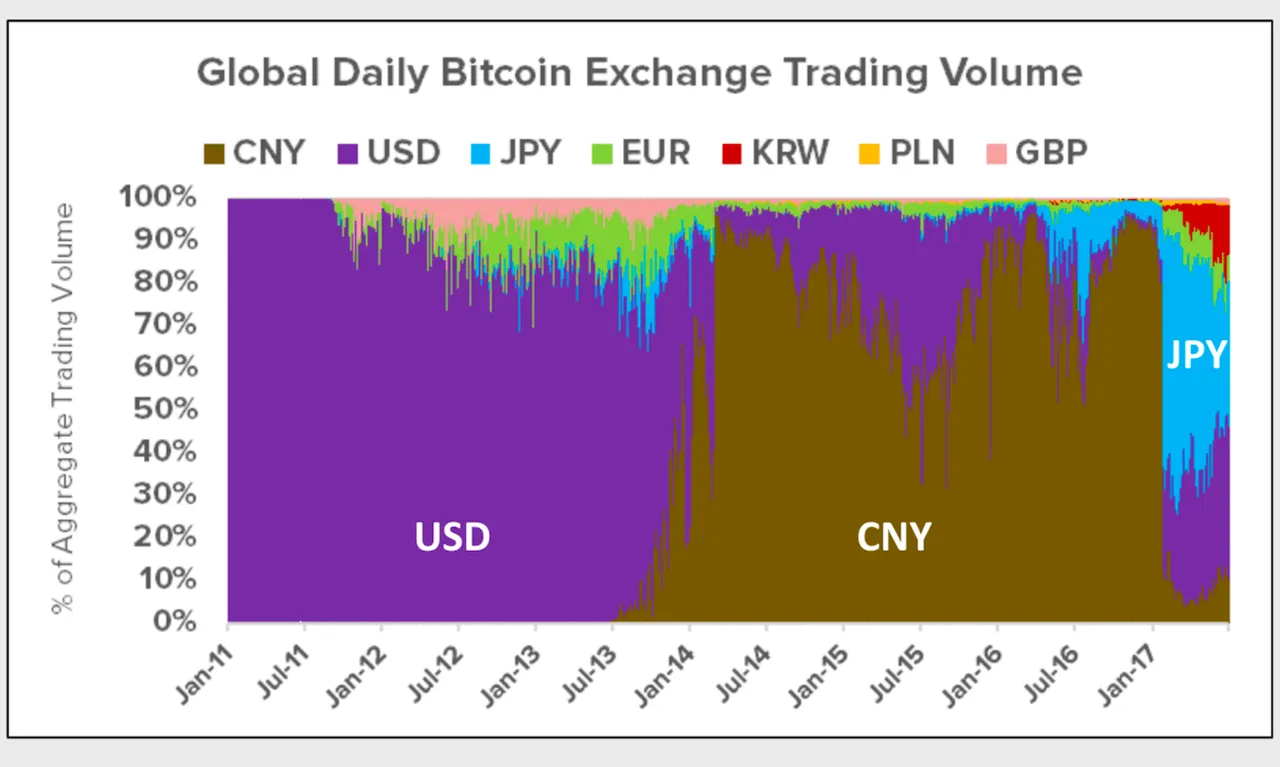

But that was at a time when Chinese bitcoin trading accounted for as much as 90% of global volume (as shown in the chart below from CoinDesk's second-quarter State of Blockchain report.)

This state of affairs persisted until as recently as January of this year:

After hearing the news of China cracking down on exchanges I really thought we would see a much larger crash then we did. I'm glad to see I was wrong.

Leave your thoughts in the comments.

Follow @contentjunkie to stay up to date on more great posts like this one.