The central bank's tough move equates to banning Bitcoin exchanges. This will not strangle the country's Bitcoin economy - but negate the huge benefits that Bitcoin could bring to India.

The Indian edition of Economic Times reported a somewhat disturbing news from the Central Bank of India (RBI) on Saturday. It has effectively banned all regulated banks and payment service providers from "collaborating with or providing services to individuals or companies trading or using virtual currency."

This is not surprising. Already at the end of 2017, there were indications that the central bank wants to ban Bitcoin. Finance Minister Arun Jaitley said very clearly in February 2018: "The government does not consider cryptocurrencies as legal tender and will take steps to eradicate the use of crypto assets for illegal financial activities or as part of the payment system."

For the country's crypto exchanges, the central bank's hard line obviously means that its customers will no longer have the ability to deposit money to buy bitcoins and other cryptocurrencies. As Gadget360 ° reports, the ruling has promptly borne fruit: both the HDFC and Yes Bank have informed their customers that they may not continue to use their bank accounts, credit or debit cards to buy Bitcoins or other virtual currencies.

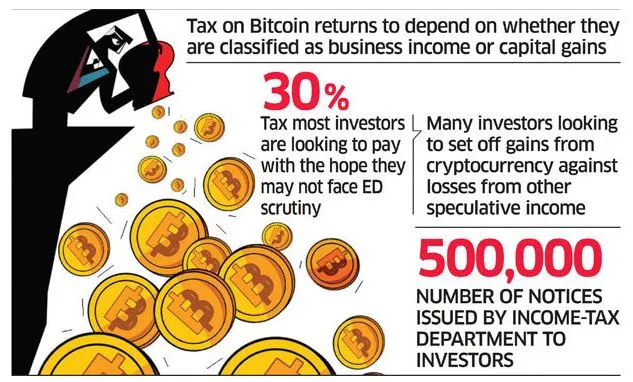

Some advisers are telling clients to pay the maximum 30%, hoping that this may protect them from the attentions of government agencies such as the Enforcement Directorate, insiders said.

"Not surprising, but stupid"

The Indian magazine has tried to get statements from representatives of the Bitcoin exchanges of India. The only answer came from Koinex CEO Rahul Raj. He said the announcement had hit the markets in any case. Both the values of tokens and the trading volume had fallen significantly. However, he also believes that RBI has given the banks some time to settle any outstanding obligations. "This time is essential for the crypto industry to initiate a dialogue with the regulators and work out a common strategy."

Less friendly was an anonymous employee of a large Indian crypto exchange: "This is not really a surprise, but it is stupid". The government and the banks are the ones that cause the big scam in the world, "but they say Bitcoin is being used for illegal purposes." He says that already in January the bank accounts of the crypto exchange were frozen and there were campaigns in social media to keep people away from cryptocurrencies.

Siddharth Devnani, an expert in the crypto industry, explains Gadget360 ° that some banks have already begun to block the accounts of exchanges in recent months. He assumes that RBI's order will cause all banks to do the same. He calls this "almost a complete ban on exchanges," and looks at it rather with concern: "Peer to peer sides and other groups that already exist will fill the vacuum, and many more trading platforms will be created that fly under the radar or outside of India. "The consequences will be that bitcoin trading will be completely unregulated, further increasing the risks of fraud and money laundering.

Somehow understandable, but counterproductive

It is understandable that the Central Bank of India is worried that Bitcoin and other cryptocurrencies will be misused for illegal activities. Since the end of 2016, RBI has been determined to fight the epidemic black markets in India, for which it has also [withdrawn a large part of the cash](It is understandable that the Central Bank of India is worried that Bitcoin and other cryptocurrencies will be misused for illegal activities. Since the end of 2016, RBI has been determined to fight the epidemic black markets in India, for which it has also withdrawn a large part of the cash used. This significantly boosted awareness of Bitcoin and made India one of Bitcoin's new big markets. It was no coincidence that the event coincided with the start of the big Bitcoin rally, which peaked at more than 14,000 euros earlier this year.) used. This significantly boosted awareness of Bitcoin and made India one of Bitcoin's new big markets. It was no coincidence that the event coincided with the start of the big Bitcoin rally, which peaked at more than 14,000 euros earlier this year.

The ban on banks doing business with Bitcoin companies, however, could have a rather counterproductive effect. Firstly, as Devnani explains, it can bypass P2P marketplaces such as LocalBitcoins, making it possible to continue using cryptocurrencies for fraud and money laundering. By weakening or effectively abolishing regulated exchanges, the government will find it even more difficult to control the market.

At the same time, the central bank deprives India of the opportunity to benefit from the crypto-revolution. For hardly any other country in the world can Bitcoin be as useful as it is for India. The country has a well-educated, English-speaking work force that sells its services - be it telephone support or software development - to international markets. India is also the largest recipient of remittances from migrant workers abroad. Both one and the other benefits massively when financial transfers are made quickly, safely and without expensive middlemen.

But it seems the central bank has cut this opportunity. Because without liquid exchanges, Bitcoin will be much less useful for such purposes.

Image Sources:

- Post header created by myself

- https://economictimes.indiatimes.com

- https://www.forbes.com

Have a nice day!

LOVE&LIGHT