Status of bitcoin non-commercial bookmakers:

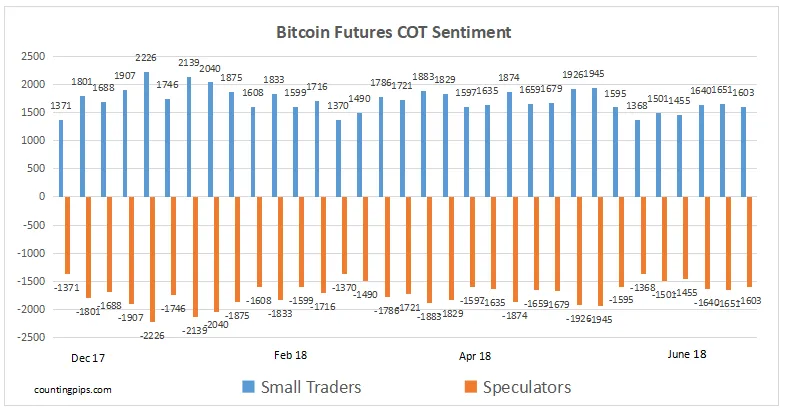

According to the latest commitment of traders (COT) issued by the Commodity Futures Trading Commission (CFTC), large cryptocurrency speculators in the bidcoin futures markets this week have reduced their net recession.

Non-commercial futures contracts of bidakoin futures traded by big bookmakers and hedge funds, recorded the accuracy of 1,363 contracts in the data reported through Tuesday, July 31. This was a weekly increase of 48 contracts from last week, in which the total was 1,651 pure contracts.

After two weeks of low recession, the contract of speculative slowdown has declined. The overall recession has remained above the -10000 net contract for the third week.

In the meantime, small traders have cut their existing enthusiastic positions evenly by offsetting -48 contracts at the current enthusiastic level of 1,651 pure contracts this week.

Bitcoin Futures :: COT Data: bookmakers versus small traders

Bitcoin futures data is in the third week since the beginning of Cryptocourrency futures data release on December 19. The data includes business classification of not only speculators and small traders, and commercial traders (usually business hedges or producers of a product).

Since the introduction of bitcoin data release, bookmakers have been on the downside to this market, while small traders have continued the Net Bullish situation.

Bitcoin as per USD :

From Tuesday to Tuesday, in the weekly reporting time-frame, Bitcoin Cryptocurrency futures closed at around $ 7710.1, according to informal market data, the loss of $ 5,547.54 was due to the previous closure of $ 8257.64