What happens when miners stop mining?

Every Bitcoin miner has a minimum price to mine at. This price affects the decision to invest in mining and/or to continue mining with existing hardware. It may be the minimum of one of the below:

1. A price below which mining cannot be justified by its direct profit.

This is the price where the running costs + normal profit margin are not met. Ie. the miner is operating at a loss or insufficient profit to be worth the effort.

2. A price below which mining cannot be justified based on a longer term profit outlook.

Some miners will continue to mine at a loss based on the idea that "continuous uptime" of the network provides a rationale for future customers to buy their Bitcoin. If the Bitcoin network doesn't go down just because of a price collapse, it gives confidence in the token, so that in the future the miner can expect to be able to make profit that will compensate for a temporary loss. This is similar to how some retail businesses run even on slow days or late into the night, even at unprofitable times, so that their customers will always have confidence that the shop will be open when they need them - providing reliability makes for reliable customers. However, there is still a price where the expected loss is too much to be justified by potential future profits.

3. A price below ideological value

An ideological miner is one who mines not just for profit, but who is willing to mine at a loss because they believe in contributing to the continued operation of the Bitcoin network as a public good. While it's unlikely that an ideological miner will have a specific price in mind, they also only have limited resources that they can commit. There is a price below which they would be burning resources at a rate they cannot afford, or cannot sustain for long.

4. Inertial price

There is also a price (or period of time at a price) that overcomes the above plus inertia. For some miners, particularly the larger operations, turning machines off, cancelling electricity contracts etc. means that it takes effort and incurs costs to disable machines. Inertia will cause some miners to continue operating at a loss, but only if the price does not appear persistent. In some cases, they may decide to shut down mining, but the execution of that takes time, and as such mining at a loss continues for some time even after the decision has been made.

What happens when the price of Bitcoin goes below these prices?

For many miners, all 4 may be the same price. For some, 3 may be $0, and if so, they will continue to mine no matter the price, for a time at least. However, the lower the price of Bitcoin is, the fewer miners for whom the price will be above the minimum of the above, and the fewer miners will continue to run their machines.

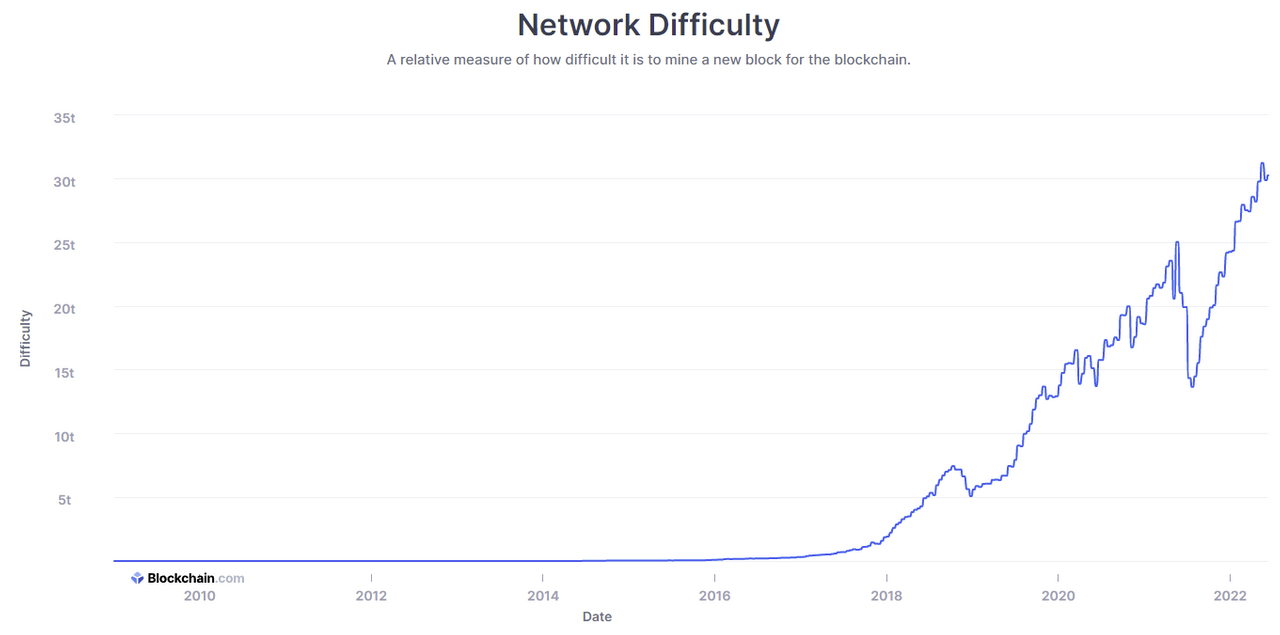

Difficulty adjustment

Bitcoin mining has a factor called "difficulty" which adjusts regularly to ensure that the network is always producing blocks at a rate of approximately once every 10 minutes. In this way, Bitcoin remains adaptive and reliable even as the hash rate of the network changes. Usually hashrate is growing, so usually it only has to adjust upwards. In rare cases, the network adjusts difficulty downwards, and cases of sustained declined hashrate are even rarer, where the network makes a series of downward adjustments. The largest difficulty adjustment ever was in July 2021, after a sustained decline in hashrate over the previous few weeks.

https://www.blockchain.com/charts/difficulty

Although it is often said that Bitcoin difficulty adjusts every two weeks, in truth it only adjusts after 2016 blocks. If the network is operating normally, ie. 10 minute blocks on average, that will be two weeks. In a situation where hashrate has substantially declined, the period to adjust will necessarily be longer than that. If the network was operating at half-rate for a full 2016 blocks, it would take 4 weeks to adjust. In addition, there is a limit to how much the network can adjust at once - it can't increase or decrease difficulty more than 20% per adjustment. With a persistent and substantial enough drop in price, causing a persistent and substantial enough drop in hash rate, the Bitcoin network would not adjust enough return to 10 minute blocks after a single adjustment. If the same hash rate continued, it would take more than 2 weeks and another adjustment at least before returning to normal.

Death Spiral

A persistently low Bitcoin price can cause persistent problems on the Bitcoin network. Persistent problems on the network could be expected to cause further damage to the price of Bitcoin and even the ability for miners to transfer and sell their rewards (it takes 100 blocks before a coinbase transaction can be spent). This could become a feedback loop, where a declining price reduces hashrate, causing more problems which in turn result in a declining price and so on.

Hard Forks

Changes to the Bitcoin difficulty adjustment mechanism can be made that resolve this problem and/or revive the network. While it would be a technically simple thing, there is little certainty of a network being accepted as "Bitcoin" and honoured as such widely across exchanges, especially before the existing network has stopped producing blocks entirely. Unless well coordinated and executed, a hard fork that replaces BTC would be extremely problematic for the exchange ecosystem and all businesses in the space. Further, those who are familiar to the history of Bitcoin will be aware of how executing a hard fork today would underminee the ideas and legitimacy of Bitcoin, due to the contentious history of hard forks in the project.

Conclusion

There does exist a price, as long as the price persists, below which Bitcoin blocks come in very slowly and cause the network to operate a constrained rate. The reduced hashrate not only undermines the networks capacity to function for transactions, but to adjust to the reduced hashrate.

While the network is much more resilient than a simplistic cost/price analysis would suggest, it is still absolutely dependent on the token itself maintaining a sufficiently high price to continue operating. How high that price is, is not clear. Historically Bitcoin has survived one major and persistent decline in hash rate, but this does not guarantee that it will survive any such decline. Hard forks will ensure that some form of continuation will occur, but that the continuation will be considered "Bitcoin", that your coins on exchanges and other services will be honored as such or that they will continue to commmand a high price is very much not clear.