For those new to crypto, all they see is the surface.

The intricacies and technical aspects are lost to many.

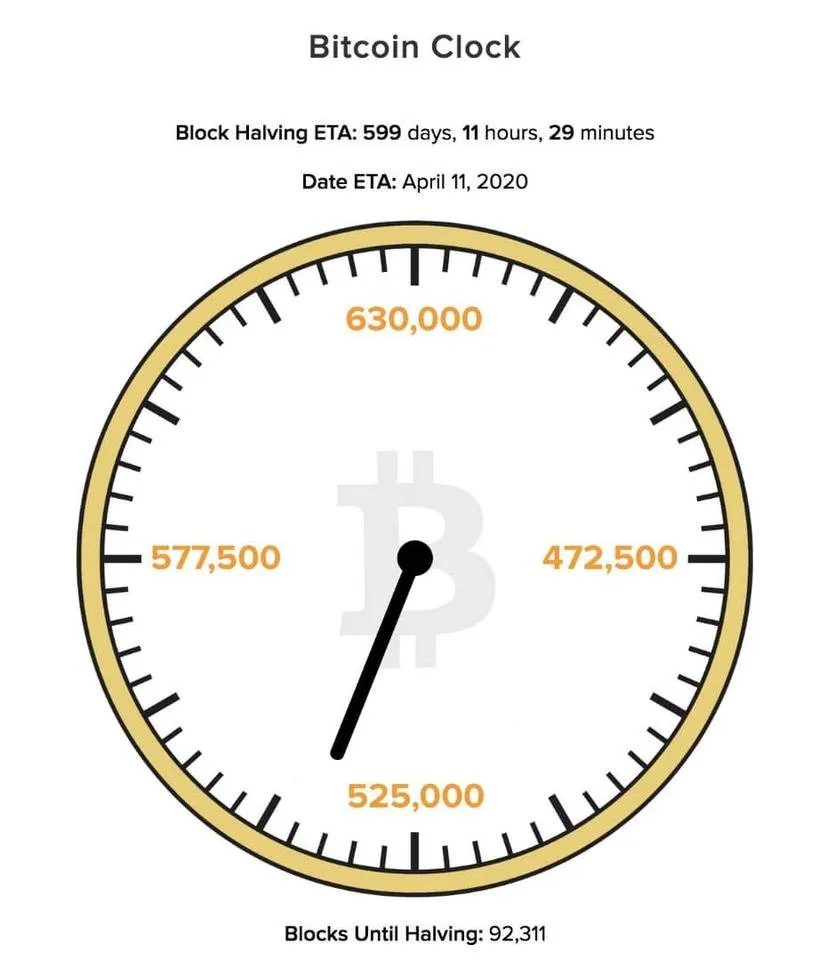

One if the more confusing aspects of bitcoin seems to be the halving of the block rewards and why that is important.

Crude!

If I were to state it in lay man terms, the halving of the bitcoin block rewards is an algorithm built into the bitcoin blockchain that halves the rewards miners get for successfully mining a bitcoin block.

At the current rate, each block yields 12.5btc each time a miner successfully mines it.

By year 2020, that would be reduced to 6.25 and by 2024, would be reduced to 3.125 btc per block and so on.

The bitcoin block rewards reduce by half every 4 years or every 210,000 blocks to be more precise.

So starting from 2008, we have had two two scenarios where btc block rewards reduces by half, once in 2012 and another in 2016.

Possible historical consequence

For me basically, I feel it was an amazing idea to build this into the blockchain as it reduces the amount of bitcoin people can gain.

This adds to the rarity of bitcoin and as more people store btc without spending it, we can expect demand for it to go up.

One thing I have noticed is that one year after the halving of block rewards for btc, it always hits a new ATH.

In 2013, one year after the block rewards were halved, btc hit an all time high of $1000 or thereabout, before going on a 3 year dip till 2016, by 2017, one year after the second halving of btc block rewards,..... Well, we all kbow what happened.

Big question

So the big question now is, will btc continue this trend? Do we have significant historic data to show that btc will increase to a new ATH probably in 2021?

Bitcoin is not even up to a decade old, who knows what lies ahead.