After the 666 point drop on the 33rd day of the year on Friday, which I said likely was a signal that things were going into play, the Dow Jones Industrial Average (DJIA) lost as much as 1,597 points by mid-afternoon on Monday.

The Dow ended up closing down 1,175 points, or 4.6% which was the largest single-day decline for the blue-chip index on a points basis in history.

But, the Dow, like most things, has been inflated higher due to historic Federal Reserve money printing since 2008, so a 1,000+ point drop now with the Dow near 25,000 is nothing like it was even in 2009 when it was under 9,000.

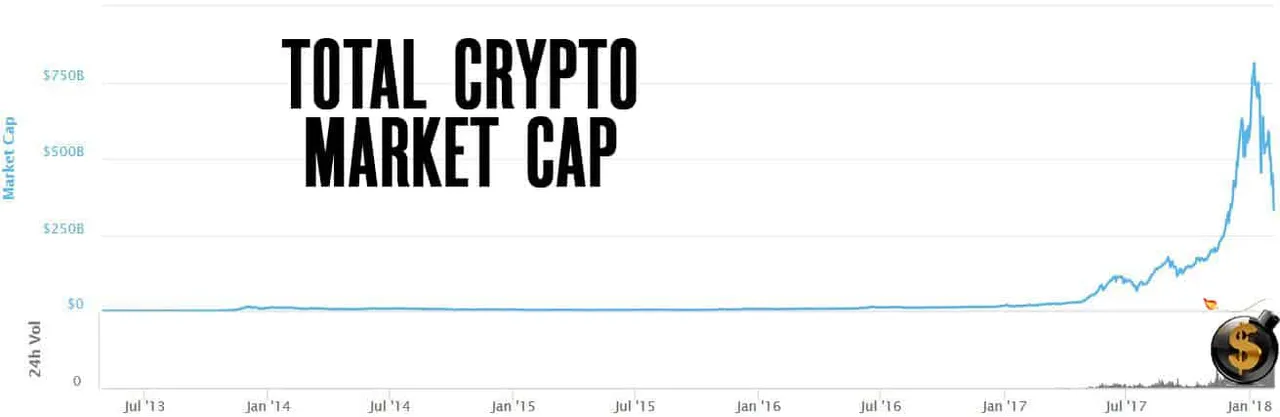

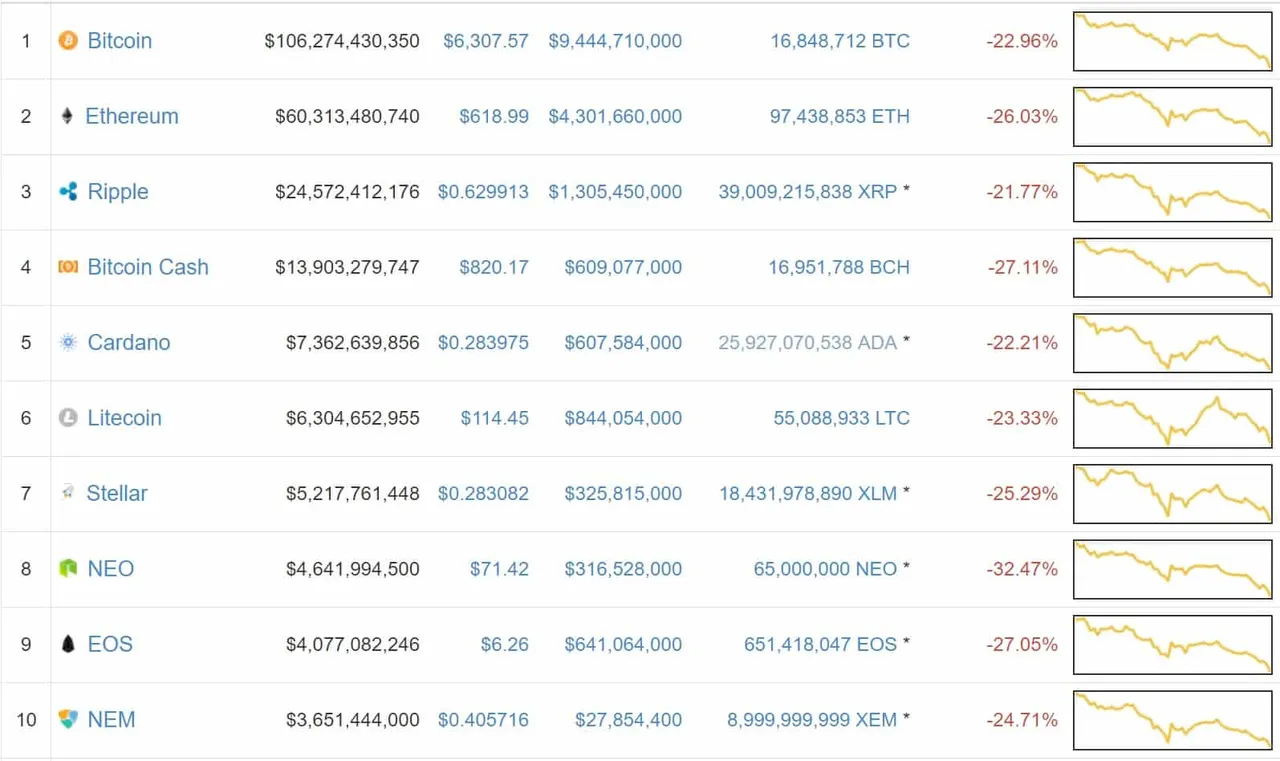

Meanwhile, the cryptocurrencies continued to get routed and have not fallen below $300 billion in market cap after being above $800 billion just one month ago.

Bitcoin is now below $6,500, Ethereum is close to $600 and every other cryptocurrency in the top 50 in market cap was massively in the red again today.

I’ve been saying for the last two months to be taking profits. This is why. I also said on Friday that it still isn’t time to buy. I’ll be updating subscribers (subscribe HERE) first when I think we are close to the bottom.

This afternoon I joined Kerry Lutz on the Financial Survival Network to discuss where things are at in the cryptocurrency space and where things may go from here.

You can see it here:

As you may have heard, Anarchapulco & Cryptopulco, from February 15-18th is completely sold out at 1,500. But we will be livestreaming the entire conference. You can find out more HERE.

The Dollar Vigilante Investment Summit still has spaces available, however, and will be held on February 19th. So, even if you couldn’t get tickets to Anarchapulco you could still come down and watch the livestream by the pool, enjoy the evening festivities and then attend the TDV Summit where cryptocurrencies will definitely be a hot topic of conversation!