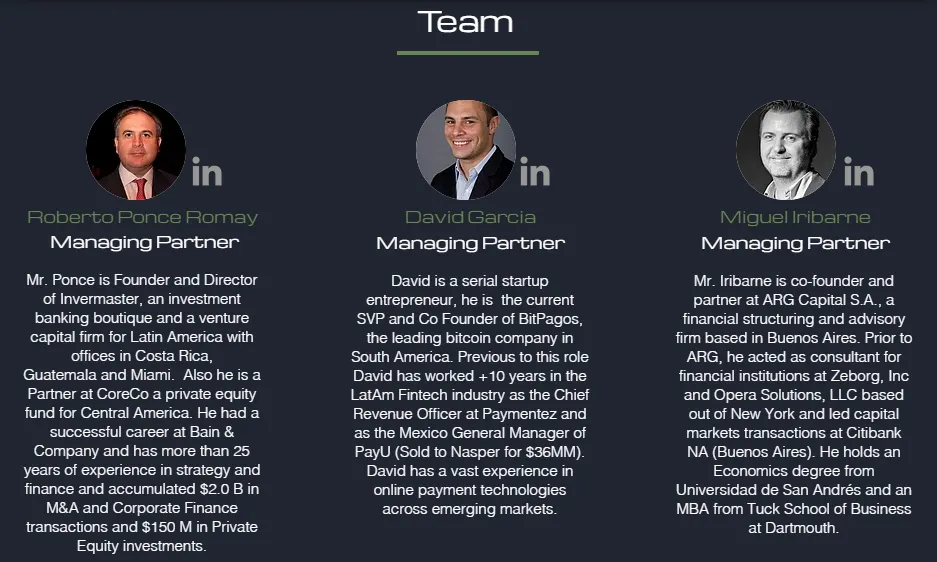

Bitcoin has paved the way for new investment opportunities in the cryptocurrency space. We're in the second half of 2017 and cryptos remain the flavor of the month, every month! Latin Americans looking at newer investment opportunities have something to look forward to in the newly formed Crypto Assets Fund co-founded by Roberto Ponce Romay, former senior-manager at consulting firm Bain & Company.

Romay is helping raise approximately $50m with this private fund that invests in Bitcoin and other cryptocurrencies such as Ethereum, ZCash, Ripple, Litecoin and Dash. Crypto Assets Fund claims itself as a unique fund as it differs from the traditional investments by diving into the crypto market that offers potentially high returns in a short term, despite their inherent volatile nature.

The first portion of funding, estimated to be valued in the ball park figure of $10m is in the final stages of completion and an announcement is expected later this month.

This service seems to provide wealthy investors with a crypto-asset in their portfolio with exposure to Bitcoin and Ethereum without worrying about tax compliance, storage complications and regulatory implications. There isn't any fees being charged on the service provide, but the fund will collect 30% of the carried interest based on certain conditions.

Half of the initial funds will be invested in Bitcoin, the remaining across other cryptocurrencies. Future investments will also be spread across certain ICOs to include newer assets and investors.

At launch, the funds will be held by Switzerland-based Xapo, with OTC (over-the-counter) trading services provided by B2C2 OTC, an electronic market maker and a UK FCA appointed representative.

You can find more information on the fund's official website here.

Remember, cryptocurrency investments are subject to market risks so irrespective of your personal choice of investment and strategy, it's wise to remember that market can move both ways.

Do you personally invest in any hedge funds? How is your experience so far?

Class Action Law Suit Filed Against Kraken

In a shocking news today, few traders on the Kraken crypto exchange platform have filed a class-action lawsuit against the exchange over issues resulting from it's flash-crash in May earlier this year and alleged mis-management of the situation.

Five customers, 1 from US, 2 from UK and Israel respectively have filed the case against Payward Inc, which operates as Kraken. These five customers had a total of 3,414.078 ETH liquidated. The amount was worth roughly $329,000 at a price of $96.32 but is around $915,276 at press time.

They have accused Kraken of negligence, breach of contract and unjust practices. They also accuse Kraken of not suspending trading amidst a denial-of-service (DDos) attack which seemed to have several impacted the exchange's ability to conduct trades appropriately.

Had KRAKEN’s exchange been functioning properly, the market manipulation and coordinated ‘flash crash’ and DDoS attack would not have affected the price of Ether in Plaintiffs’ and the Class’ margin accounts and would not have dropped the price of Ether to the depth to which KRAKEN perceived that it reached; and KRAKEN would not have implemented an automated liquidation of the user accounts holding Ether on margin.

However, Kraken has officially stated and I quote:

We cannot compensate traders for the outcome of naturally occurring events in the market, nor losses due to unavoidable DDoS attacks.

These plaintiffs have filed a lawsuit via Florida-based Silver Law Group, known for their lawsuits filed against Coinbase and now-defunt Cryptsy. Plaintiffs are seeking an unspecified amount in damages as well as compensation fees. In addition to these they have sought certification for class-action status.

The world of cryptocurrencies is filled with stories of success and scams. We've also seen big exchanges attacked by hackers, notably Bitfinex and more recently-Bithumb. In light of these events the law suit comes as no surprise as cryptocurrency markets are largely unregulated and most exchanges are driven by internal policy instead of a government mandated policy.

What are your views on this class action law suit?

- Do you feel Kraken must be held repsonsible for the DDoS attack and failure to suspend trading under these circumstances?

- Have you been a victim of a crypto exchange hack or an exchange's failure to perform to expected levels?

You may also continue reading my recent posts which might interest you:

- Let's Talk—This is Why Steemit Can Succeed In a Market Where Facebook Stumbled!

- Thank You Steemians! I've Crossed the 3000 Followers Milestone! Top Author from India and a Quick Recap!

- Dummies Guide to Basic Steemit Account Security + Account Recovery Guide! Must Read For Steemit Users!