This is a project I’ve been keeping my eye on. The token sale is complete and tokens have been distributed.

The Salt Lending model is pretty straight forward, it’s like LendingClub for blockchain assets.

If you owned some BTC for example, but needed some cash, you could borrow against them with the Salt Platform. That’s pretty cool for a couple of reasons.

First, any blockchain asset could become liquid now. And second, by borrowing against your blockchain assets instead of selling them you avoid a taxable event.

In a world where everything might soon get tokenized, that means the Salt platform could become very valuable.

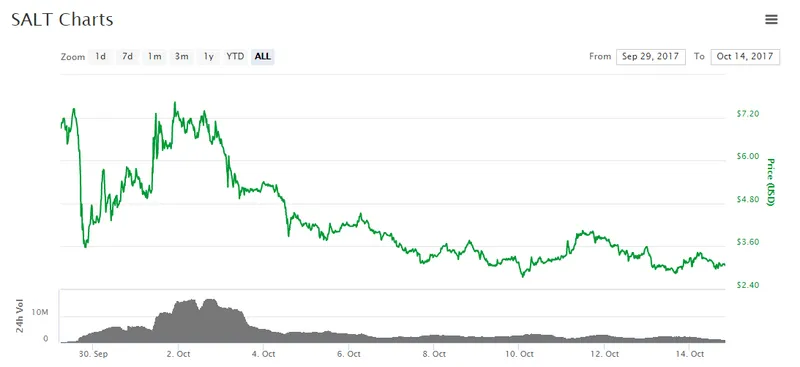

They sold tokens between $3 and $10 in the token sale and between $0.25 and $1.50 in the pre-sale.

Now it’s trading right around $3.

We’ll probably see more selling pressure in the near-term as pre-sale investors take profits. Also, the platform has not launched yet. That’s expected to happen before the year is out.

Still though, I like Salt for the long-term and bought a few tokens.

They’ll be able to get clients ranging from the individual to the institution. The SALT token membership is also likely to be cheaper to use then services like LendingClub. And I think Salt will ultimately be safer because people are putting up real collateral.

This one is backed by Erik Vorhees and I like the team.

Check out their abstract for all the details.

SALT to me looks like a good long-term crypto play.

What do you think?

For more on cryptos follow me @g-dubs and on SteemFollower

Buy Bitcoin, Ethereum, and Litecoin at Coinbase and mine with Genesis – use code jWxfye for 3% off