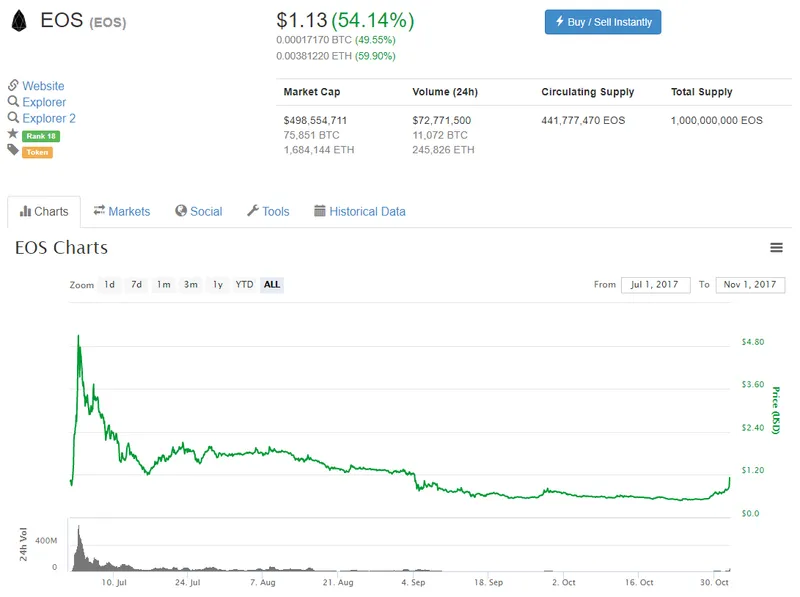

I took a look at EOS back in mid-July. At the time, it was trading around $1.35, and I decided to pass on this one thinking we would see lower prices in the future.

That’s exactly what has happened. Since my original article EOS has trended down, reaching a low of around $0.50. It’s been moving up the last few days and accelerated today. Now it trades over $1.00 again, so it’s time to take another look.

EOS bills itself as the most powerful infrastructure for decentralized applications.

It’s scalable, flexible, and usable with a web toolkit for interface development. EOS’ parallel architecture makes it scalable. Initial benchmarks show EOS can sustain over 10,000 transactions per second (TPS) and once it’s fully operational it’s supposed to do over 100,000 TPS. That’s more than Visa, Facebook, or Google. And more than Ethereum too.

The company behind EOS is block.one, a company that offers end-to-end blockchain solutions. It’s led by CEO Brendan Blumer and CTO Dan Larimer. Dan, of course, was instrumental in creating Bitshares and Steemit.

The project is progressing nicely, you can take a look at the roadmap here. In September the team released Dawn 1.0, the minimum viable product. Release of Dawn 2.0 is expected before the end of 2017.

While the development proceeds, so does the token sale. EOS is doing a unique ICO where its tokens are being released over a year long period. It started last June 26 and should run to about June 1 of 2018. You can find more details here.

Here’s a look at how the EOS token has performed so far.

EOS has been labeled as the Ethereum killer. Let’s look at a few key differences between the two.

Ethereum is application agnostic. In other words, if an application is needed, someone will build it on top of the platform. EOS has many functionalities that most applications need built-in and offers a software development tool kit. That way developers can focus on their specific use case. The Ethereum way reduces bloat. The EOS way makes development easier.

Another key difference are the governance and consensus mechanisms. Right now Ethereum uses PoW but is planning to move to PoS. With PoW you’re at risk of contentious hard forks. And there’s no guarantee a switch to PoS will be successful. EOS uses DPOS, which takes much less energy and has no risk of a hard fork. EOS has a mechanism to freeze and fix broken applications and there is a common jurisdiction for disputes.

Then there’s the tokens. The EOS token gives you a proportional share of the EOS network, but there’s zero transaction fees. The EOS supply is fixed. The ETH token is needed to pay fees in exchange for operations on the network. The ETH supply is inflationary.

This is just the tip of the iceberg for EOS. Definitely an interesting project, more research is needed. It’s enough though that I’ll likely pick up a few tokens.

For more on EOS check out the White Paper.

EOS also just released a white paper on storage. It’s combining IPFS and the EOS.io software to provide high bandwidth storage on the blockchain.

And finally, here’s an update from Dan from October 29.

What do you think of EOS? Can it compete with Ethereum?