Today, the Senate Banking Committee heard testimony from the top two financial regulators, the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

The chairman of each, Jay Clayton for the SEC, and J. Christopher Giancarlo of the CFTC, each released written testimonies prior to the hearing. Here it is for the SEC and CFTC.

Let’s see what they’ve been saying.

I have to say Chairman Giancarlo was overall positive. He compared cryptocurrencies, blockchain, and distributed ledger technology to the Internet. He said:

During the almost 20 years of “do no harm” regulation, a massive amount of investment was made in the Internet’s infrastructure. It yielded a rapid expansion in access that supported swift deployment and mass adoption of Internet-based technologies. Internet-based innovations have revolutionized nearly every aspect of American life, from telecommunications to commerce, transportation and research and development.

One of the other important points Giancarlo made is that they are used to volatile assets like bitcoin. And he noted how other asset classes, like VIX, were more volatile than bitcoin.

In all fairness he also said the cryptocurrency space needed more regulatory oversight.

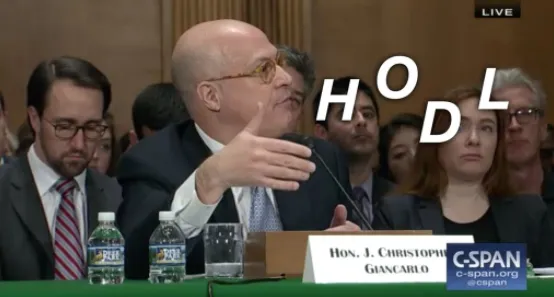

Also cool, Giancarlo explained hodl to the US Senate Banking Committee.

Chairman Clayton was a bit less enthusiastic about the space and had a bigger focus on the ICO market.

The concern of the SEC is that hard-earned money is getting sucked up in bogus projects that are outside the scope of federal securities laws. And he wants to see Americans have the full protections afforded under those laws.

He wasn’t all doom and gloom and did say:

I am very optimistic that developments in financial technology will help facilitate capital formation, providing promising investment opportunities for institutional and Main Street investors alike.

Overall I think the SEC and CFTC testimony is going to be beneficial for the space. Taking a look at the charts we formed a nice V bottom with good volume. Time will tell.

What do you think? Is the bottom in for the crypto market?

and trade cryptos on Binance