SUMMARY

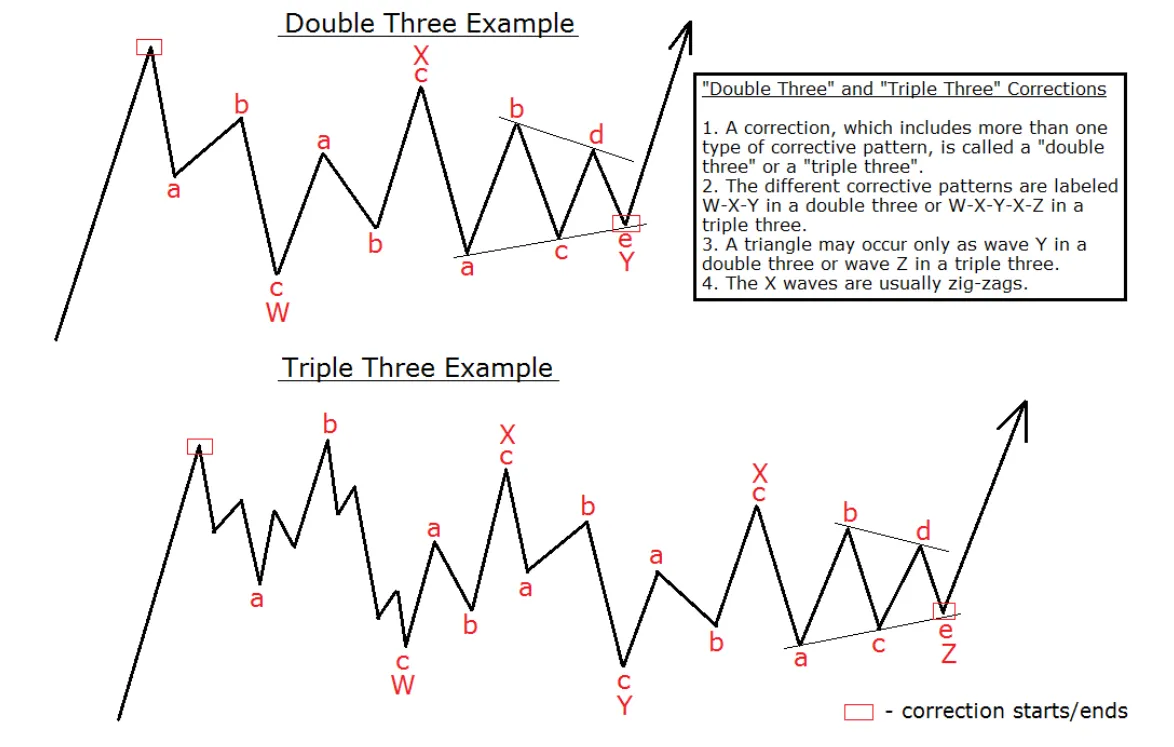

Aeron (ARN/BTC) is used to demonstrate complex combination Elliott Wave corrective counts. These are often required when price moves sideways as shown in below chart. The WXY is a double combination but at triple combination (WXYXZ) is used to delineate the price spread. The subwaves of zig zag and flats and a triangle are also noted on how they compose the parts of the complex combo. The video takes you through each step.

Here are the basics of the Double and Triple Combinations as explained by EWM Interactive.

Legal Disclaimer: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf