SUMMARY

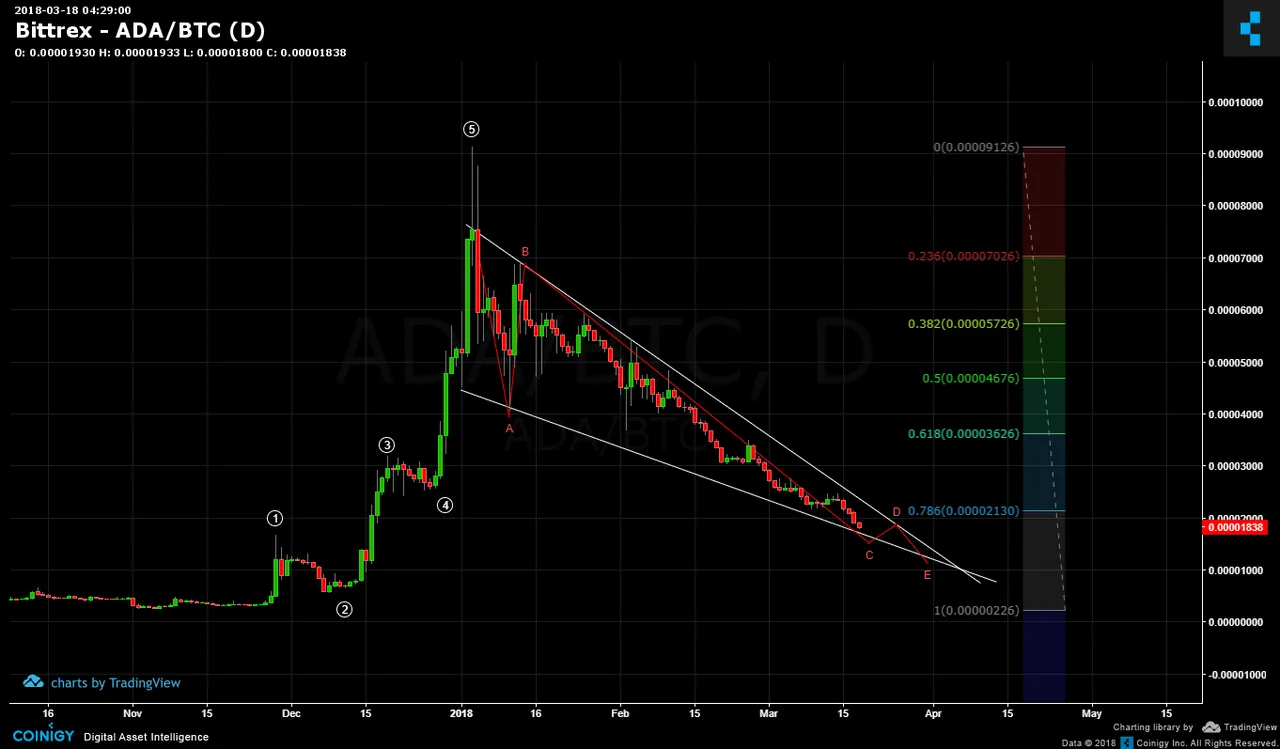

Cardano (ADA/BTC) is really playing out both the time and price extension to the correction. After placing the five impulse motive up, price has been meandering and just taking every excuse to take as long as possible. Surprised? None should be.

So, if viewed from the perspective of Fibonacci, this correction has surpassed the 0.78 Fib level and so the next likely stop point is the square root of 0.78 which is 0.88 or the 88% retracement Fib zone. The subwaves of the correction is for now set at red abcde and the c wave is about complete. The remaining d and e waves should bring price to an ideal proximity to the apex. Is this a guarantee of an all time highs? In a word, no. However, there is at the very least a breakout to be had and whether this would be the trend reversal point depends on the subsequent price action being an impulse or three wave. We need to wait.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--