Bitcoin tanked following the launch of futures products, but should that be surprising?

Bitcoin ran up late last year and peaked on a very interesting day...

The all time high recorded in bitcoin just so happened to also take place on the very same day that futures products were launched.

Coincidence?

Well, if you follow Wall Street at all, you will know that they are likely very few coincidences in finance.

Why did the peak happen on the same day as the futures launch?

My first thought was that the reason for that was because a lot of the buying that took place prior was due to excitement about the futures launch and then when it actually happened, traders locked in profits.

A sort of "buy the rumor, sell the news" type of thing.

However, the FED recently released a report that said perhaps there was more to just a "sell the news" type of event that transpired once those futures products were launched.

In fact, they went as far as to say that in their opinion much of the decline seen in early 2018 was due to short selling largely made possible by futures products.

Hmm...

Their report can be seen here:

Whether they are correct or not remains to be seen.

Though, I do have some doubts considering that bitcoin futures products are cash settled, which makes them have no direct affect on the price of bitcoin.

However, in theory someone could load up on futures contracts and then manipulate spot markets in order to make their futures bets profitable, something I would be willing to put money is going on right now.

In that context, it would be pretty easy to see how futures products have an effect on the underlying asset even if they are cash settled.

All that being said, what can we expect the future prices of bitcoin to be using other assets as an example?

The first and best example I can think of is that of gold.

Bitcoin has long been labeled digital gold, and for good reason.

Luckily for us there is readily available data for us to see what happened when gold futures first launched.

Futures products launched for gold on January 1st of 1975, 4 years after the dollar was taken off the gold standard and gold was allowed to trade freely.

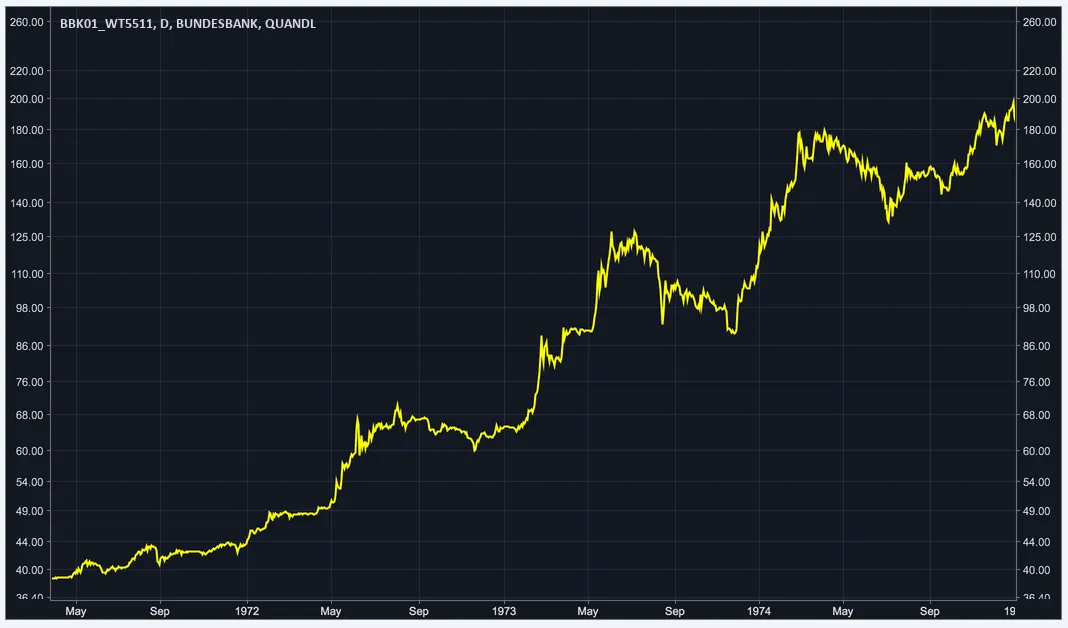

Check out the chart of those 4 years here:

(Source: https://medium.com/@obiwankenobit/bitcoin-futures-and-the-ghost-of-gold-81418864c961)

Pretty impressive chart right?

Gold went up more than 5X over that time period.

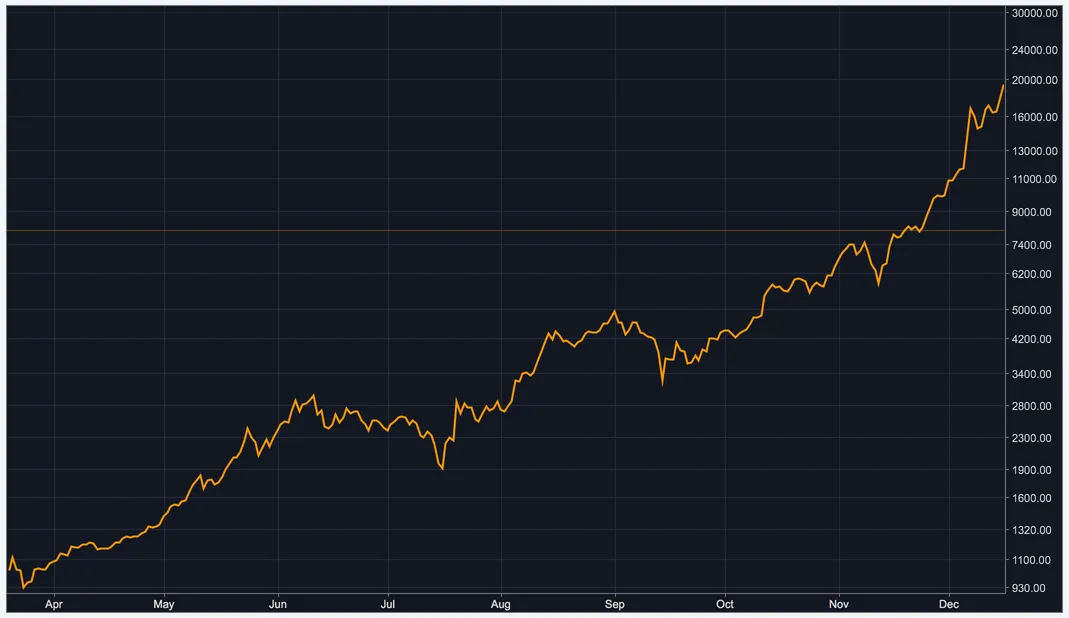

In fact it almost looks as impressive as bitcoin's in 2017 leading up to the introduction of futures products:

(Source: https://medium.com/@obiwankenobit/bitcoin-futures-and-the-ghost-of-gold-81418864c961)

Then comes the introduction of futures products...

Take a look at what happened to gold when futures products began trading on January 1st, 1975:

(Source: https://medium.com/@obiwankenobit/bitcoin-futures-and-the-ghost-of-gold-81418864c961)

Gold was trading for right around $200 the day before futures were introduced, see the green line above.

Then the price of gold fell by 50% over the next 18 months, while starting its decline literally the day after futures products were launched.

Coincidence?

Perhaps, or perhaps not, though remember what we said about coincidences on Wall Street above.

Either way, I can say that I absolutely wish I had seen these charts back in December of 2017, it might have saved me quite a bit of cash.

I likely don't need to put up a chart of bitcoin to show you what has happened to it since futures launched in late December 2017.

Given this information perhaps the decline in bitcoin shouldn't be all that surprising.

In the next post I will go over what the future of bitcoin may hold if we use the price action of gold as it relates to the introduction of futures products as a model.

Stay informed my friends.

Image Source:

https://thecryptoo.com/cme-group-launches-bitcoin-futures/

Follow me: @jrcornel