Inflation continues to spike and so do bitcoin trading volumes.

Venezuela has been hit particularly hard by inflation over the past few years, hitting fever pitch recently.

Even getting to the point where the government started asking for its citizens to stop selling the currency for other currencies and precious metals.

Yikes!

At this point the country's local currency (bolivar) is down about 95% over the past few years alone against other established currencies, IE the US dollar.

This has lead to money leaving the local currency and moving into other currencies, and into bitcoin.

Mass exodus into bitcoin?

Money has continued to flee the country and find its way into different stores of value.

A particularly unexpected one being bitcoin.

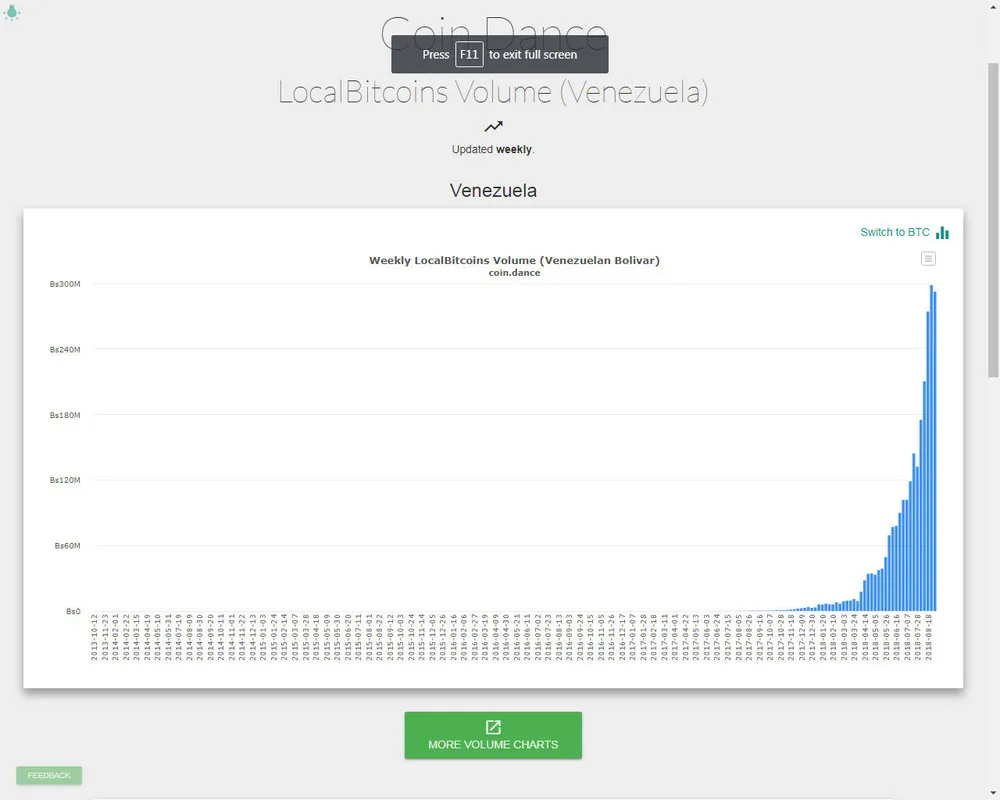

Check out the latest bolivar inflows into bitcoin:

(Source: https://www.ccn.com/bitcoin-trading-volumes-in-hyperinflation-struck-venezuela-hits-record-highs/)

As you can see, the inflows just keep climbing.

According to the above chart posted by Coin Dance, nearly 300 million bolivars were traded for bitcoin last week.

It is looking like that record may be broken this week as 292 million bolivars have already been traded for bitcoin.

Fixes continue to fail...

On August 10th the government of Venezuela basically orchestrated a reverse split on the currency, where they destroyed supply and wiped out 5 zeros off the currency.

Just like in the stock market though, reverse splits are rarely a good thing or work like they are intended to.

Since that time alone, the currency has experienced another approximately 100% inflation.

As more and more countries experience a fiat currency crisis, I would not be surprised to see money continue to flow into bitcoin.

Something that cannot be printed into oblivion, unlike fiat currencies controlled by governments.

Stay informed my friends.

Image Source:

https://www.ccn.com/bitcoin-trading-volumes-in-hyperinflation-struck-venezuela-hits-record-highs/

Follow me: @jrcornel