Listening to a phone interview by Mike Novogratz, he came out and said that the pullback we had on Friday (yesterday) caused too much damage for prices to make new highs any time soon.

So much damage in fact, that he decided to postpone his Galaxy Digital Assets Fund launch, which was scheduled to launch by the end of this week.

If you are not familiar, Mike Novogratz is a former Macro Fund manager on Wall Street that has been one of the bigger bitcoin bulls over the past year.

He was quoted as saying;

"cryptocurrencies will be the biggest bubble of our lifetime."

To capitalize on those thoughts, he went about setting up a $500 million dollar hedge fund, the largest such hedge fund in the industry. Not only that, but the fund would be backed with a good portion of his own money.

That fund, Galaxy Digital Assets Fund, was the one that got put on ice after the latest bout of volatility in bitcoin.

In his defense, this was more than your normal run of the mill bitcoin volatility.

Prices dropped close to 50% in less than 4 days. With roughly 35% declines coming in a 12 hour stretch yesterday.

Bitcoin markets haven't seen price action like that since 2013.

To put it bluntly, it was downright scary.

Novogratz's thoughts on that price action...

"When you get kicked this hard, it takes a lot of ice to get the swelling down."

For that reason...

"It will take the market a while to recover and bitcoin prices will probably consolidate between $10,000 and $16,000, and won’t approach $20,000 again for at least three to four months."

That is quite a long time before he thinks bitcoin will see new highs again, which is why he doesn't want to launch his fund right now, when he thinks there is a good chance bitcoin might have to go lower for a bit before it can go higher.

Why I think he's wrong:

For one, if you read my piece yesterday, you will know that I think most of that drop yesterday was manipulation. It wasn't "normal" market activity, though I will be the first to admit, there isn't really such a think as "normal market activity".

Either way, I think the drop was done intentionally by a small few as opposed to market forces taking over.

More about that can be read here:

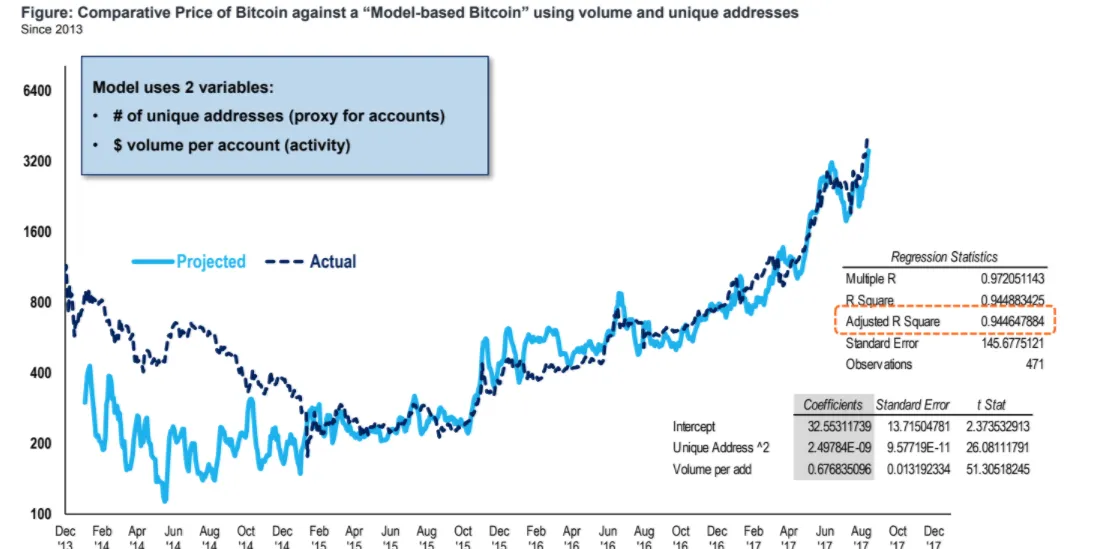

Also, there has been strong correlation between the price of bitcoin and it's network. How strong of a correlation you might ask?

Well according to research published by Tom Lee, there is a 94% correlation between the price of bitcoin and the number of wallets and number of transactions being done per wallet. IE, as the network has increased, so has the price, almost in direct correlation.

Which means that anyone calling the price of bitcoin pure speculation, hasn't been doing their homework.

The price is simply increasing as it's network grows, which doesn't seem that crazy at all.

A model of what Tom Lee is talking about looks like this:

Since November, wallets and transactions have been increasing, but the price had been increasing at a faster rate, which would imply that a pullback in price was needed or a huge surge in network activity was needed.

We got the price pullback.

Currently new wallets and activity is continuing to increase but the price is now going sideways/slightly lower, which is likely coiling the price like a spring for the next move higher.

Finally, the 3rd reason I think that we will hit $20k again a lot sooner than Novogratz thinks is simply because of The Thanksgiving Effect!

Over Thanksgiving, everyone went home to their friends and families and talked about how much money they were making in bitcoin.

Then all those friends and family members went out and opened accounts on Coinbase and bought bitcoin. That is basically when this whole massive upswing in the crypto markets started.

I expect we will see the same thing again over the Christmas/New Year's holidays.

People will be telling all their friends and family about how well they have done this last year in cryptocurrencies and people will be eager to join in.

For that reason I would expect to see a huge surge in buying basically starting after Christmas to a few weeks after New Years.

Overall, I understand why Novogratz is a bit cautious at the moment, but buying at $10k was likely a great entry point if he would have continued along with launching his fund. If he decides to wait a couple months, he may end up paying double that by the time his fund is ready to roll.

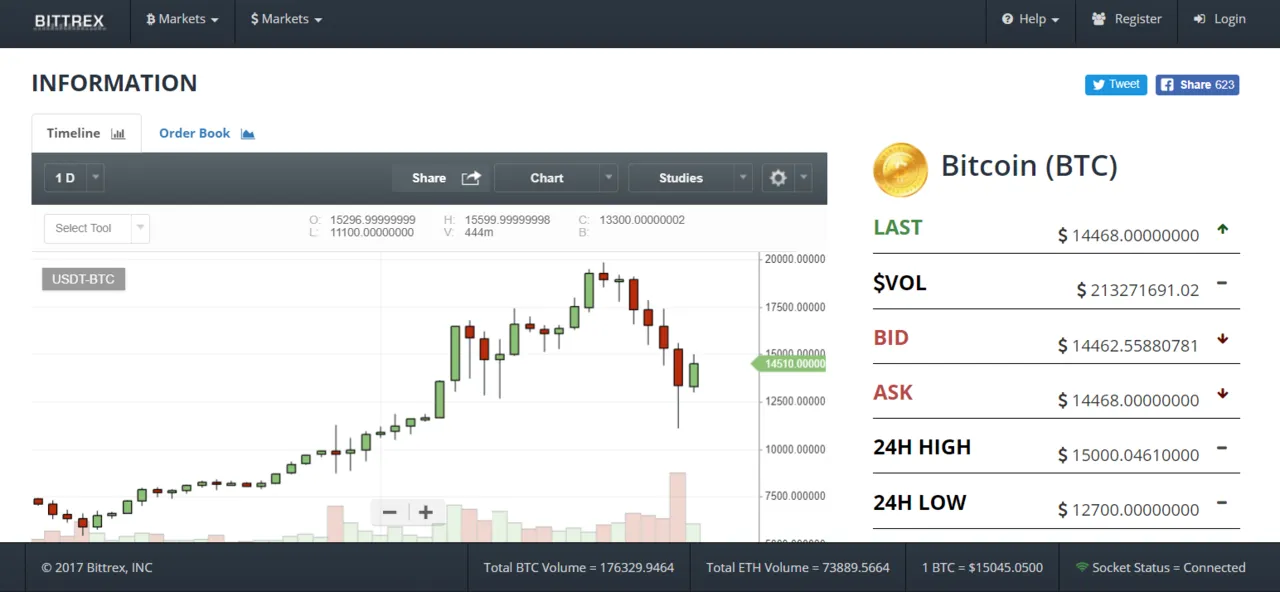

Plus, if you check out prices right now, it looks like bitcoin has already peaked above his $16,000 upper limit of his consolidation range.

We will know more in a few weeks.

Stay informed my friends.

Sources:

Image Sources:

http://blog.startwithwhy.com/refocus/2015/11/wrong-vs-missing.html

https://news.bitcoin.com/how-to-explain-bitcoin-to-your-family-this-thanksgiving/

Follow me: @jrcornel