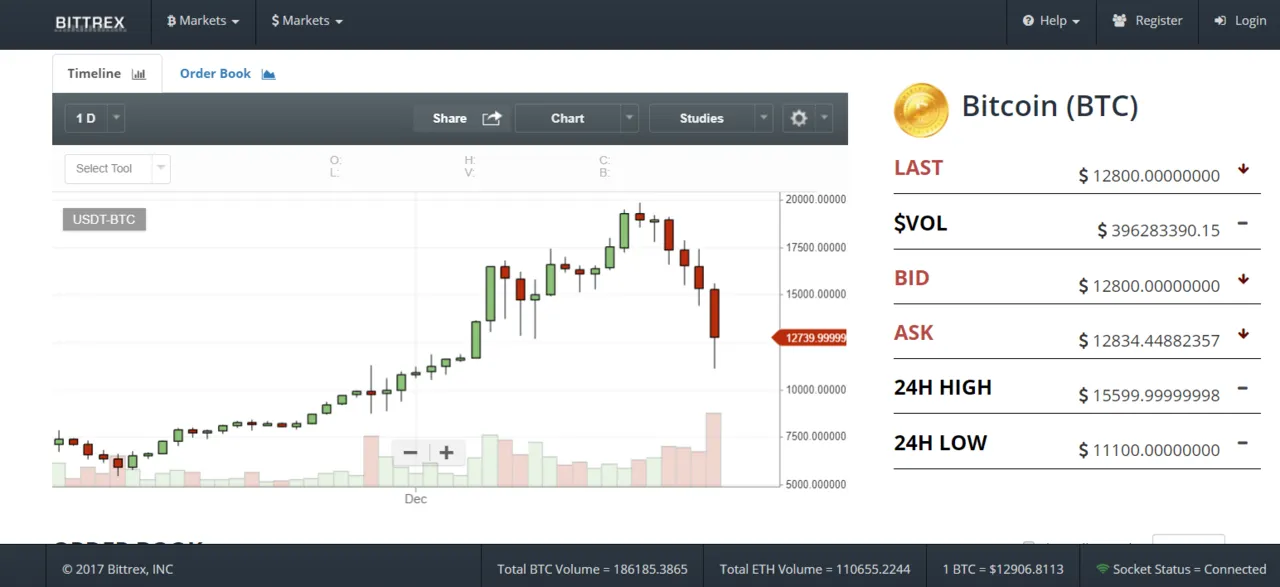

For months now, Bitcoin has gone basically one direction, up.

There had been minor corrections along the way, in both September and November, but nothing really significant since August.

That all changed last night when Bitcoin and many other cryptocurrencies plunged by as much as 40% in less than 12 hours.

That is by far the biggest move down in that short of time that we have seen in months.

What caused the drop?

Well, like many dips in the past, the specific cause isn't always clear.

Some are speculating that it had to do with the hacking of the South Korean crypto exchange Youbit. Where roughly 1/5th of the exchange's holdings were stollen by hackers.

http://money.cnn.com/2017/12/20/technology/south-korea-bitcoin-exchange-closes/index.html

The exchange immediately became insolvent following the hack.

Some other speculations had to do with the drama surrounding the bitcoin cash inclusion on Coinbase, which saw prices briefly reach $8,500 within minutes of enabling trading on the coin.

Trading was immediately halted and a more "normal" roll-out was done hours later, which still saw prices of bitcoin cash climb by roughly 100% from its pre Coinbase addition prices.

Much of that price appreciation came at the expense of bitcoin, as it's price dropped by roughly the same amount that bitcoin cash's price gained.

The most likely cause for the drop?

This is my opinion, but I would say the most likely cause for the drop was a combination of the above and also something else... something a little more sinister.

I think there was big time price manipulation going on.

I think there was price manipulation going on during the runup in prices and I think there was price manipulation on the drop we are currently seeing unfold.

According to a report released a few days ago, roughly 40% of all the circulating bitcoins are owned by roughly 1000 investors.

These investors are mostly made up of wealthy individuals, some institutions, and some hedge funds.

Given the large percentage of the asset they hold, it would not take much collussion on their part to really affect prices.

For example, if just a couple of these guys (or hedge funds) got together and decided they were going to get involved with a wash trading scheme in order to walk prices up, it really wouldn't be all that hard.

Plus who is to stop them? There aren't really any regulators policing this kind of activity.

The scheme:

Basically, the way it would work is that a couple of these large holders would just start trading back and forth among themselves, creating the illusion of heavy trading volume.

In doing so, they could also walk prices up or down via wash trading.

So, the net effect would be increasing prices and steady (high) volumes all the way up.

The increased prices would draw in retail investors/traders and also draw in the media which starts blasting stories on bitcoin 24/7.

Then when prices get "high enough" and there is enough outside money entering, these large holders start to dump some of their positions on the newly invested retail players.

Driving prices down, quickly past where retail entered, causing retail to panic sell and further drive prices down.

The net effect becomes a plummeting bitcoin price.

Then, when prices get low enough, which in this case was roughly 50% off the highs, the big players show back up and buy up their positions again.

Rinse and repeat.

This kind of thing becomes even more profitable when you factor in the futures/options markets where these large players could have also bought puts and sold calls before they drove prices down, thus making even more money on the move.

I can't say for sure that this is what is happening, but to be honest, I would be surprised if something like this wasn't happening.

Greed is a very powerful motivator... and if something is wreckable, it will be.

Stay informed my friends.

Image Sources:

https://www.ccn.com/bitcoin-price-manipulation-centralized-exchanges-seems-coordinated/

http://www.livebitcoinnews.com/bitcoin-price-suffers-behind-scenes-manipulation-intensifies/

Follow me: @jrcornel