If you are not familiar, GBTC is a Bitcoin Investment Trust that trades on the OTC market place.

The trust owns bitcoins and the trust is designed to flucuate in price based on the value of those holdings.

Except it doesn't really.

In fact it has traded at a significant premium ever since it has been introduced.

Sometimes trading for a 100% premium to it's actual NAV (net asset value).

For that reason, myself and several others have said that GBTC was likely a decent short opportunity when you think the price of bitcoin is ready to trend down.

You have the opportunity of profiting on the downturn as well as some of that premium likely coming out.

Which would likely happen if bitcoin fell sharply or if new exchange traded products like etfs became available and investors had other options to invest in.

Seems like a sure thing to short sellers, at least that is the narrative they want you to believe.

Given, all that information, why in the world would I got out and purchase some?

My plan on purchasing some a few weeks ago was more on the underlying dynamics of the security more so that anything else.

For one, the premium in the security was down around the 40% mark, not great, but better than it has been recently.

Plus bitcoin has pulled back quite a bit itself, so not taking the lower premium into account, this was likely a decent spot to buy bitcoin.

Finally, and most importantly, GBTC announced that they would be undergoing a massive stock split.

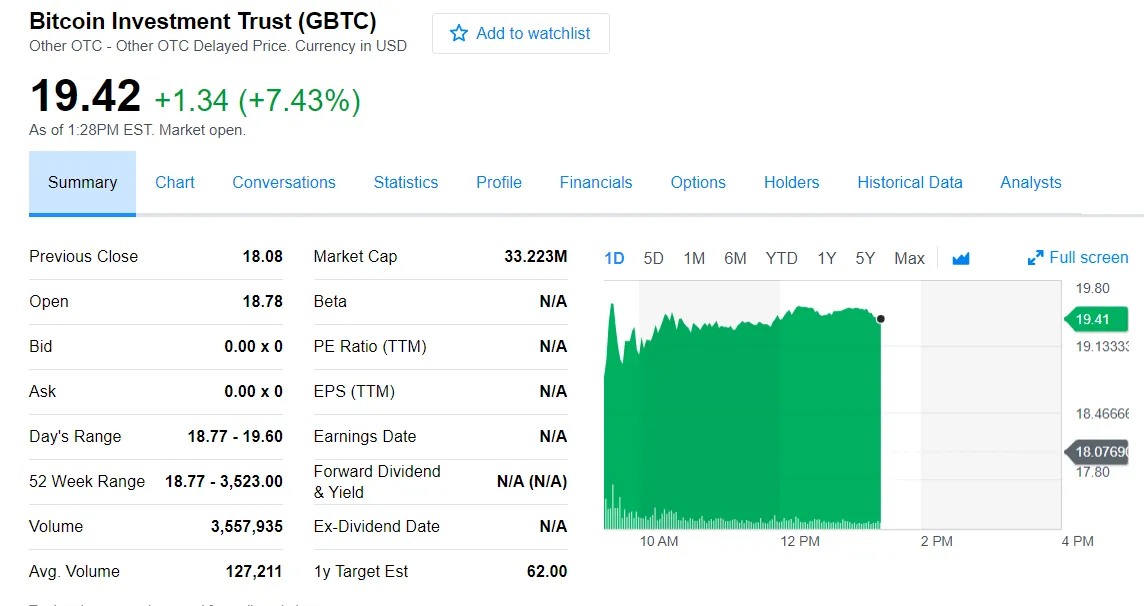

(source: https://finance.yahoo.com/quote/GBTC?p=GBTC)

GBTC announced that they would be splitting the shares by 91.

Which means that for every 1 share of GBTC that you own, you would receive 90 extra shares post split.

In finance, stock splits are said to be neither bullish nor bearish. However, if you look at the data, more often than not a split turns out to be bullish.

Especially in the case of something like GBTC which has such a large retail following.

The majority if GBTC investors are retail and my theory was that not as many retail investors like to buy something that costs roughly $1600 per share, not nearly as much as they might like buying something that costs $18 per share.

My thinking was that, not only can you buy bitcoin on a major pull back, right near $11k, but you can also buy GBTC ahead of a massive stock split that will possibly cause more retail investors to pile in, spiking the premium it trades at.

If that turns out to be the case, I could make money on my investment whether bitcoin spikes or not.

If bitcoin does spike, I could make even more money if the premium also inflates than I would have just buying bitcoin outright on a cryptocurrency exchange.

Which means, buying GBTC offered the possibility of me making money whether bitcoin spikes or not, and if it does spike, it offered me the opportunity to juice those returns even more.

For those reasons, I am now long GBTC in my IRA.

Stay informed my friends.

Follow me: @jrcornel