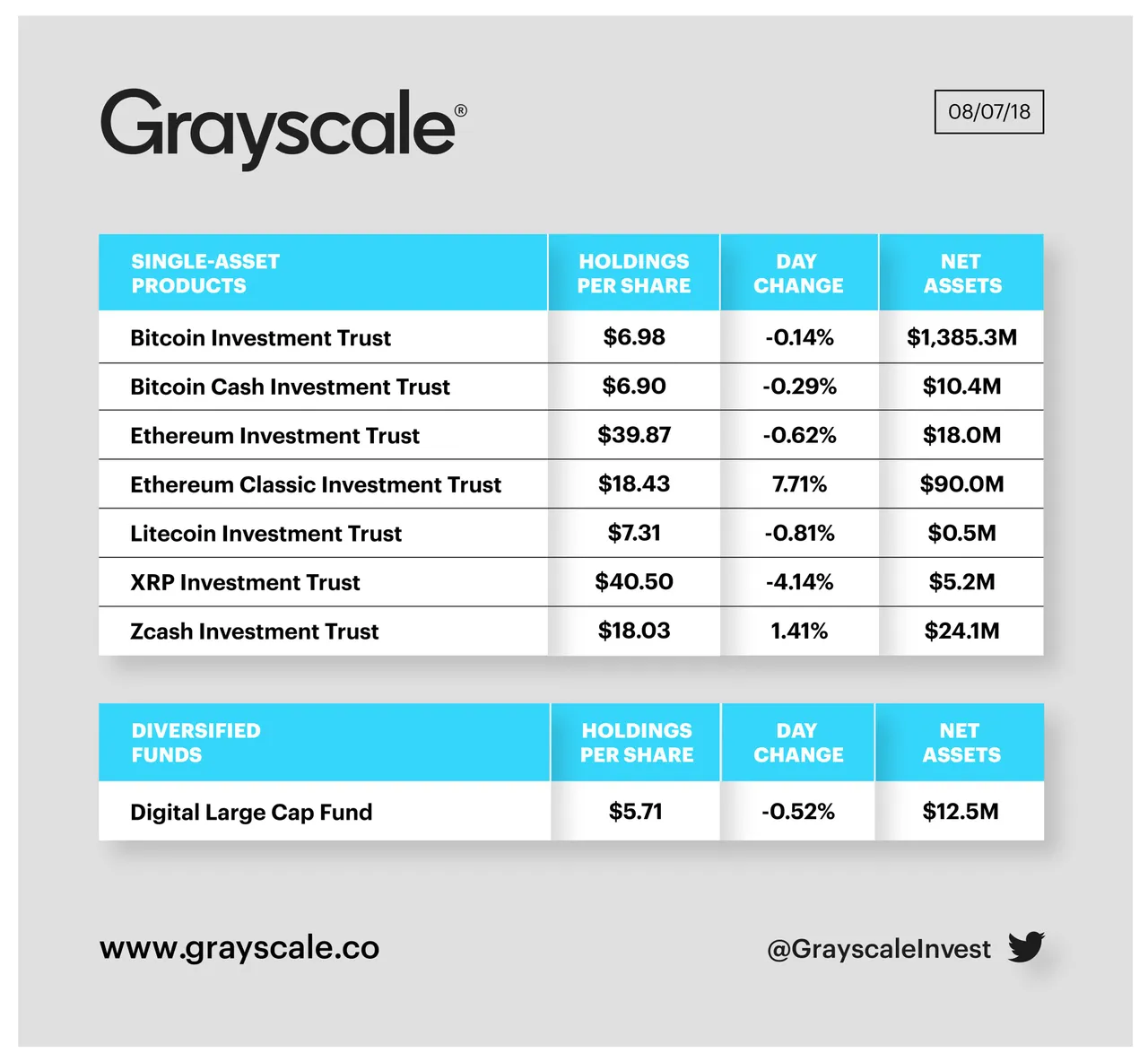

The firm now holds over $1.5 billion in digital currencies.

Grayscale Investments, a crypto-focused investment fund, reported today that it has $90 million in Ethereum Classic (ETC), the open-source, public, blockchain-based distributed computing platform that features smart contract functionality, leading up to its listing on Coinbase.

According to a recent tweet, the firm now has over $1.5 billion in digital assets through its investment products targeting institutional and accredited investors. This number is up from the $1.4 billion reported in July. While bitcoin (BTC) makes up ~$1.38 billion of total assets, Ethereum Classic (ETC) is notably the second largest holding of the firm.

This is likely due to a combination ETC purchases and the significant price run that took the coin from $14 to recently surpassing $20 with a market cap over $2 billion for a short period. Now, ETC is ranked 11th in the AltDex 100 Index (ALT100), a benchmark index for large-cap cryptocurrencies and tokens, after surpassing major cryptocurrencies including NEO (NEO) and Monero (XMR).