Based on the Bitcoin euphoria since August 1st, it appears the market is perceiving the Bitcoin scaling issue to be history. Given Satoshi's original plan for scaling, even if the 2MB "promise" activates, it will prove to be far too little and likely too late.

Unfortunately, I'm seeing exactly the signs I would expect to see if this was never going to happen at all. SegWit1X, here we come!

Diligent followers of my blog may have noted that I identified the technical and ideological problems with SegWit and noted there was no possible reason to endorse it other than ignorance or malevolence.

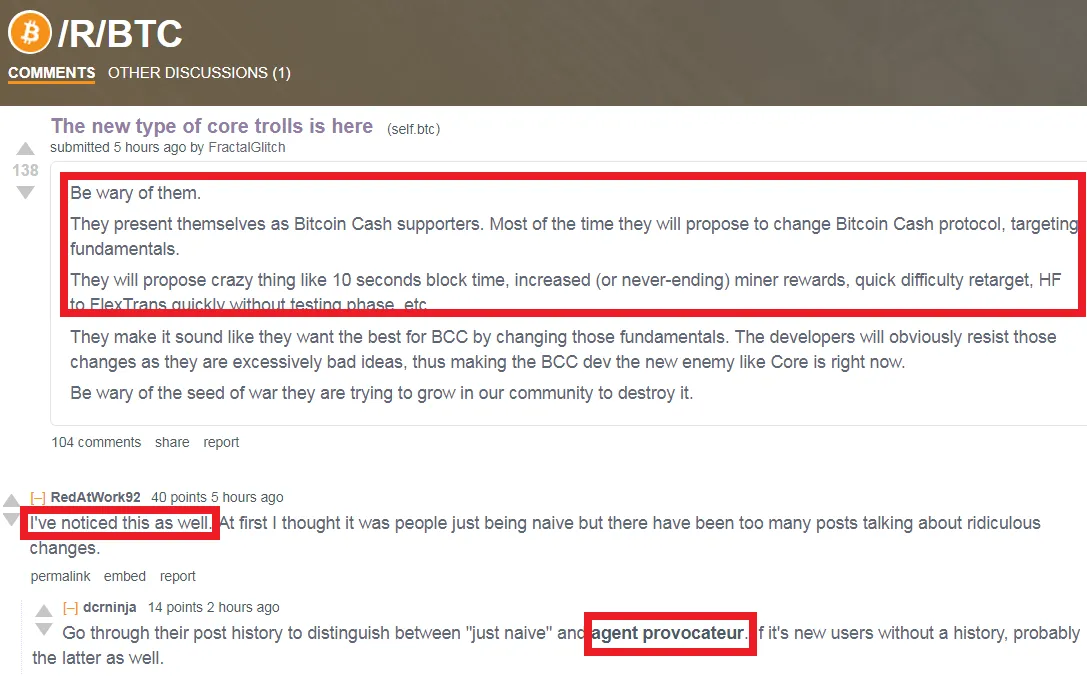

Regular readers may also know that while I have reservations about Reddit in general, and about both Bitcoin subreddits, r/Bitcoin appears to be an open spigot of controlled and censored propaganda, while r/Btc seems relatively open and level-headed.

Both of these provide relevant back-story for what is beginning, again, on /r/btc and r/bitcoin.

There really isn't much reason to engage in organized trolling of r/btc at this point. The market appears to have declared a winner, or is at least happy to comply with the consensus majority. The only reason to do this is that those undertaking in the astro-turfing know that Bitcoin is far from out of the woods, and they do not want any chance of a competitor. This is exactly what anyone involved in Core/SegWit2X would be predicting, since they know that SegWit is snake-oil that violates the white-paper definition of Bitcoin as trustless, p2p cash. The last thing they would want is another viable, similarly profitable Bitcoin chain available to jump ship to when 2MB either fails to activate or proves too little, too late...

Could this be bullish for Bitcoin Cash long-term, which is now only ~26% less profitable to mine than Bitcoin?

Copywright: PBS, The Simpsons, The Fellowship Of The Ring