This week has been risk-on for investors as they come back to the stock markets and other assets. Due to this, dollar weakness has been seen all over the board, and on the back of this BTCUSD has reached a temporary high of $9920.

The stock market corrections that started two weeks ago saw S&P 500 and Dow Jones decline 10%, and this week they have gained half of that back. This has resulted in heavy USD selling and most indicies, commodities and currencies have appreciated strongly.

The dollar weakness has helped BTC trend up nicely this week, but now more dense resistance is ahead, more precisely between $9900 and $11800.

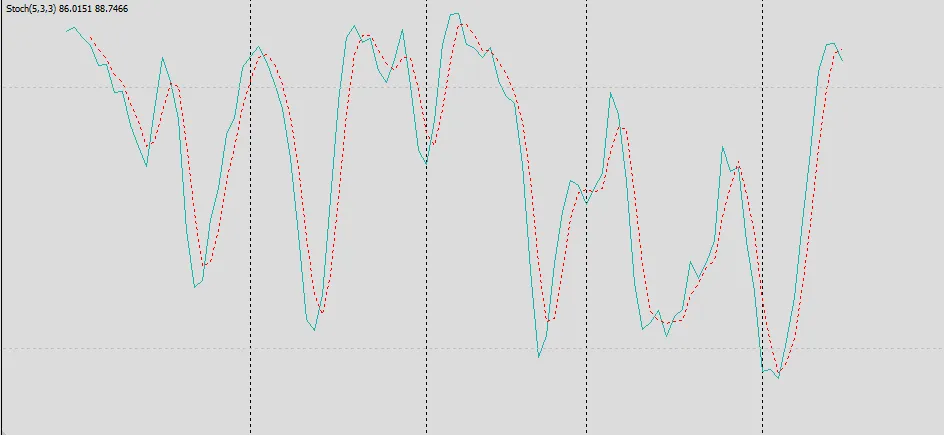

Technically BTC is overbought at the moment. This is the stochastic on the daily chart:

So an overbought daily stochastics combined with a strong resistance ahead might signal a pullback before further highs. However, the risk is on among investors so the markets can continue without any retracements.

Happy trading!

This is not financial advice, everybody is responsible for their own trading, I am just sharing the analysis for my own trading.