In my vision all the applications that altcoins are doing at the moment will finally be done by Bitcoin.

This will be done by 2nd layers in the form of side chains, each designed for a specific function. Since the Bitcoin blockchain is the oldest, most secure and most adopted blockchain, the best dev’s of the world are working here to improve the network and the biggest infrastructure is available.

When a sidechain of Bitcoin can deliver a certain service, it will outperform all altcoins doing the same thing, because it will be cheaper, better and more secure. Furthermore, you can use a coin that more people around the world are owning and accepting. Also It is way more efficient to build everything on one network, 2nd layers will use the security of the base chain without extra use of energy.

Segwit will be implemented soon. This will be the fundament for side chains and cause a lot of innovation on the Bitcoin network in the years to come!

The first expected 2nd layers will be Lightning Network and Rootstock (RSK). Both of them will enable instant transactions for a tiny cost, whereby LN will be anonymous and RSK programmable (smart contracts on Bitcoin!). My expectation is that the fast and anonymous altcoins will be replaced by Bitcoin first. Litecoin is an exception, I will explain this later.

I expect it will take way longer before Bitcoin will replace altcoins designed for more advanced features like cloud storage, computing power sharing ect. These altcoins I will keep in my portfolio for now. Off course also my Steem Power.

Who is gonna use Dash and Monero with a small user base and infrastructure when bitcoin can do it faster, cheaper and more secure?

Dash:

Dash is based on an interesting technology, but will soon be absolete in my opinion, because of Lightning Network. I bought Dash around 13 USD and sold it today for 170 (1300%). I kept one Dash as a ‘collector item’. I think Dash will loose relevance over the months / years to come and so will the price. The charts are not forecasting a better scenario, the double top could signal an upcoming bear market.

Monero:

Monero is one of the most known anonymous coins in the crypto space and well adopted by the dark web. I bought Monero around 8 USD and sold 70% today for 43 (540%). After they shut down Alphabay, it looks like there will be more action coming what will cause the volume of the currency used on the dark web to drop. Secondly, bitcoin is also used on these sites and when anonymous and instant transactions are enabled by LN, Monero will become absolete over time. The chart of Monero doesn't look promising either, a downtrend is going on for a while already.

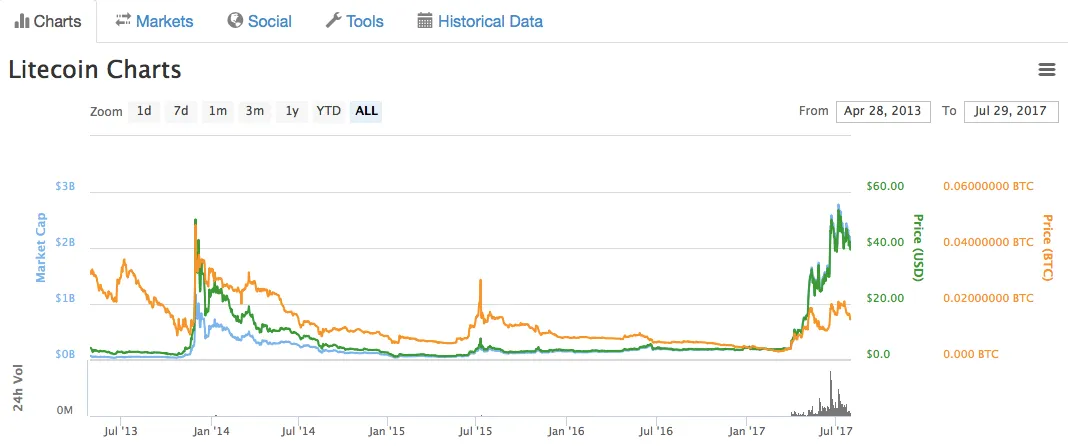

Litecoin:

Litecoin is also a faster version of bitcoin, but an exemption on this story. Litecoin can perfectly co-exist with bitcoin by providing transaction capacity when bitcoin is overloaded. Litecoin and Bitcoin are based on the same technology and the Lightning Networks can be connected to each other. This means that bitcoin payments can be done over the Litecoin network and the other way around. Here you can read more about it:

https://segwit.org/my-vision-for-segwit-and-lightning-networks-on-litecoin-and-bitcoin-cf95a7ab656b

Another great function of Litecoin can be the implementation of new updates that get stocked on Bitcoin. A great example is the update of Segwit. Because Litecoin is less robuust and the market cap. and infrastructure are smaller, it is easier to push an update through. When the update is done on Litecoin, it makes less sense to block it on Bitcoin because it is tested on a real active coin now. This means that Litecoin can take the lead in innovation for the Bitcoin network. Litecoin will remain very useful so I stored it as a long term holding.

Bitcoin

I am extremely bullish on Bitcoin at the moment. Bitcoin will almost sure get the most important update in it’s history very soon. This update is Segwit, this will reform Bitcoin from a payment system to ‘the internet of value and trust’. Also will Segwit double the transaction capacity, so it will give an immediate positive effect to the transaction speed and cost.

There will be a hard fork on the first of August, but I am not worried about that. The brand and limited supply of BTC will not be damaged, because BCC will be an altcoin and will take probably only 10 to 15% of the value. I think it can be a good thing, because now both sides in the scaling debate can go their own way without delaying each other. Another positive thing is that the market now will tell what the right solution is.

Over the last months the bitcoin price was correlated with altcoins, while a few months earlier they were negative correlated (bad news about bitcoin made altcoins skyrocket based on speculation that they could replace bitcoin). When Segwit became a close to sure thing, I was already wondering why they remained correlated. This doesn't make sense, because Segwit can be a huge threat to altcoins.

Yesterday I was surprised that the bitcoin price and price of altcoins moved in an opposite direction. Maybe the correlation is now broken and altcoins will tank on good news about new innovations on Bitcoin. This was another sign to expect a bull run for bitcoin and a bear market for altcoins in the near future. Remember that bitcoin only doubled since the last ATH 3 years ago and many altcoins multiplied double digits within only a year. This makes me think altcoins are in a bubble and bitcoin only enjoyed an solid rise.

Disclaimer:

In this post I describe my own vision on the cryptocurrency market and the choices I made for myself. This is not trading advice, everyone is responsible for his own trades / investments and should investigate the market himself.

previous related post:

https://steemit.com/bitcoin/@michiel/flippening-part-2-yesterday-i-sold-half-of-my-ether-for-bitcoin-and-here-is-why

Do you (dis)like this post, have something to ask or to add, let me know in the comments!