Leave ICO’s alone!

Before we start inviting regulators to come and save the "widows and orphans" of the cryptocurrency world it behoves us, esp those not well versed in history, to remember just how we got here.

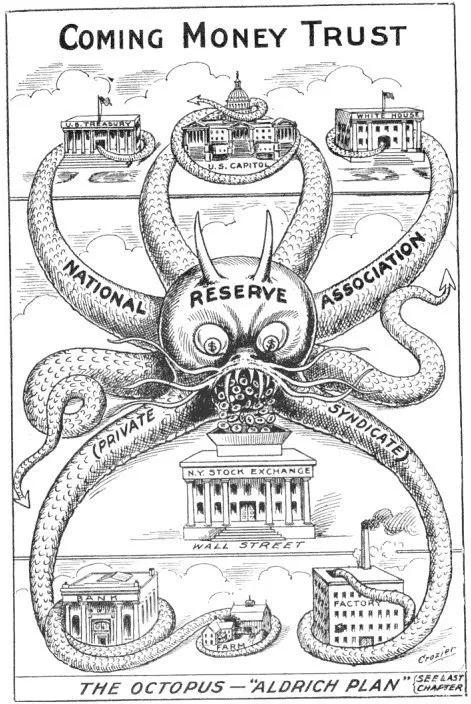

The passage of the 1913 Federal Reserve Act, controversial then and still controversial now allowed Wall Street to capture the US Government at first in relation to money management and fiscal policy and eventually extending to virtually every facet of our lives. It was Fed’s meddling in the fiscal policies of the day that caused the 1929 wall street crash (NOTE: https://www.federalreservehistory.org/essays/stock_market_crash_of_1929). They are proud that they saved the commercial banks at the expense of the stock market (NOTE: ibid). In other words they protected large banks over individual investors. The devastation in the generation was so widespread that it was not until 1954 that the Stock Market recovered, and only because a new generation began to believe in industry again and WWII and it’s after effects were behind us.

Fast forward to 2008 and we again find a bubble created by the Fed, accelerated on by the illegal creation of MERS (NOTE: https://en.wikipedia.org/wiki/Mortgage_Electronic_Registration_Systems) by Wall Street. That lead to the Fed bailing out large financial institutions again, this time via forced acquisition at the expense of individual investors.

After over 100 years of meddling why is it not obvious that correcting, directing, controlling a market simply DOES NOT WORK. Markets are chaotic structures. Trying to linearly control a market simply creates feedback ripples that result in outsized negative effects that are hard to predict and even harder to control. What do we call a black swan event if it happens often? Gray Swan?

This is why Bitcoin was created. THIS is why it was launched. Let’s remember that Bitcoin was the first ICO.

While some of us are quick to scream "SCAM" around every new token issuance they see, ICO’s serve a very important purpose. They reduce the cost of raising capital by 100x.

The current estimated cost to take a company public in the US is north of $100million. In 2014 the cost for Markit, a financial data provider, to go public and raise $1.45 Billion dollars was 5%. That’s $220million. (NOTE: https://www.forbes.com/sites/jayritter/2014/06/19/why-is-going-public-so-costly/#2f8258264ff0) Notably most of the raise came from existing shareholders, which one would presume would lower their regulatory compliance and marketing costs.

Additionally Wall Street firms won’t touch firms with less than 50million in sales, high profitability and low variance of income. An article in Fortune on 2013 argues that 100million WAS the old standard, but 50mil is ok if… (NOTE: http://fortune.com/2013/02/25/is-your-company-ipo-ready/)

But one of the major reasons why a company fails is undercapitalization. (NOTE: http://www.investopedia.com/slide-show/top-6-reasons-new-businesses-fail/) And access to capital is one of the top competitive advantages a company can have (NOTE: ). Amazon is a great company but their cash cow, 2nd day delivery of most products, is due to their ability to have hundreds and soon thousands of warehouse locations around the country. Their capital access gives them a competitive advantage small warehouse owners and small retailers cannot match.

On the other hand the launch of a new crypto currency ranges from $2.5million at the top end to virtually free at the bottom. A young entrepreneur, let’s call him "Satoshi", can create a new p2p piece of software, release it on an obscure forum and in less than 10 years have each unit of said currency be worth not more than just the almighty dollar, but more than an ounce of gold.

Without a doubt there are many scams coins and s__t coins in the ecosystem. Onecoin deserves to be called out as the scam it is, and many coins released in the early years of Bitcoin have now been virtually abandoned. It is important to us, as an industry, to call out these problem coins loud, often and to the authorities if necessary. Naming and Shaming works, although it is a blunt instrument. Notice however, that existing fraud and Ponzi laws worldwide are sufficient in the case of Onecoin and that the death of old coins is a natural occurrence, not a result of regulations.

Some people may argue that "reasonable" regulation is a middle road that we could all tread, but I disagree vehemently. We already know the many problems with attempts to regulate the internet, technology, and media so I won’t rehash them here. I would like to, however, point out two problems with regulations that aren’t obvious.

Regulation is a binary switch. It either exists or it does not. However ONCE it exists it is impossible to extinguish, rarely does it get smaller and usually it proceed to the left.

Regulations also absolve consumers of personal responsibilities by shifting quality control to the regulators. It is THAT precisely that allows non-sophisticated investors, "widows and orphans", to have enough confidence to invest. But of course when markets panic as they tend to do the “widows and orphans” get hurt anyway and regulators try to pick up the pieces afterwards.

These effects directly contradicts the ethos of crypto currencies as I understand them. Individual responsibility, individual control, self knowledge, lack of trust in counterparties are the hallmarks of what we do and are a reaction to the betrayal of trust by those to whom we have given the keys. Regulations are a step backwards. ICO’s should not and cannot ever be regulated.

David Mondrus

CEO

http://trive.news

david@trive.news

The truth is the truth no matter who speaks it.