Brief

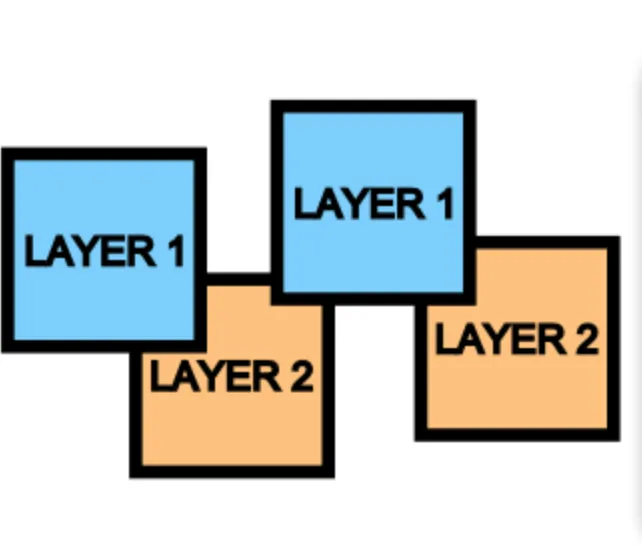

Let’s start off with a simple introduction of blockchain layers. Layer 1 is the actual blockchain. The Bitcoin chain, Ethereum chain, or Ripple chain are layer 1 protocols and are often referred to as the ‘main-chain’. Layer 0 is the protocol that runs under the blockchain. It isn’t visible to the naked eye, but it serves it purpose. Layer 2 is a protocol built on top of the main-chain. It creates infrastructure people can use to transact on the blockchain without interfacing layer 1.

Think of it in terms of clothing. Layer 1 is your shirt, it’s the main-chain of your outfit. Layer 0 is the undershirt – it keeps you warm but nobody can really see it doing its job. Layer 2 is a jacket – people see your jacket and to the naked eye, you are just wearing a jacket. They don’t realize it’s just an added layer to help keep you even warmer.

Why does this matter? It matters because in a world where functionality is the most significant things, protocols running underneath or on top of the main chain can add a new dimension of function to make the entire blockchain substantially more efficient.

Layer 0 Protocol: bloXroute

A block propagation startup called bloXroute is preparing to set the standard for 0 layer scalability. The software being developed by Emin Gun Sirer and the bloXroute team is being proposed for Bitcoin, Bitcoin Cash, and Ethereum. The effect this could have is phenomenal to even think about. Before I get into the numbers of what it can, a qualitative explanation is due.

In its essence, bloXroute propagates blocks on the main-chain through a trustless distribution network. Pseudo-centralized chains like EOS and Ripple, that trade pure trustless code in return for increased functionality, have shown us we can scale transactions by an exponential amount by putting the fate of the network into a select few hands. EOS claims to have hit 4,000 transactions per second (TPS), Ripple has consistently done around 1500-2000 TPS. At the same time, more decentralized networks like Bitcoin and Ethereum manage 4 and 15 TPS respectively. The trade-off between decentralization and functionality seems to be all too real. But bloXroute is changing all of that.

The general idea here is to reverse this trust by inverting the direction EOS and Ripple take. While EOS functions by trusting only 21 block producers (who have offered incentives to people voting for them in first place), bloXroute aims to have a few servers/nodes that trusts the entire network. It utilizes a Blockchain Distribution Network (BDN). While other BDN’s exist, bloXroute is the first decentralized BDN to come into the picture. The BDN blindly trusts nodes and does not discriminate any transactions. In fact, bloXroute the company have no control over the BDN - they merely designed it. By default, as a layer 0 protocol, it merely adopts the network as it is. Since it accepts everything as it happens on layer 1, it offers no added security to the chain. If a malicious transactions manages to make its way through the main-chain, bloXroute (and any other layer 0) will accept it just as the network did. The pure motive here is to scale.

The propagation by bloXroute scales the network by removing data from the blocks and instead assigning it a special ID. “But wait, no information on the blocks? Is that safe? How do we verify previous transactions and look up data for blocks”? It is able to remove the data by storing it on a distributed ledger also called a relay mechanism. You can go back into the chain and find all relevant data (block headers, hash, and transaction data) by going into the relay-based chain. The BDN, which is the relay network, holds all transactions and relays it to nodes as and when they call for it. By doing this, bloXroute has claimed to be able to reduce the size of each transaction 100 times.

The constraint today is that each transactions is about 470-540 bytes in size. Bitcoin has an average of a 1.2 – 1.4 MB block limit while Bitcoin Cash blocks are about 8 MB. Let’s see just how much this affects scalability in both chains. For this, we will assume Bitcoin has a 1.4 MB block and 470 byte transactions; and Bitcoin Cash has an 8 MB block and the same 470 byte transactions. If bloXroute was implemented, each transaction would be lowered to 4.7 bytes.

• Currently, Bitcoin has space for 2478 transactions per block, which is 5 TPS. Bitcoin Cash has space for 17,021 transactions per block, which is 28 TPS.

• If we implement bloXroute and transactions are lowered to 4.7 bytes, Bitcoin would have space for 297,000 transactions per block, which is 496 TPS. In Bitcoin Cash, it would lead to 1.7 million transactions per block, which is 2836 TPS.

• Bitcoin Cash is open to radically increasing block size in order to keep fees low and the mempool small. In the event of global adoption, if BCH was to both implement bloXroute and increase the block size to 32 MB, it would have space for 6.81 million transactions per block, which is a whopping 11,347 TPS.

Final Analysis

The outcome from this shows the potential for scalability within layer 0 protocols. While they have the drawback of not providing extra security, it is a negligible drawback. Security completely stems from protocol on layer 1. With or without layer 0, the security would be the same. But layer 0 is able to add an astounding level of scalability which could see the networks become 100x more efficient than they currently are.

Layer 0 is the opposite of Batman – it’s the hero crypto doesn’t deserve, but the one it needs. In order for cryptocurrency to set foot in the same space as payment processors like Visa and MasterCard, it undeniably has to scale to a great level. Layer 0’s are the ideal solution in order to protect the integrity of the blockchain and simultaneously keep it useful and efficient.

- AB

ReverseAcid Monthly Recap

- ReverseAcid Monthly Recap - November 2018 (Vol 1)

- ReverseAcid Monthly Recap - December 2018 (Vol 2)

- ReverseAcid Monthly Recap - January 2019 (Vol 3)

- ReverseAcid Monthly Recap - March 2019 (Volume 4)

Crypto Analysis Series

- Part 1 - Basic Attention Token and How It's Revolutionizing the Internet

- Part 2 - Golem Network Token as a Potential Giant Killer

- Part 3 - Augur and the Future of Decentralized Predictions Markets

- Part 4 - Dogecoin - Such Meme, Much Value

- Part 5 - Zilliqa

- Part 6 - IOTA

Previous Posts

- Diving Deeper into Zero-Knowledge Proofs (Part 2)

- Bitcoin’s Innate Problems: Volatility and Mining Centralization

- Legislation and Taxation of Cryptocurrencies - A (Very) Brief Outlook

- CME Futures and Dealing With Volatility

- Two Men on an Island - An Introduction to Zero-Knowledge Proofs and What Follows (Part - 1)

- Why Unveiling Fake Volume is Essential for Market Growth

- Understanding the Difference Between an ‘Open-Community’ and ‘Closed-Network’ Blockchain

- Operational Difficulties in Running a Cryptocurrency Exchange

- Dharma Protocol: Tokenized Debt and Funding Through Decentralized Systems

- Should Cryptocurrency Wallets be Registered with Government Authorities

- Venezuelan Economic Crisis: An Outsider's Perspective

- Barriers to Stablecoin Adoption: Detaching from the Traditional Notion of Markets

- Why Bitcoin Proves Markets Function on Behavior

About Reverse Acid

Be a part of our Discord community to engage in related topic conversation.

Follow our Instagram and Twitter page for timely market updates