It's been an exhausting 6 weeks for those who have been following bitcoin. Stress levels have reached all-time highs for many investors primarily due to the multiple fake bottoms that bitcoin had. Short of saying - bitcoin's unpredictability has multiplied with the entry of institutional investors and mainstream, mom and pop investors.

Synopsis:

1.) Using the Fibonacci sequence, bitcoin could have just reached the bottom at $7,800.

2.) The only other alternative is for it to go down to $5,663, but this outcome is less likely.

I have discussed at length what Fibonacci sequence is and its relevance in TA in my previous blog Bitcoin Fibonacci Sequence but here's a recap:

Fibonacci numbers are derived by adding the last two preceding numbers. Hence, the Fibonacci series looks like this: 1, 1, 2, 3, 5, 8, 13, 21 etc. Mr. Fibonacci claims that these numbers can be found in almost everything on earth. The measurement of the nautilus shell follows these number sequence. The branches of a tree match the Fibonacci number sequence and similarly, the dimensions of the human body can be explained by these numbers. In other words, Fibonacci is the numerical formula for God's creation. Now, stock chartists also discovered that the stock chart patterns (and crypto charts for this matter) also follows the Fibonacci numbers.

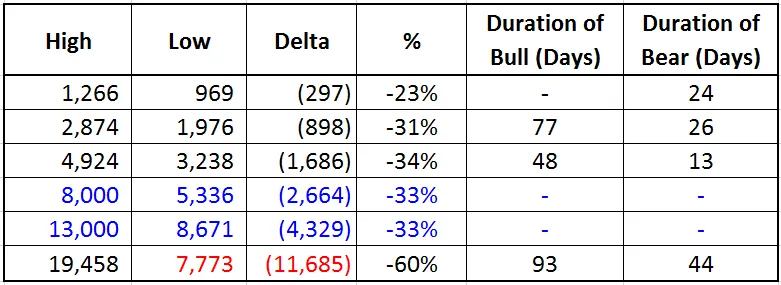

Using the Fibonacci sequence in analyzing bitcoin's historical highs and lows (corrections), it looks like this:

The black text in the table above are historical data {www.worldcoinindex.com} and the blue text are "plugged in" numbers using the Fibonacci sequence. You can clearly see that bitcoin skipped two number series "high" when it jumped from $4.900 to $19,500 - an extremely aggressive and unsustainable ascent. Had bitcoin made a correction at $8,000 and $13,000, the lows would have been in the vicinity of $5,336 and $8,671.

If we were trying to predict bitcoin's bottom on December 17 (when it started to drop), there are three most likely scenarios:

1.) Using the historical trend percentage, where bitcoin losses about 1/3 of its value, the bottom would have been in the vicinity of $12,842 (19,458 x 66%).

2.) Retracing the closest Fibonacci sequence that was "missed", the bottom would be around $8,671 (+)(-).

3.) Retracing the farthest "missed" Fibonacci sequence, the bottom would be around $5,336 (+)(-).

At this point in time, we already know that bitcoin has surpassed the $12,842 and $8,671 which leaves us $5,336.

The following supports the possibility that we just hit the bottom at $7,773:

Bitcoin already lost 60% of its value from its ATH which is almost double the historical trend of 33%.

44 days in the bear territory is more than double the historical average of more or less 20 days.

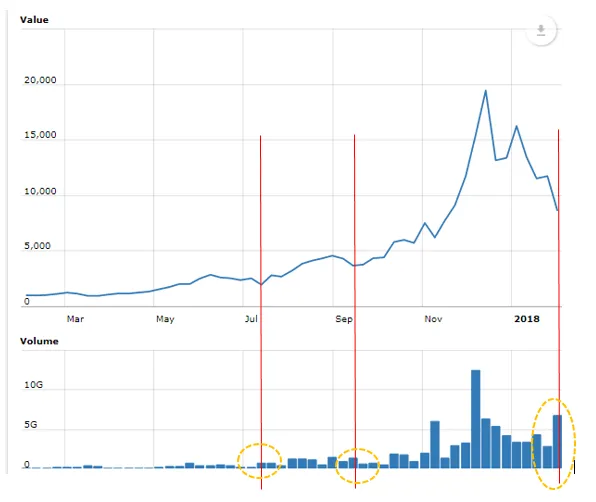

The bottom is accompanied by high volume. Below is the screen from Poloniex.

The volume is not as dense I would expect but I'm wouldn't be surprised since investors are already experiencing high fatigue at this point (consequently, the "inconclusive" volume also supports the alternative view discussed below).

- the three-wave Elliott pattern is complete from the "breaking point" designated by the red line:

On the other hand, the following points to the $5,336 as the "true" bottom:

The Fibonacci number series points to the $5,336 as the true bottom in the strictest interpretation of the sequence.

The bear just breached one of the strongest support line (if not THE strongest) which signals a very bad omen:

Breaching of one of the strongest support line normally results to even lower drop from the point of "breakage".

- Coincidentally, the bear also broke out of the symmetrical triangle downwards. This is the biggest symmetrical triangle the bitcoin's history although I have to point out that this triangle is incomplete because it missed the 3rd touch points at the ceiling of the triangle (symmetrical triangle by definition requires a minimum of 3 touchpoints each at the ceiling and base of the triangle). Hence the drop is premature.

- The volume at $7,800 is not too "convincing" to signal the turnaround.

I would expect the volume to be close to 10G as a solid confirmation.

Conclusion

Based on the above info, I'm assigning a 60% probability that we already reached the bottom at $7,800 for this correction.