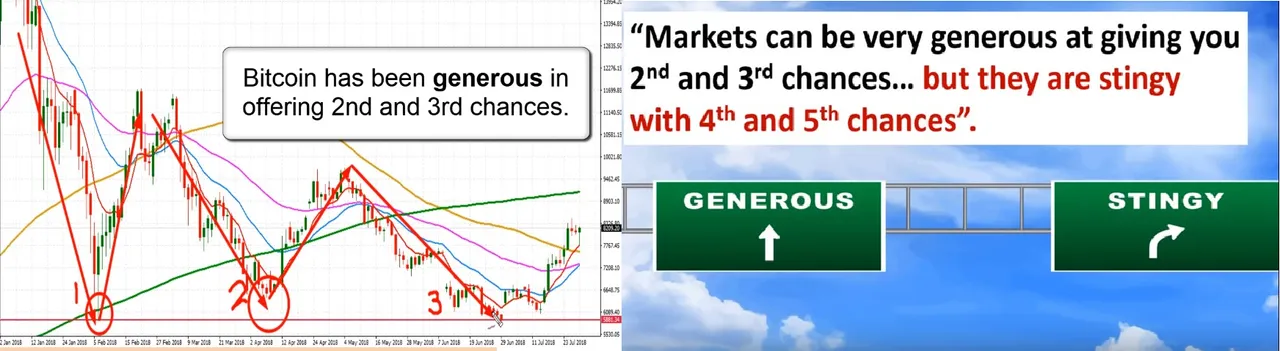

So lately people start to notice that Bitcoin might not come back to its February lows and that a bull run is likely to happen. Many people had the idea to buy in at the lows of 5k but it seemed to be that Bitcoin never touched that level. Now there is an old saying that the market is generous at the first 3 attempts but after that it simply gets stingy.

Now don't be sad cause i don't have a magic ball either. However what i do know is that there is still a great opportunity in front of us that is totally overlooked. Altcoins... Yes! And including Steemit. In my previous post about Steemit rankings i explained that when there is blood on the streets the opportunity for buying quadruples. So don't think you missed the boat and start dwelling about dumb shit that it's over... No take action and start to invest in coins you see potential in, diversify a portfolio and reduce your risk.

And that's where you start dollar cost averaging.

DCA (dollar cost average) is described as a safe way of finding your entry in the market. It’s difficult to exactly know when price has bottomed and get the perfect entry within one trade.

Dollar cost averaging gives you the opportunity to spread your capital over multiple entries to prevent missing the boat but also to reduce your risk instead of risking your entire trading equity in one time.

Dollar cost averaging can be done as the image shows above here and many people already spend for example an x amount of dollars or euros on BTC every once a week undoubtedly what the price is. This way they can build up their capital in BTC over the long-term without to much risk.

I recommend everybody to use the DCA method especially now with Altcoins on a 60 to 80% discount. I myself buy 1 Neo every week on Wednesday. figure something out for yourself and calculate the money that your willing to spend on certain Altcoins!

Best regards,

Sem