I find it sad when I read rally cries akin to ‘Viva la résistance’ and down with the Global Financial Oppressors because Bitcoin will soon free us from their centuries of oppressive regime (I use this Bitcoin in this post as it currently has market dominance). This is because in the very next sentence I see people salivating at the hype of Bitcoin ‘Mooning’ to $28,000 by June this year Source, and then $1Million by 2020 courtesy of the notorious John McAfee Source.

These people buy into these predictions (self-fulfilling?) and put their hard earned savings into something endorsed by the early adopters who have already made their fortunes and celebrities such as Paris Hilton and Floyd Mayweather who are well known for their in-depth understanding and appreciation of cryptos and the underlying technology 😉

There seems to be a disconnect between what people claim to be behind- the underlying technology, i.e. Blockchain, and their blatant greed of pumping the price of the cryptocurrency by whatever means possible, even if it means allowing the very same financial institutions in and slowly take over this marketplace.

The simple truth is this: there seems to be no genuine revolution. Hypocrisy is rife in the air. We talk ‘large’ on forums, to our friends (anyone who will listen really) about the utopia of using cryptocurrencies for our daily needs, how it will be commonplace and that Fiat ($, £, etc.) will be overthrown (Viva la yadda yadda …..). However, in reality, we are squirrelling away Bitcoin into our wallets, waiting for that $1million/BTC prediction to come true so that we can exchange it for Fiat immediately, evade taxes like Pablo Escobar and go live on our private island sipping Mai Tai’s while getting foot rubs all day long.

Now if we believe that WallStreet, other Financial organisations, various Governmental institutions around the world have been sitting on their hands or twiddling their thumbs and have just woken up to cryptos and their potential, then we are grossly deluded. They have just been watching the whole experiment unfold and been waiting for the ideal point to enter then control the market and maximise their profits in the long run.

For example, Poloniex, one of the largest exchanges in the crypto universe was just bought by Circle, a company backed by Goldman Sachs which is one of the most prominent Wallstreet Financial Institutions Source.

Now the very same Goldman Sachs with very close ties to the U.S Government has announced today that it will start Bitcoin Futures trading and in doing so will add legitimacy to Bitcoin Source. This seems to have sent pre-teen shrieks of delight through the crypto community. But surely we do not need banks to provide legitimacy to Bitcoin as Carl Monroe correctly states: “This was not the point at all. How does the bank that Satoshi wanted to bring down, bring legitimacy to his legacy exactly?” Source. Banks are not interested in adding legitimacy to anything. And with CBOE and CME also trading and Bitcoin futures, who do you believe, in the long run, with such financial instruments and exchange takeovers, are the real benefactors? If anything I see this as a hostile takeover of cryptocurrencies by the very organisation that Satoshi set out to liberate us from.

This is not so far-fetched when you consider people are also proud of the concept that Bitcoin is Decentralised and not ‘controlled by anyone’. However, this can be seen as also that ‘no one is responsible’ for Bitcoin which is not such a good thing. Without some measure of responsibility of ownership, in a Decentralised network, you are potentially open to a takeover by someone like a group of Financial Institutions. This is especially true when everybody in the crypto universe is fighting over which coin is the one to rule them all 😁

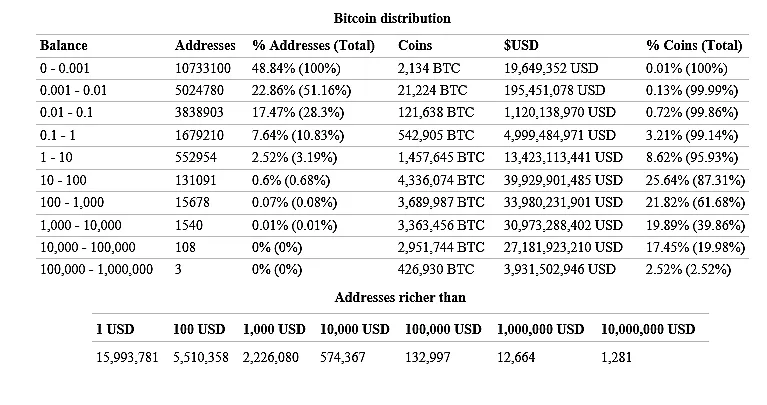

In addition to the above problem the presence of Whales in this market, a roughly estimated 1,000 people who own 40% of all Bitcoins Source could very easily collude to manipulate the market through the use of coordinated trading bots and the use of social media. A potential scenario is driving up the price of Bitcoin, betting against the Futures market, cashing out all at once and inducing a price crash (rinse and repeat). Which is what you are probably witnessing right now!

Today’s Bitcoin Rich List below will be of interest also:

Source

The lack of regulation in the cryptocurrency market allows this kind of manipulation to go unpunished and those with access to privileged information to profit at our expense.

At the end of the day all of this greed on our part, lack of regulation (allows easy manipulation), the introduction of a Futures market which minimises counterparty risk and increases liquidity for the financial players (compared to OTC)- it is the financial markets wet dream come true!

I don’t know what the long-term answers are…. But in the short term, I am a firm believer in understanding your opponent. Get to know finance, other asset classes and what actually constructing a Portfolio is really about. The effort involved is as comfortable as reaching for your keyboard and searching excellent sites such as investopedia.com for concepts and tutorials.

But, listening to self-proclaimed “experts” who live in their mama’s basement and have suddenly made it big on paper by purchasing some Bitcoins a while back and throw around some buzzwords and produce a derivative Technical Analysis on YouTube is indeed not the answer.

“It is better to fail in originality than to succeed in imitation.”

― Herman Melville

(In the interest of full disclosure: I HODL Bitcoin (circa 2012) and other Cryptos since. I also participate in the traditional Financial Markets and believe in having a balanced portfolio of assets. Also, I consider the Futures market is good for Bitcoin as it can help stabilise its volatility and improve price discovery in the long run)

My other recent crypto and related posts that you may be interested in:

Behavioural Finance and its possible explanation of stock market bubbles and crashes

Introduction to Bitcoin and Cryptocurrencies: How to spot winners, get and store them