Cryptocurrencies are something so new that there are only very few statistics about this whole business industry.

It's hard to estimate how many cryptocurrency users there are, and so far there were only very few studies to collect data about the user behaviour.

That's why I was happy to find out that today, the Camebridge University released their global cryptocurrency benchmarking study, an extensive study about global cryptocurrency users, wallets, and markets.

The research provides insights about the active cryptocurrency wallets and exchanges, in which regions cryptocurrencies are the most popular, which currencies are being traded the most, cryptocurrency mining behaviour, and much more.

The study is split in different topics: general data about the cryptocurrency industry, wallets, exchange platforms and mining.

Cryptocurrency industry

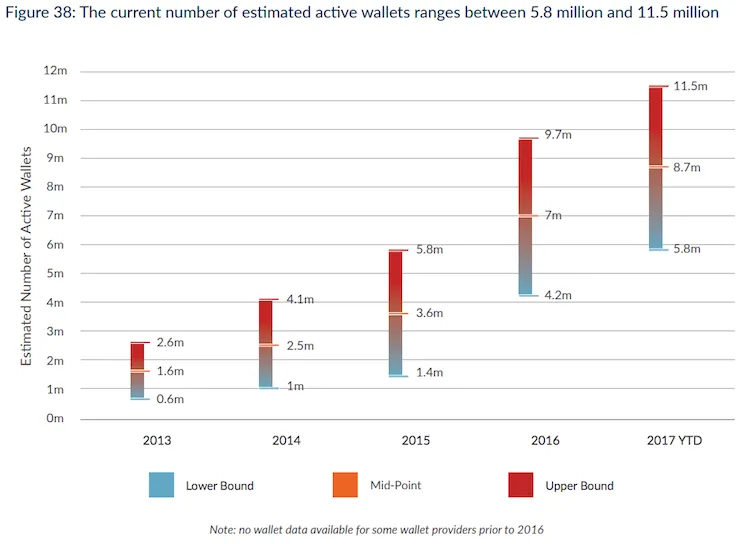

There are currently between 2.9 million and 5.8 million unique active users of cryptocurrency wallets. The exact number is of course quite hard to guess.

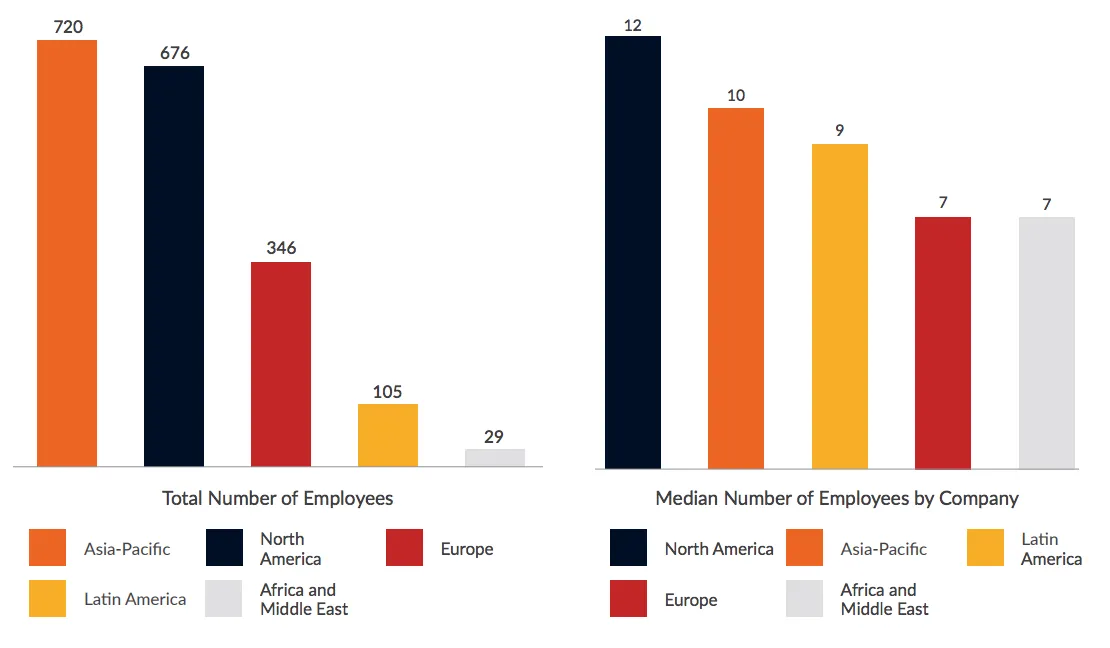

A minimum of 1,876 people are working full-time in the cryptocurrency sector, but the actual total figure would probably much higher since many organizations didn't provide any headcount figures.

Most of these people employed in the cryptocurrency industry are working in Asia (720 people), followed by North America (676 people).

It also seems like the different sectors within the cryptocurrency industry are overlapping: 31% of the cryptocurrency companies surveyed stated that they're operating across 2 or more industry sectors.

And while cryptocurrency-to-cryptocurrency payments account for 27% of currency transfers, national-to-cryptocurrency payments actually take up 60% of total payment company transacton volume.

Wallets

There are anywhere between 5.8 million and 11.5 million cryptocurrency wallets currently active. Of course this number is very vague, but that's because it's hard to determine how many wallets are really "active" if most users are 'just' storing their cryptocurrencies.

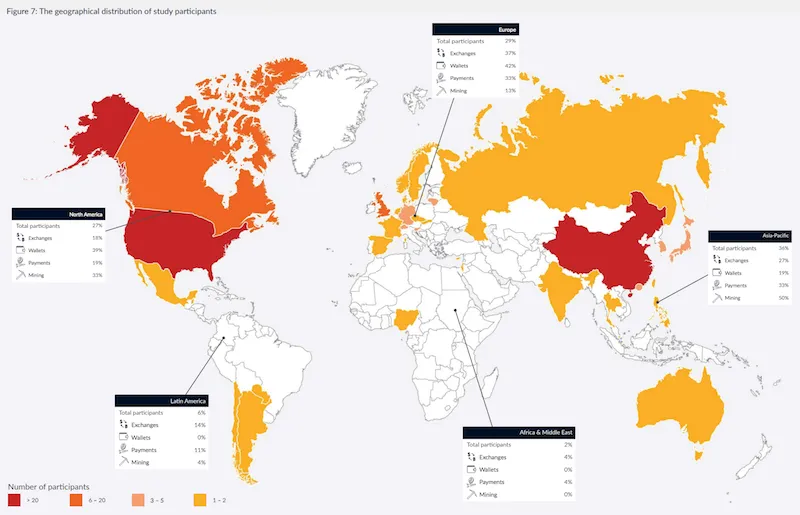

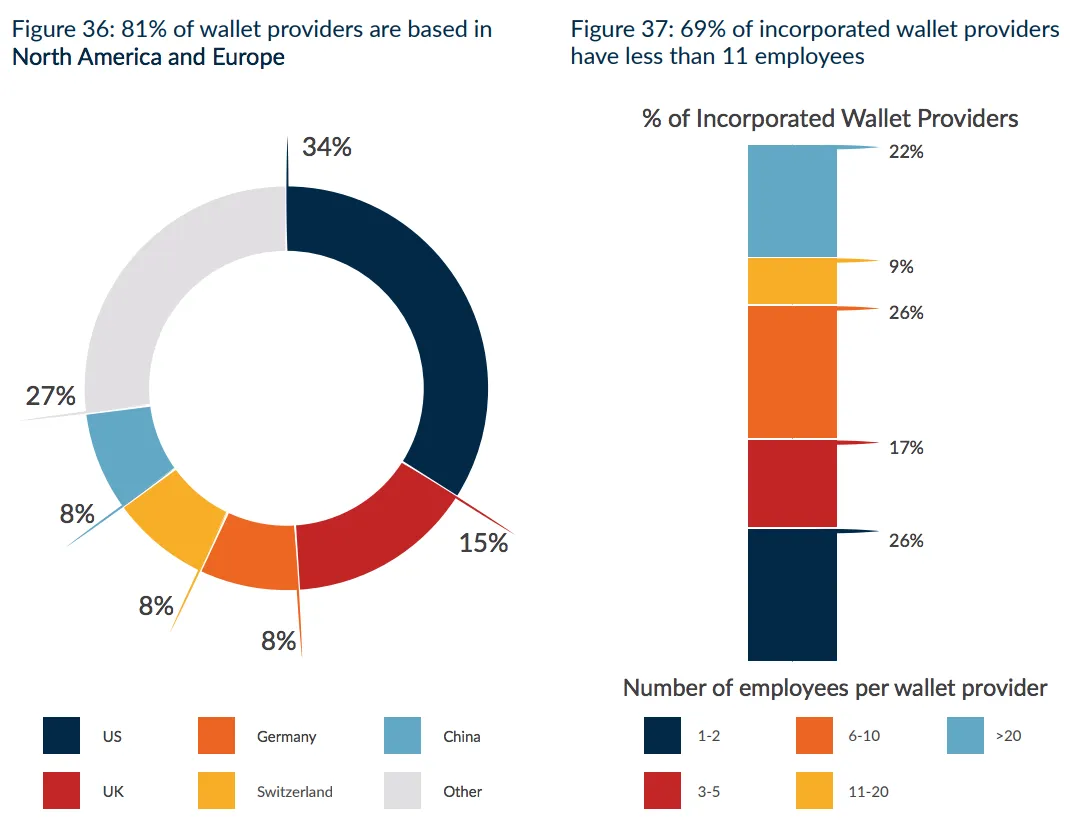

Most users are from North America and Europe (both about 30%), followed by users in the Asia-Pacific Area.

And since most exchanges also offer wallet features and vice versa, the lines are quite blurred here as well.

52% of wallets surveyed had an integrated currency exchange feature, of which 80% enabled the user to a national fiat-to-crypo exchange service.

Exchange platforms

The exchange sector employs the largest number of people within the cryptocurrency industry, and also has the highest number of operating entities.

While only 35% of large exchanges hold formal government licenses, 52% of small exchanges do.

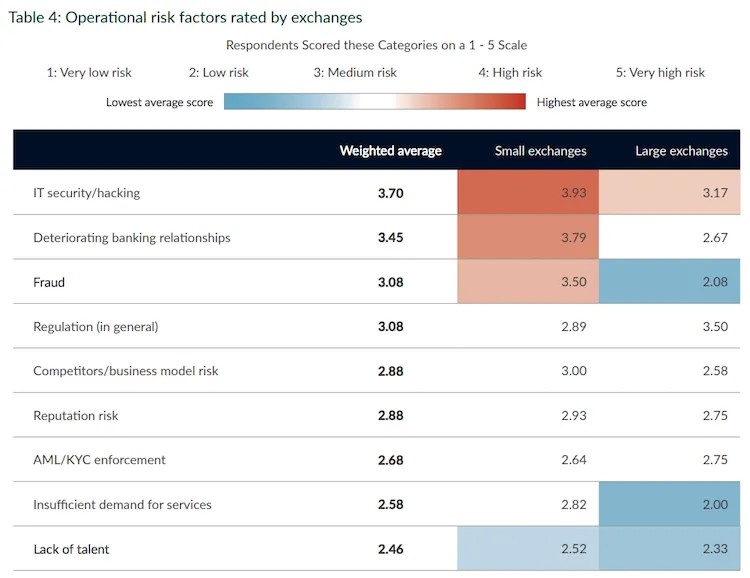

Around 17% of the budget is being spent on security issues, and there are 13% of employees working in the security department.

73% of exchanges operate by holding the user's private keys, therefore partly taking control over the user's funds.

In comparison, Europe and then Asia-Pacific currently have the most amount of Cryptocurrency Exchanges.

The US Dollar was the most widely supported fiat currency and was available at 65% of exchanges surveyed, followed by the Euro with 49% availability.

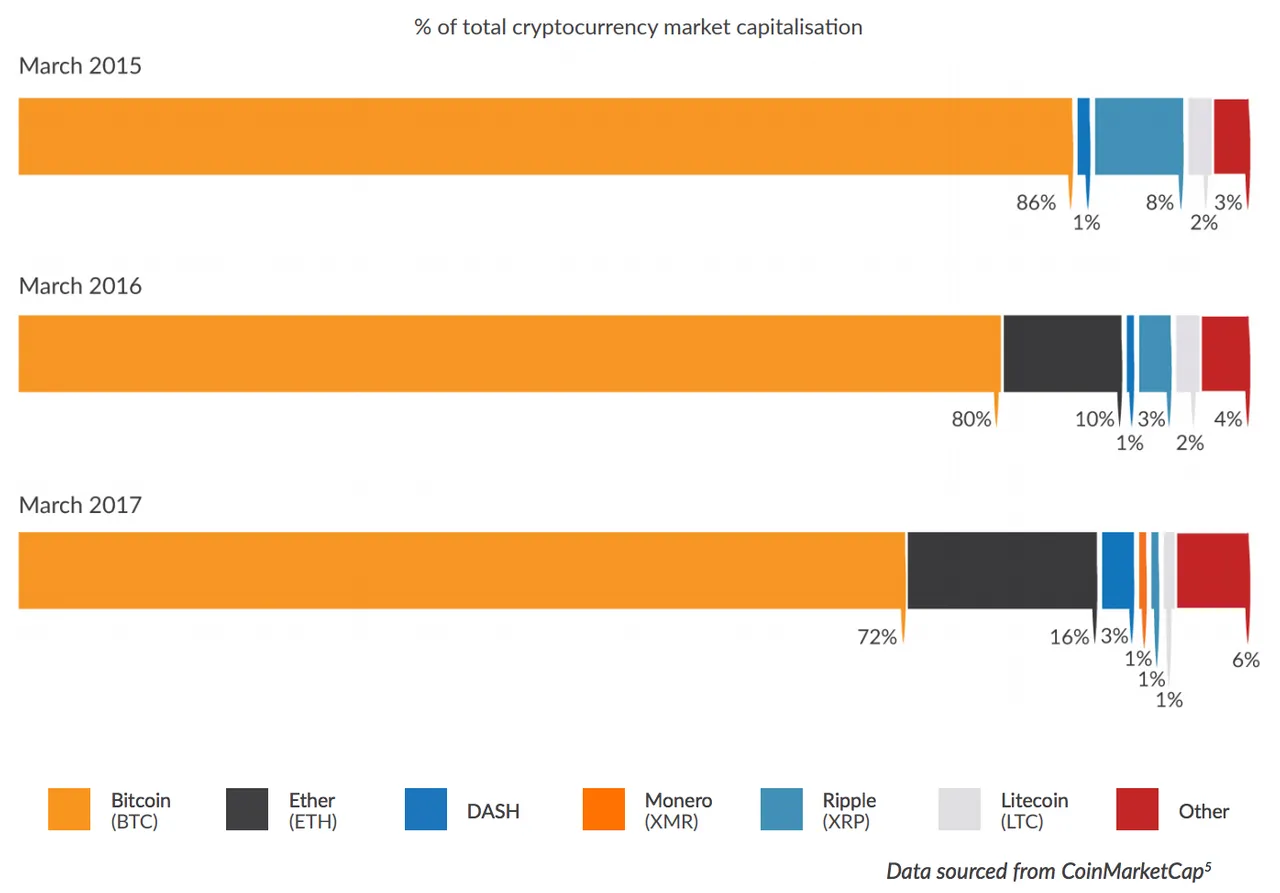

When looking at the cryptocurrencies within the exchange, every single alternative currency was tradeable with Bitcoin - followed by Ethereum and Litecoin. Ripple, Dash, Monero, Ethereum Classic and Dogecoin were also widely represented.

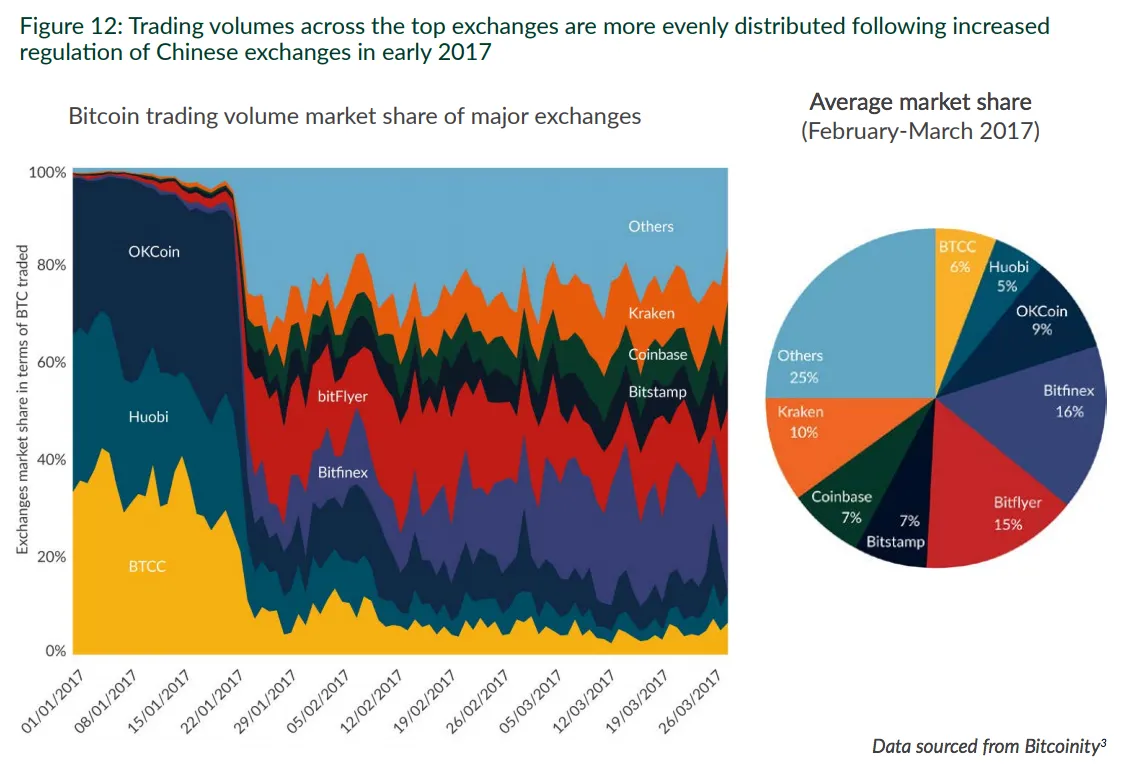

Bitfinex currently has the highest market share of all exchanges with 16%, but you also need to take into consideration that 25% of the overall market share came from a number of small exchanges.

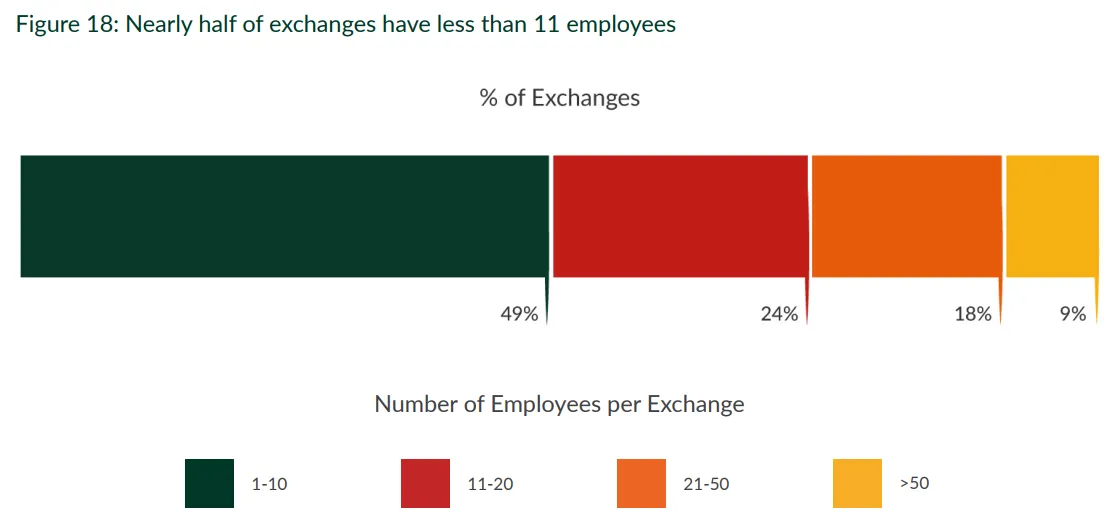

Almost half of the exchange platforms surveyed only employed less than 11 people - despite having millions of dollars coming in on the exchange.

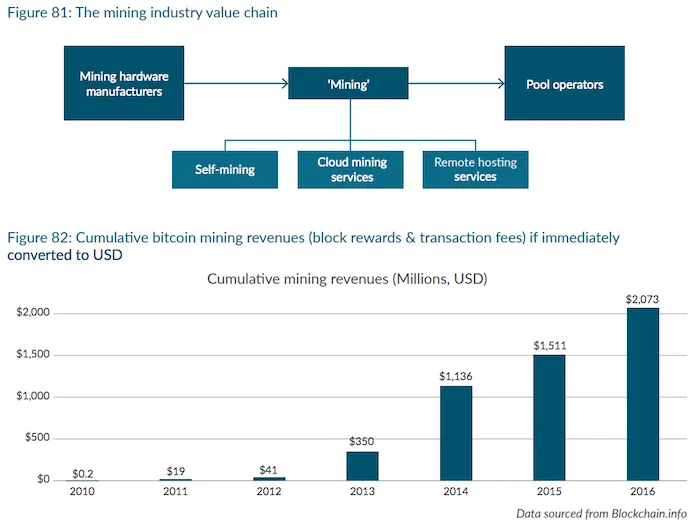

Mining

The mining revenue has fluctuated quite a bit despite the recent boom of cryptocurrencies.

In 2014 for example, the total Bitcoin mining revenues per year (block reward + transaction fees) was far higher than in 2016 when revenues were immediately converted to USD.

In 2014, the total Bitcoin mining revenue was at $786 mln dollars compared to only $563 in 2016.

This significant difference can be accounted to the increase of Bitcoin mining difficulty.

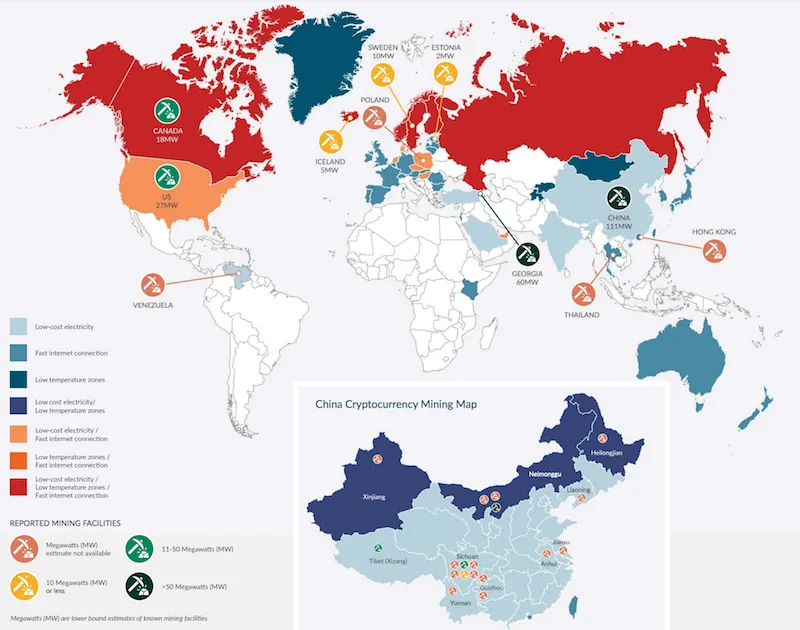

The cryptocurrency mining map shows that well-known mining facilities can be found all over the world, but China holds a notably large amount of mining facilities.

58% of large mining pools are based in China, followed by the US with 16%.

While 70% of large miners would classify their influence on protocol development as high or very high, only 51% of small miners say the same.

Which of these statistics was the most interesting or even shocking to you and why?

© Sirwinchester