Week 35 - Aug 28 Investment Moves

- Current US market condition 11 am (EST)

- Aug 28 Option trades

- Dividends for this week

- BAC (Bank of America) and Warren Buffett.

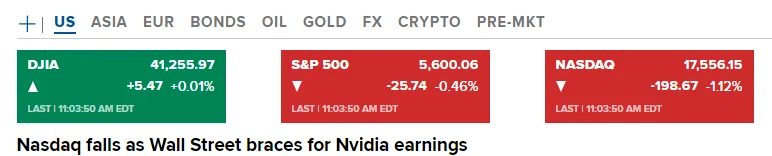

Current US market condition 11 am (EST)

Here are the current markets as of 11 am (EST):

The biggest risk is what happens if NVDA earnings are weak and causing a 2% drop in TECH stocks. I will adjust some of my PUT credit spread to prepare for this possibilities.

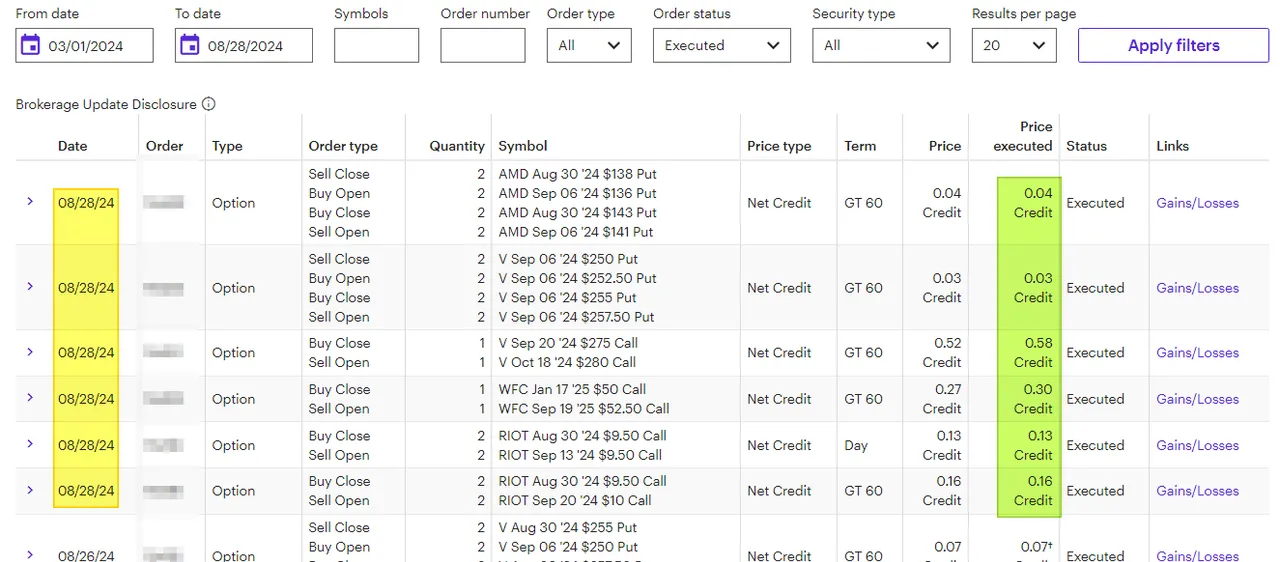

Aug 28 Option trades

Today's option trades:

Summary:

- Rolling AMD Put credit spread out and down for $4 premium each. Lower the strike price if the NVDA earnings move the chip market down.

- Rolling V Put credit spread up for $3 premium each.

- Rolling V covered call up and out for $58. I added $5 in strike price and one month to the time left on the option.

- Rolling WFC covered call up and out for $30. I added $2.50 in strike price and 9 months to the time left on the option.

- Rolling RIOT covered calls by adding two weeks for $13 each.

- Rolling RIOT covered calls by adding three weeks and $0.50 in strike price for $16 each.

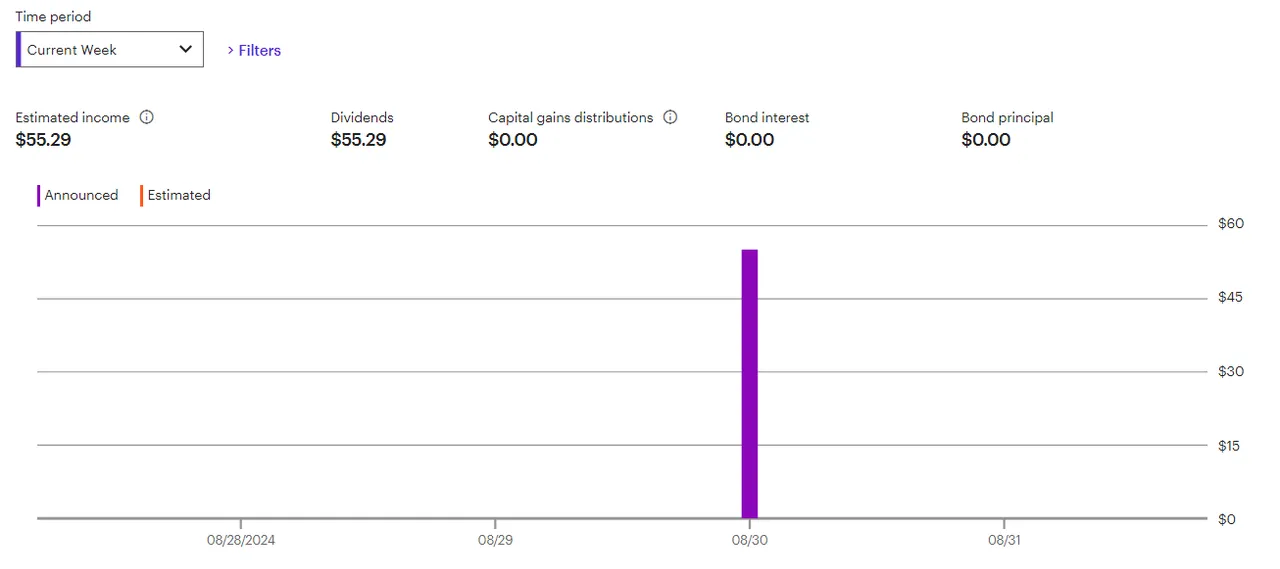

Dividends for this week

I am still waiting for a 55-dollar dividend that will be paid at the end of the week.

August is my slow month and next week is when I expected to get some big weekly dividends. I'm going to stick to my plan of "rotating" out of some dividends as I receive them. I already "used" or spent ~$900 before the actual dividend that is coming in the first week of September (See last week's post). If I do make another move, it going to be smaller in size.

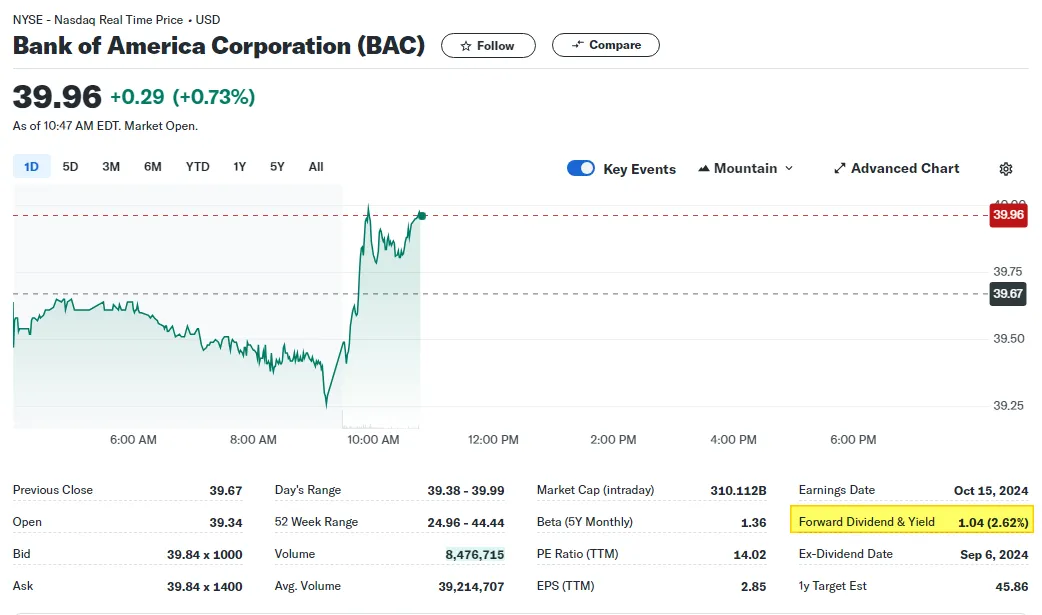

BAC (Bank of America) and Warren Buffett.

Warren Buffett sold more of BAC shares recently.

I remember when he spent $5B buying shares of BAC to "help them out". I remember buying 100 shares within a year or so from that news.

In hindsight, I wish I invested One Billion or more. Ok, all I had was around $800 at the time. On June 1, 2012, I pulled the trigger on BAC which was struggling and barely paying .01 cents in dividends. I have collected dividends for over 12 years now and you can see my returns are about 450% on my 100 shares purchase and a weighted average of 175% return (when you factor in dividends).

My $720 investment now makes me a $1.04 dividend x 100 shares or $104 per year (14.4% yield on cost).

I going to hold on this this just for the dividends knowing that my $720 investment is making me over $100 a year in dividends. The second piece is because I reinvested the dividends into more shares the 100 shares have now grown to ~160 shares. During the COVID stock market crash in March 2020, I added another 40 shares (which has made me 90% since then).

I will continue to watch my 140 shares of BAC share grow into 228 shares as of Aug 2024. It will take about another 11 years before that hits 300 shares (without any new cash added).

Do you want to earn money by using InLeo? Posting, or commenting to others can help others monetize their content. Join me here: https://inleo.io/signup?referral=solving-chaos

Have a profitable day,

Solving-Chaos