2025 Week 32 Summary (Aug 9) - Investments

- 401K plan with BITCOIN exposure

- Billions or Trillions of dollars of new capital

- Week 32 Summary

401K plan with BITCOIN exposure

This week EO (Executive Order) by President Trump to allow 401 Ks to have Bitcoin as an asset class is an interesting one. If you don't understand the issue, let me try to explain this to you.

Most people have limited access to CASH. Middle-class and working-class folks have most of their money in REAL ESTATE or active retirement programs like 401K/403B.

Imagine you are a 29-year-old and have been working for the same company since graduating from college. You might have 20K-50K saved up in a 401K plan, but have $50 a week extra in free cash flow. If you wanted to buy Bitcoin, you would need to send that cash to Coinbase or some other third-party exchange to do so.

Now, I'm at my fourth or fifth company since college (meaning that I'm about 20+ years older than the 29-year-old in my first example), and I have some of the same challenges still. My active 401K can't does not have a Bitcoin option. All of my previous employers' 401K plans might not allow it, or the FINTECH that manages my rollover IRA restricts RETIREMENT funds from buying into Bitcoin.

The next issue is that about 60-80% of Americans have very limited cash at the end of the month. I was buying between $25-$100 several times a year, with an average of about $500 invested into my COINBASE account. This means there were some months I had zero extra cash. Other times, I needed to wait for the income tax refunds to hit my accounts before I had access to $100 to buy BITCOIN.

This is why the Jan 2024 Spot ETF solved half the issue with those who had brokerage accounts. However, not everyone has a brokerage account. This is why the Aug 2025 Executive Order for 401K can solve the other side of the issue.

Billions or Trillions of dollars of new capital

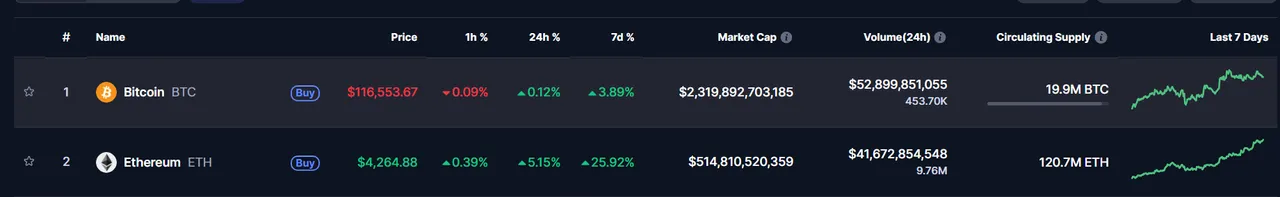

There is a lot to say about this. Ether will benefit from the GENIUS Act (from July 2025). Watch the video below.

What has happened in the last 4 weeks is setting up #Bitcoin and #ETHER for a decade of long-term gains. This is one reason why #BMNR might be one way to play the ETHER run-up. Bitmine will try to do what #MSTR did between 2020-2025.

Yes, I'm long on Bitcoin and Ether.

Week 32 Summary

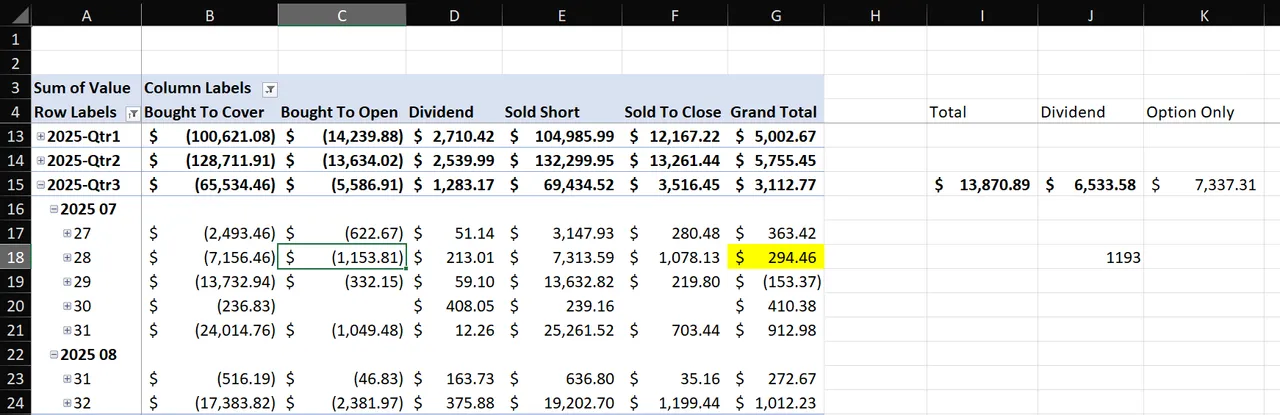

This week, I made over $600 in option trading and got over $350 in dividends. I added more MARA and started a new position in BMNR. I plan on adding more IBIT in the coming weeks, but I don't think I will be adding more ETH directly.

I have over $1K in dividends coming in the next 4 weeks, and one of my GOALS is to have at least 1 share of MSTR.

I think 2026 will be exciting for investors who position themselves for the coming new capital into DIGITAL Assets.

Have a profitable day!