Aug 4, 2025 Investment moves.

- Aug 4 Breakdown

- Aug 4 Investment Moves

- Summary of my trades - explained

- TCG - Assets - update

- 2026 Adjustments

Aug 4 Breakdown

Aug 4 is Q3 of 2025.

Aug 4 is week #32 of the trading year.

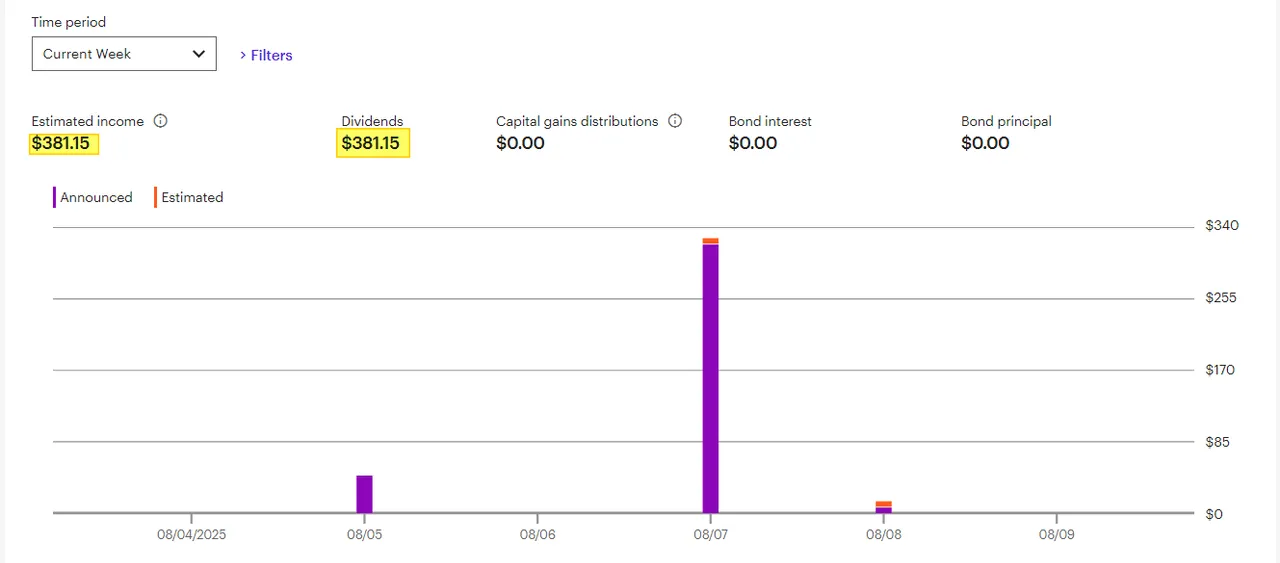

This week #Dividend is mostly from BITO and JEPI, with some coming from my weekly dividend ETF payout.

Aug 8 Investment Moves

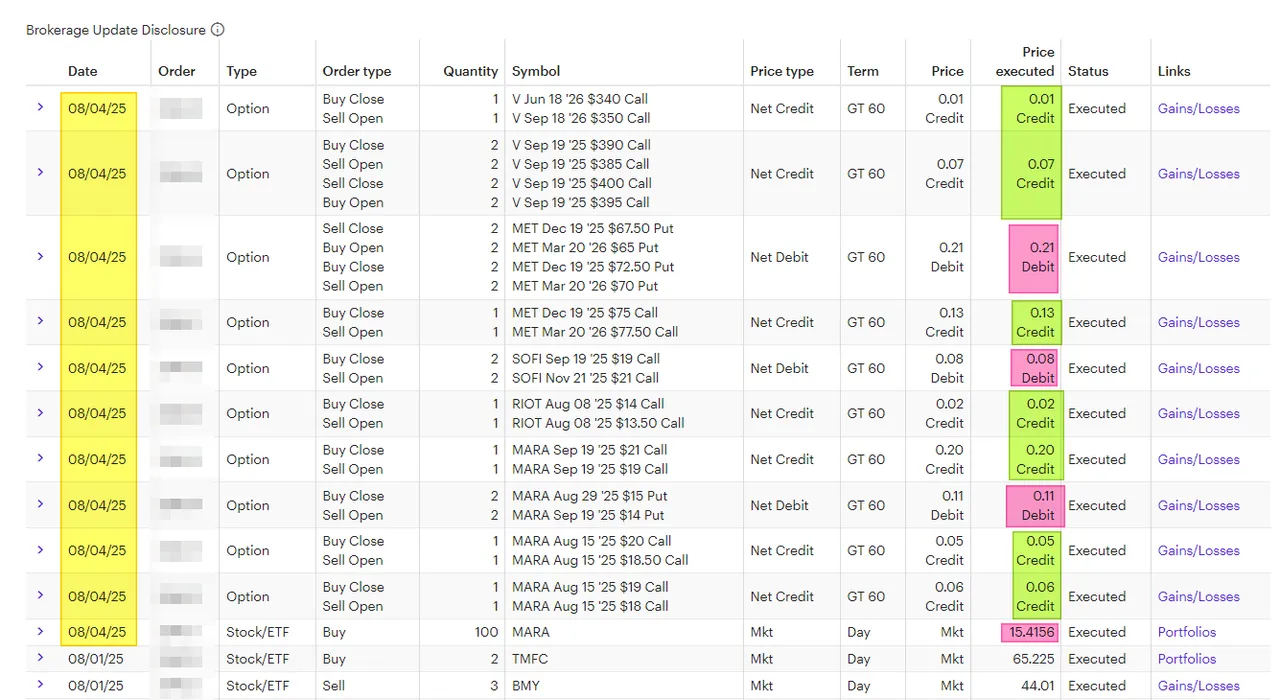

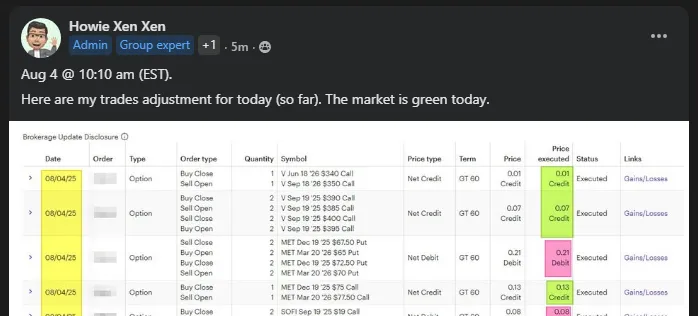

These trades were all posted on social media (FB/X) around 10:15 am (EST). I post when I make the trades, ensuring full transparency. Most of my trades are "Rolling" of options, so you can see the Closing of the position and the OPENING (or adjustment) being made. There is no just showing the winner without showing the losing trades.

I usually post on different sites to show that this data is public and outside of my control. I don't put logos or watermarks on my Pictures, but that's because you will NEVER see these screen captures reused and HAVING a POSTING time earlier than when I post it. Therefore, I, the content creator, and others might copy my stuff and pretend it's their trades.

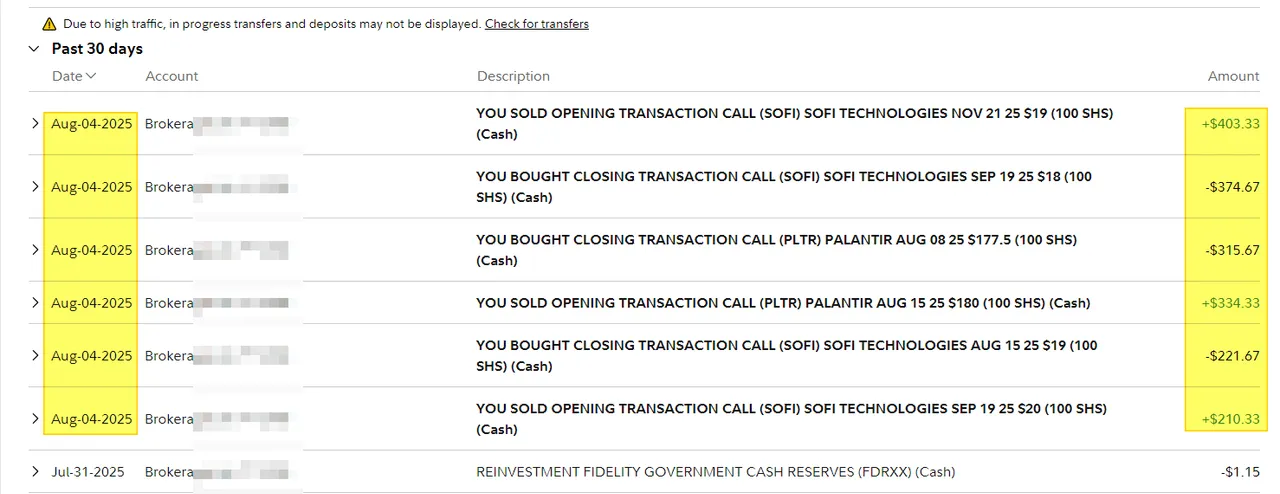

Here are my other option trades in a different account for today:

Summary of my trades - explained

- #SOFI: my covered calls are ITM because of the recent move UP. So I will roll UP and OUT.

- #PLTR: earnings can move the stock faster than I expected. So I will roll UP and OUT now.

- #Visa: my covered call has been ITM for a long time (over 6 months or a year now?). I'm rolling this up $10 in strike price to help me capture some of that UPSIDE.

- Visa: Iron Condor (Sept 19, 2025). Adding Risk back into the Call credit spread by lowering the Strike Price to $395 (from $400). Notice that my covered call was at $340 and my IC was at $400 SP.

- #MET: I'm widening the distance between the covered call ($75) and the put credit spread ($72.50) from the $2.50 currently to $7.50 (meaning this reduces my risk). This cost me $30 to do, but in the end I should be able to make money on future trades that I make.

- #MARA: I added 100 more shares.

- MARA: my covered calls are adjusted down for more risk.

- MARA: my put credit spread is rolled out into the future and lowering the SP to $14 (from $15).

TCG - Assets - update

I started to test collecting #Pokemon and #MTG cards. I'm mostly focused on SEAL products, and for MTG, only the limited edition collector stuff. For MTG, I would like to get some Spider-Man Collector boxes. The IP should be strong and make it a good investment compared to the FF (Final Fantasy) IP.

On the Pokémon side, I've just been getting the current releases via the "retail" MSRP method. This is not an easy thing to do in 2025. It's so hard to find products in the wild that I like going to the stores with a limit of 1 or 2 items, because the ODDS of finding a product are just higher than stores without limits.

While you will never build a big position by buying one item at a time, the key is to do it over and over. GameStop drops are two or three times a month. I find this one way to get seal products. Getting stuff from the PC (Pokémon Center) is just as hard, but it's possible if you have time to spend 30-60 minutes dealing with the QUEUE.

My goal is to try to get the product of each new set and hold it. Like the Stock Market equivalent of a Buy-and-Hold investor. Right now, every product is worth more than MSRP on release day. However, this can't last for the next 2 or 3 years. At some point, it will be unprofitable to "FLIP" current sets for profits. When that happens, people will DUMP their holdings, which will cause prices to drop.

Let's see if I can survive the emotions of big swings in market prices.

2026 Adjustments

There is a list of adjustments that I need to make next year.

One of the biggest ones is moving from a "super safe" option trader into a more "risker one". I usually like to have a 90+% win rate, so I don't need to manage my holding "perfectly". I've been tracking my data for over 4 to 5 years, and I feel like I understand how to enter and exit my positions.

Moving from .10 delta (or less) to .15-.20 delta options.

Using safe options helps with learning how to trade. In exchange for the high win rate comes with LOWER #premium. This means my #ROC (return on capital) is lower than other traders. So why did I trade knowing that my ROC is "underperforming"? The reason is simple: to learn how to do it and make money at the same time. If you lose money over and over, you will most likely think it is a SCAM or a rigged system. Once you have experience making money, you can "adjust" your trading system.

I've been too conservative recently, and I need to update my RULE-based trading system. I will tell myself that I need to open the position within the .15-.20 delta range. The key is I need to better manage positions that can turn into LOSSES much sooner than when I was trading with .10 delta or less. There are plenty of traders who use .20-.30 delta for their trades, but I don't know if I'm ready for that right now.

I would expect my premium to go up by 30-50%, which should translate into 5K-10K more profit per year. I have 4 months to train my brain that it's OK to take on more risk in 2026, and I can start to track the data in Q3 and Q4 of 2025.

Have a profitable day,

Solving-Chaos