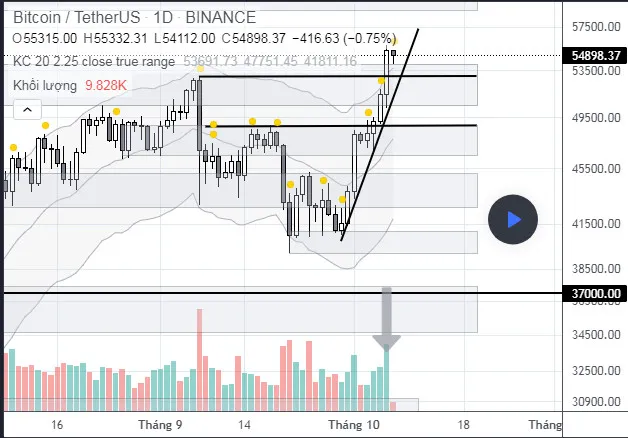

ANALYSIS BITCOIN FRAME D1:

#BTCUSDT made a break - breakout - from the old top, where the dump started, yesterday. Thus, theoretically in terms of market structure, #BTCUSDT at D1 has officially returned to the uptrend. From this point on, strategies will be in favor of buying #BTCUSDT.

#BTCUSDT has been up 7/8 days recently. The down days in this ascending sequence are also very small. That reflects 2 issues: (1) The bullish momentum of #BTCUSDT in D1 is very good, the trend can continue, (2) the current uptrend because it is too fast and strong, may have caused #BTCUSDT fell into an overbought state.

The overbought situation is more obvious because (1) #BTCUSDT has widened the volatility in the past 4 days, with a wide range of consecutive days, each day is wider than the previous day. This type of volatility can lead to over-signaling - climax. (2) #BTCUSDT has broken out and closed the trading day completely outside the upper boundary of the Keltner Channel, which is a pretty clear signal of a climax or overbought situation.

The takeaway from D1 of #BTCUSDT is that the uptrend may continue, but at the moment there are clear signs of overbought - climax or extreme - overbought. Buying #BTCUSDT here will not have many advantages, on the contrary, it is easy for us to "swing to the top" when the technical correction occurs due to the buyers locking in.

BITCOIN ANALYSIS H4 FRAME:

Our #BTCUSDT wait-and-see below support failed yesterday. #BTCUSDT only recovered 1/2 of the way and then immediately rebounded sharply. Even the H4 price bar correction as we expected was quickly absorbed, creating a bullish #pinbar yesterday (first arrow marks)

The breakout - breakout - is created by a very large bullish bar, with very large volume, showing strong bullish momentum. The possibility of false break - false break - to reverse this price bar is relatively difficult. Therefore, #BTCUSDT on H4 is more inclined to continue the uptrend than to reverse.

However, at H4, #BTCUSDT has also fallen into overbought state. Shown as (1) price touches the upper boundary of the ascending channel, (2) the price breaks out outside the upper Keltner Channel boundary. These two factors suggest that we should not buy chasing now at H4 but should wait for a technical correction.

OVERVIEW: