- Billions in Crypto 'Dry Powder' On Exchanges Ahead of Bitcoin's Next Move ;

- Bitcoin Price is Showing 3 Textbook Technical Signs of a Severe Correction ;

- Bitcoin Halving Searches on Google Hits All-Time Highs ;

- Circle CEO Claims ‘Explosive’ Stablecoin Demand From Everyday Businesses;

- Crypto Markets Took a U-Turn During the COVID-19 Crisis, Say Oxford Profs;

- 🗞 Daily Crypto Calendar, April, 18th 💰

- Bitcoin Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Billions in Crypto 'Dry Powder' On Exchanges Ahead of Bitcoin's Next Move

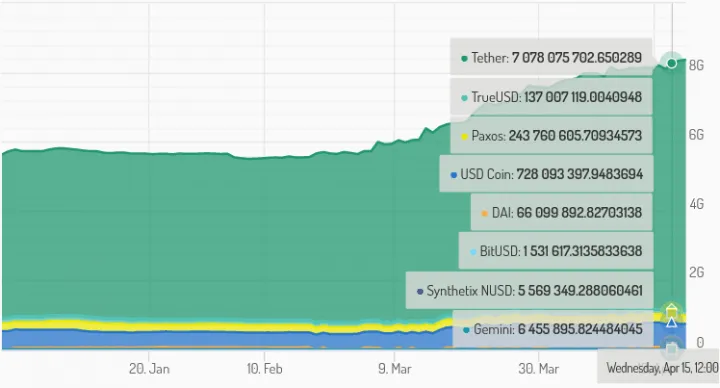

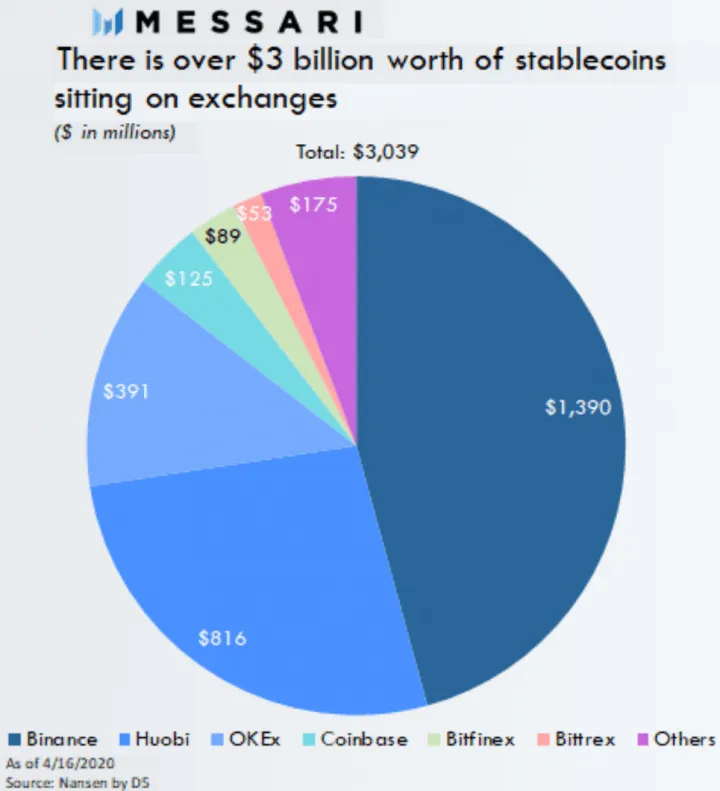

With the stablecoin market remaining at record-high levels for well over a month, more analysts are taking it as a sign that crypto traders have not given up on higher prices, but are simply waiting for an opportunity to enter bitcoin and other digital assets once again.

As reported, many crypto investors sought refuge in popular stablecoins like tether (USDT) and the Coinbase-backed USD coin (USDC) as the crypto market saw one of its largest sell-offs ever on March 12 and 13. However, the market capitalization of the major stablecoins have not decreased even as volatility in the crypto market has returned to normal levels. On the contrary, stablecoin market capitalizations have continued their rise, causing some to speculate that all of this capital is eagerly waiting to enter bitcoin (BTC) or altcoins again.

As pointed out by Ryan Selkis, founder of crypto market researcher Messari Crypto, investors who had given up on the crypto market would most likely have sold their crypto and cashed their money into their bank accounts instead of keeping it in the form of stablecoins on exchanges. The fact that over USD 3 billion in stablecoins is kept in the form of stablecoins, however, suggests that the very opposite is true.

🗞 Bitcoin Price is Showing 3 Textbook Technical Signs of a Severe Correction

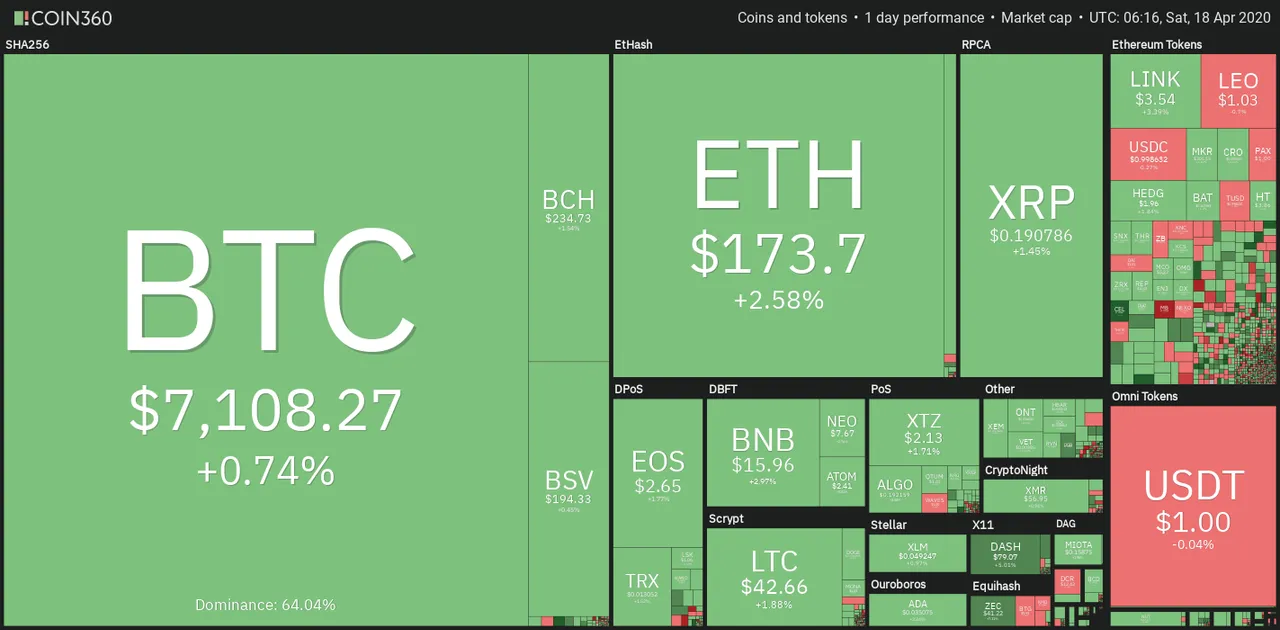

The Bitcoin price (BTC) has been consolidating in the $6,900 to $7,100 range throughout the past 36 hours, right below a heavy resistance level at $7,200. Typically, a large price movement occurs when BTC gets stuck in a tight range for a prolonged period of time.

Currently, there are three technical factors that show Bitcoin is vulnerable to a large move down: deviation from the descending trendline, the emergence of a fractal resembling the 2019 top, and the increase of Tether supply.

Deviation from the descending trendline

Technically, when the Bitcoin price rejects off of a descending trendline, it suggests a bearish retest of lower support levels. Earlier this week, a cryptocurrency trader known as Trader XO suggested that in the near-term, the Bitcoin price could be following a descending trendline and possibly retest the month’s open.

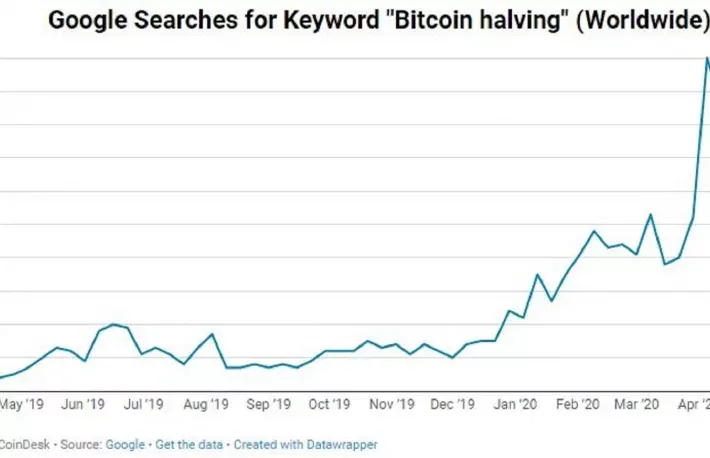

🗞 Bitcoin Halving Searches on Google Hits All-Time Highs

Searches for “bitcoin halving” on Google Trends recently reached record highs, suggesting peak interest in the retail crowd about the upcoming supply altering event.

Queries about the highly anticipated event peaked in the week ending April 11, the highest in bitcoin’s (BTC) 11-year history. It moved down 18 percent as of press time but remains at elevated levels. It remains double what it was for the week ending March 21.

The sharp rise is indicative of an “increase in retail interest,” according to Mike Alfred, CEO of fintech and data company Digital Assets Data.

🗞 Circle CEO Claims ‘Explosive’ Stablecoin Demand From Everyday Businesses

Four months after Circle pivoted to stablecoins, the startup’s new business model has received an unexpected boost from the global coronavirus crisis, said co-founder and CEO Jeremy Allaire.

U.S. dollar-backed blockchain tokens are surging in popularity around the world, and this time much of the demand is for payments in normal business transactions, not just to move money quickly between cryptocurrency exchanges, Allaire claimed.

“Over the past several weeks, we have seen explosive interest and growth in USDC,” he said, referring to the stablecoin Circle issues in partnership with Coinbase. “There is clearly very significant global demand for digital dollars, and the use of digital dollars as a new payment medium.”

🗞 Crypto Markets Took a U-Turn During the COVID-19 Crisis, Say Oxford Profs

Regulators will need an action plan the next time a macroeconomic crisis hits crypto markets and the pandemic has sparked unexpected and revealing patterns among traders.

The COVID-19 pandemic has sparked unexpected and revealing patterns among cryptocurrency traders, according to new research.

In their paper entitled “How Crisis affects Crypto: Coronavirus as a Test Case,” posted to the Oxford University Faculty of Law blog on April 17, Hadar Y. Jabotinsky And Roee Sarel observed that the crypto markets took a pronounced U-turn midway through the crisis.

Analyzing the period of Jan. 1–March 11, the researchers found that initially, both spot market prices and overall trading volume increased as the number of identified COVID-19 cases rose. This positive correlation then reversed and investors began pulling their cash out of crypto and the markets began to decline.

🗞 Daily Crypto News, April, 18th💰

- Bitcoin Gold (BTG)

BTG halving at at 3:41:50 (PST).

- CryptoAds Marketplace (CRAD)

CryptoAds Marketplace with Russian support will launch on April 18.

- TomoChain (TOMO)

"@Binance will support $TOMO Staking, starting from 2020/04/18 with lots of rewards distribution!!"

- Horizen (ZEN)

GetZEN.cash Faucet HODL Bonus launches.

Bitcoin Trading Update by my friend @cryptopassion

Here is the chart of my last analysis :

Here is the current chart :

Today we tested the level of of 6500$ and it triggered directly a bounce which sent us over 7000$. It was a nice trade to do for a move of more than 500$ in just some minutes. We have now to see if that move was not a bull trap and for this we need to go test and even better to go break the resistance line in blue at 7300$.

Last Updates

- 🗞 Daily Crypto News, April, 17th💰

- 🗞 Daily Crypto News, April, 16th💰

- 🗞 Daily Crypto News, April, 15th💰

- 🗞 Daily Crypto News, April, 14th💰

- 🗞 Daily Crypto News, April, 12th💰

- 🗞 Daily Crypto News, April, 11th💰

- 🗞 Daily Crypto News, April, 10th💰

- 🗞 Daily Crypto News, April, 9th💰

- 🗞 Daily Crypto News, April, 8th💰

- 🗞 Daily Crypto News, April, 7th💰

- 🗞 Daily Crypto News, April, 6th💰

- 🗞 Daily Crypto News, April, 5th💰

- 🗞 Daily Crypto News, April, 4th💰

- 🗞 Daily Crypto News, April, 3rd💰

- 🗞 Daily Crypto News, April, 2nd💰

- 🗞 Daily Crypto News, April, 1st💰

You don't want to miss a Crypto news?

Follow me on Twitter or Facebook

Come try out a great blockchain game: Splinterlands