One of the big reasons I bought in to Steem was I saw the "scaling" train coming down the tracks a long time ago. Most of my criticism on this front has been of Bitcoin, but that's only because that was the obvious flash-point for the biggest and worst problem. Steem had near-instantaneous transactions and no fees. It was the natural extreme opposite from the impending scaling problem in Bitcoin and Ethereum.

On numerous occasions this has gotten me attacked or wrongly flagged as some sort of "shill", and offenders even call Bitcoin Cash a garbage alt...as if we don't all know that the original garbage alt is Ripple! (It hits all the bullet points, centralized for banks, useless [not needed for transactions on network], insta-mined, etc.)

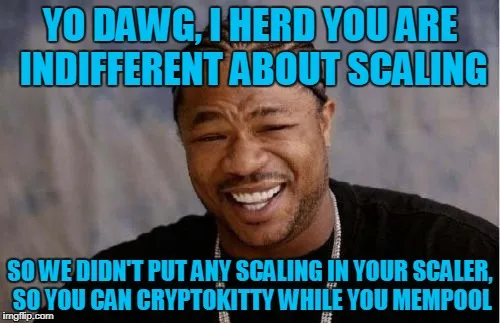

Now, thanks to people trading (mostly ugly) digital cat images on the Ethereum Network, it is not merely the top cryptocurrency but the top two (by market cap) which clearly have no ability to scale in their current form to handle any significant uptick in users.

Incidentally, this is probably why EOS has suddenly shot up from a bottom around .50 to a top around $13. Ditto for Bitcoin Cash from $200-$300 to a top of $5000.

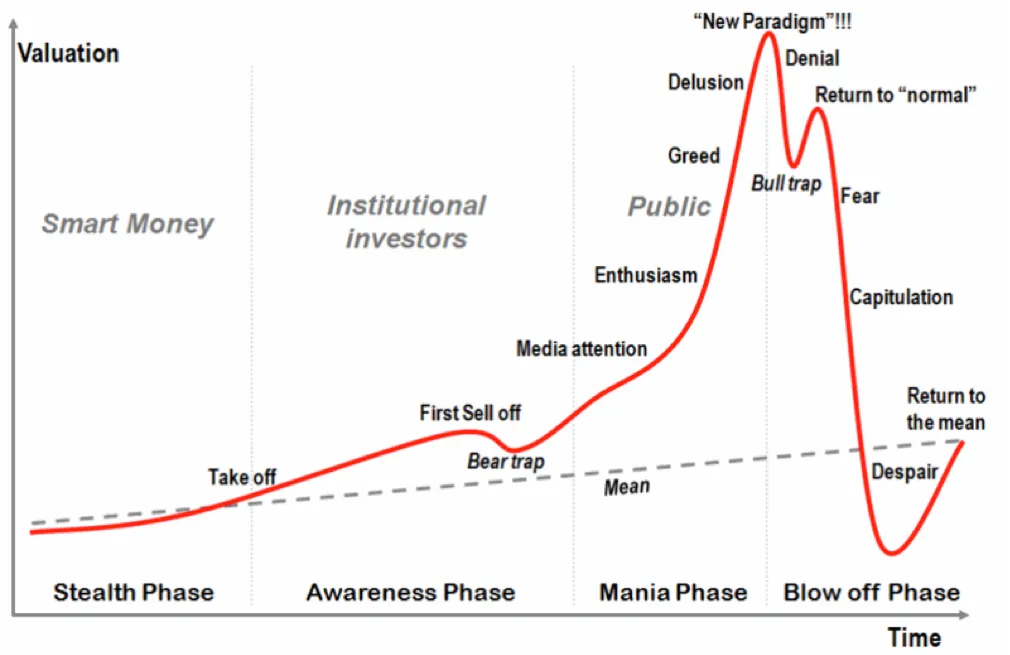

The truth is, the market does care about scaling, but only the early, smart money cares has cared so far. We've already passed the stealth phase, when Bitcoin Cash was $200-$300, and EOS was $0.50-$1. This is why we are seeing wild spikes in both currencies - "small" buyers by institutional standards can easily clear the order book on something like EOS.

I recommended EOS long ago for the same reason I recommended Bitcoin Cash long ago - the market was ignoring the scaling risk. It was not priced in. Bitcoin and Ethereum were well into the "Media Attention" phase, but EOS was still in the stealth phase. Now it has taken off:

Ethereum, or Bitcoin, don't even need to have a severe problem. The mere potential for one makes diversifying into these assets wise as institutional money flows into this sector over 2018, which means both EOS and BCH could be looking up.

(However, if atomic swaps change the scaling game in practice, all bets are off.)

The market can stomach a replacement for Ethereum more easily than one for Bitcoin. It's still in denial about that possibility (not inevitability, possibility) with Bitcoin and not fully pricing it in. If EOS is $100 in a year, we'll be saying the same thing about it, too.

You would be wise not to make the same mistake.

PS - Attention Fork Haters: I'll be discussing how Bitcoin and Bitcoin Cash can productively coexist in a near-future post, so feel free to take that into account before flaming/flagging/spamming me in Discord again. I know you've been hurt by Bitcoin Gold. I get it. I almost wrote an article about BTG being a potentially "hostile PR fork", so I do understand. I haven't done my due diligence on the later forks, but the only one I've seen that appears legitimate is Bitcoin Cash. This is not an endorsement of other or future forks. Sigh.

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Imgflip

Copyright: Xzibit, Coinmarketcap, https://www.cryptokitties.co/