'Is my capital or/and returns safe, can I liquidate my holdings during a crisis, and will I make any money?' These are questions you always ask yourself before you invest in a financial product, like a mutual fund or stocks. And chances are, you will only invest if the answer to all these questions is 'yes'.

However, when it comes to cryptocurrencies like bitcoins - which are all the rage right now - the answer to these questions is an emphatic no, at least as far as India is concerned. ..

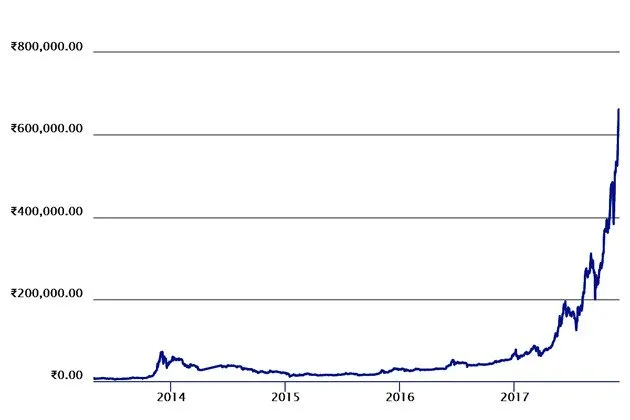

Bitcoin prices have surged from Rs 7,304.24 on 28 April, 2013 to Rs 6,26,396.07 on 30 November, 2017 - a whopping increase of over 8,400 percent! With such returns, it is no wonder the cryptocurrency has emerged as a new attraction among Indian investors.

Movement of bitcoin price in rupees from April 2013 till November 30, 2017

But, are such almost unrealistic returns a good enough reason for you to invest in the cryptocurrency? Forget the risk of volatility, as it is inherent to most investments, there are other reasons why should stay away from cryptocurrencies

When you buy stocks of a company, you know that the growth of your investment is directly proportional to the company's growth, its earnings, turnover, expansion, and other internal and external factors. Similarly, behind every investment product there's a mechanism as to how your money grows. However, in bitcoins, price is determined solely on the basis of demand and supply, and speculation is what is driving its prices right now.

Karan Bharadwaj, chief technology officer of Singapore- ..

Read more:- Link