Hello everyone,

As most of you know, the BitShares platform allows for multiple operation types. From transfers, order creation & cancellation etc. to asset creation and issuance, to worker proposal creation and so on.

To fight transaction spam and to ensure the reserve pool is not drained, each operation type has an associated fee (currently denominated in BTS). The list of operation-types and associated fees is called the Fee Schedule.

The current Fee Schedule is available here: https://wallet.bitshares.org/#/explorer/fees

And is based on USD values for operations based on @xeroc's work. You can find more details in his article here: https://steemit.com/bitshares/@xeroc/bitshares-fee-schedule

It is important to note that out of the fee mentioned, only 20% goes to the reserve pool. The other 80% is returned to the user via vesting balances if he is a lifetime member (hence the lower LTM price in the wallet fee schedule) or to the referrer & registrar of the account for non-LTM users with a split based on the registration faucet configuration.

Recently, I have been doing some analysis of the operations performed on BitShares and the associated fees and the results are very intriguing.

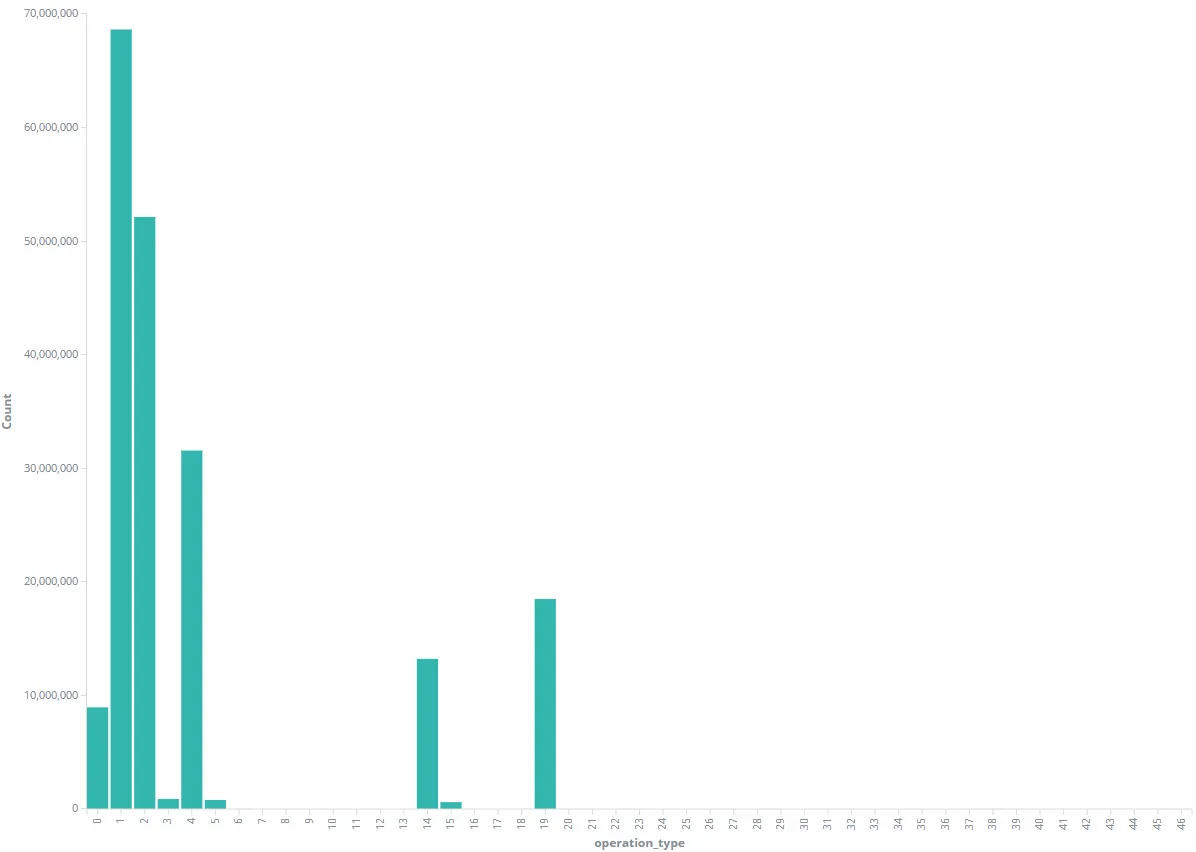

To start, here is the operation type breakdown for the last 6 months:

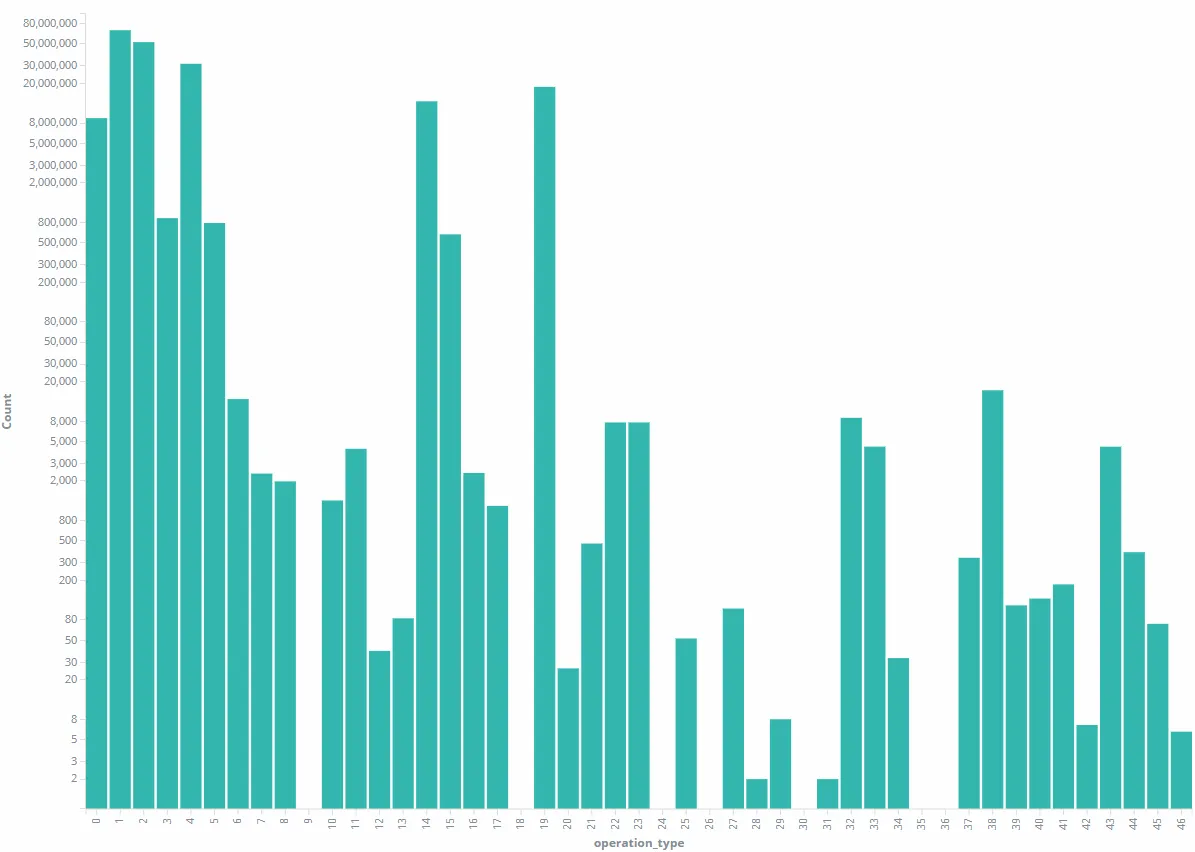

and in log scale for better viewing:

The operation_type id to operation_type table can be found here: http://open-explorer.io/#/fees

As you can see, the majority of the transactions are transfers,order creations and order cancellations. Keep in mind that only filled/partially filled orders are charged the creation fee. And only about half of the orders created are actually filled (and thus pay fees) before being cancelled.

To start my analysis, I loaded 6 months worth of transactions and fees into a database and ran some queries.

Turns out that with the current fee schedule, the total fees over the last 6 months come to a total sum of just over 3m BTS.

This means that approx 600k BTS is returned to the reserve pool from fees or just over 100k BTS / month (3500 BTS / day).

Around 25% of that comes from transfer ops, a staggering 40% or so from asset issuance performed by gateways and 20% from account creation.

So >85% of the DEX reserve pool revenue comes from non-trading operations.

Furthermore, the DEX reserve pool (replenished at 3.5K BTS / day as stated above) is spending approx 330k BTS daily at the moment. ~30k for witness payments and 300k on worker proposals.

So it's running at a loss of about 326.5k BTS PER DAY at the moment.

Even if we consider worker proposal payments as an investment for the future rather than a running cost, although workers incldue the infrastructure worker payments, and only consider witness payments as running costs, the loss is still 26.5k BTS /day.

Meaning the reserve pool subsidizes the running of the DEX to the tune of 88% or so.

The initial decision to have very low trading fees was taken to entice and bring in more users to the DEX. But as things stand the current base fee of 1/8th of a cent (0.0012 USD to be exact) for order creation of ANY size is way too low.

The end result is that trading fees (order creation/update/cancel) account for just 4% of the DEX revenue despite accounting for >50% of the total usage.

I know this might not be immediately obvious to people because a lot of assets are gateway assets with an associated percentage based market trading fee which is high compared to most CEXs (usually 0.1% compared to 0.05% or less in competing CEXs) but that's a gateway issue.

It is my belief that the BitShares fee schedule should be updated to increase fees for most operations and ensure the long term viability of the platform.

I have a Fee Schedule proposal I am currently working on that would see most fees raised 4x. Combined with a proposed 10% decrease in witness pay to 0.9 BTS / block, the reserve pool would only subsidize the platform to around 25%. Thus, with a 25% increase in usage/userbase the platform would go back to breaking even (if considering witness pay as the running costs) which sounds a lot healthier.

I will be publishing my proposal at the forums soon for discussion but in the meantime I would like to share this post as food-for-thought and to get some more discussion going.

I know a 4x increase seems excessive but please consider how low the actual fees currently are. Don't confuse base network fees that the reserve pool is replenished from with the market fees charged by asset issuers.

Personally I will campaign for lower market fees by asset issuers while fighting for the higher network fees which support the DEX as stated above.

Thanks.