Why I wrote this article

When I lately talked to friends saying Ripple though I'm not a fan could reach price x in the nearer future or even exceed Bitcoin in market cap exactly the statements of above were thrown to me:" Never ever as then Ripple's market cap is bigger than Bitcoin's". I asked "So what? What role has the market cap for a potential price a cryptocurrency can reach? The market cap of every known or unknown coin/token could exceed Bitcoin's market cap just in this moment."

Such kind of "tips" are used to a flood of critics destroying these in one split second. With statements like "but then the market cap of would ..." and "exceed", "Bitcoin" and "Apple".... Feels familiar?

This was the moment I realised that there's a common thinking in the crypto space with a lot of fallacies.

And also on the ranking pages themselves there're actual errors regarding the market cap in my eyes. Or doesn't make any sense.

Criticism, remarks and corrections are seen with pleasure and can be done here in the github rep..

Fallacy 1: Crypto market cap !== Stock market cap

Let's start wit the fallacy that the market cap of every! cryptocurrency is seen as a key indicator equal to market cap's of the stock market.

Difference 1: Regulation of the total supply

If a stock market listed company gets evaluated the market cap roughly said determines the value of the company and its price per share.

At the stock market this is a regulated process. So a listed company isn't able (without approval?) to create additional shares at a later stage to then sell them on the market. As this would dilute the shares whereby making them less worth.

Imagine a fictive company issuing 1.100.000 stocks. At the IPO (stock market launch) the stocks are sold at 50 US$ each but 100.000 stocks remain in the company and are hold by them. The company would now be evaluated at 50 million US$ due to 1.000.000 stocks at 50 US$ each - the 100.000 stocks held by the company are not in the involved in the market cap calculation. And creating new stocks afterwards on top of the 1.100.000 is not allowed.

Issued stocks in total: 1.100.000

Stocks held by the company: 100.000

Circulating stocks on the markets: 1.000.000

Price per stock: 50 US$

Market cap: 50.000.000 US$

But on the crazy crypto market this behaves different.

There is now regulation and everything equals a factory for coin minting where the issued amount of of total coins/token can be raised and sold on the markets afterwards at any time - seen in context of stocks. Of course just if it is determined like that in the whitepaper/protocol.

With Bitcoin this is different as the total supply is capped like stocks. So when the amount of approx. 21 million $BTC's is reached then it's over. Creating more BTC on top the 21 million in a later stage is not possible.

For Ethereum however this looks different for example. Ethereum's Total Supply is growing - as of Aug. 2018 - roughly 10% annually. So an additional 10% of new $ ETH can be mined and minted every new year (as from change to POS only about 10-0.5%, but probably around 1%).

This characteristic is like there's a company able to create new 10% stocks on top of the already issued ones and then throw them on the markets. So Ethereum is more akin to a currency where new money is being circulated "almost out of nowhere" over and over again than that it is to stocks..Although Ethereum has a utility and is not a currency coin.

But what would that mean? Yes the market cap increases with the same price. Just like that…

In context it would be like this: "There is a market cap and a company and in between they are just going to create new shares in addition to the original number of shares issued but the company retains them for a while." If you were to tell that to an old-established investment manager who doesn't know something like this from the stock market you probably get the look of a cow.

In addition the amount of coins / tokens retained by the company at crypto is usually not very low. In theory the company now could go out and throw its withheld coins / tokens completely on the market - so shifting them from the total supply to the circ. supply - and sale them on the stock exchanges.

The result: the market cap of a crypto currency would now shoot up in a very short time due to a high number of new coins / tokens in circulation. Theoretically - and now should be your first Aha! moment - this could lead to a cryptocurrency overtaking Bitcoin's market cap. Of course just with a constant market price serving as a appropriate multiplier.

Aha moment 1: Every (shit) coin / token could overtake Bitcoin in it's market Cap at any time if it's circ. supply goes extremely high.

In practice the shifting of coins / tokens from the total supply to the circ. supply would probably! rather lead to a lowering of the market cap since:

- the order book would increase on the side of the sell orders

- what speculators / investors would rate as a crypto summer sale and thus negative

- which in turn would drive the price down and eventually also the market cap

Btw:

Many in the community are outraged when a crypto project shift it's coins / tokens from their total supply to the circ. supply. Although it's determined like this in the white paper. First of all this is nothing different to when Bitcoin is added new $BTC by coinbase (no not the exchange) transactions into the circ. supply. The whole thing is called coin minting for a reason - not to be mistaken with the mining. And in both cases it has been previously communicated in the white paper.

The funny thing however is that since everyone's eyes are on the market cap they would have to be happy about such a shift since the market cap would increase and the currency would go up in the ranking. So the people's aspects doesn't fit completely. Only the outrage due to inflationary behavior is plausible since the supply increases in proportion to demand which can be bad for the price. However even that isn't bad because if the demand also increases it doesn't matter again. ;)

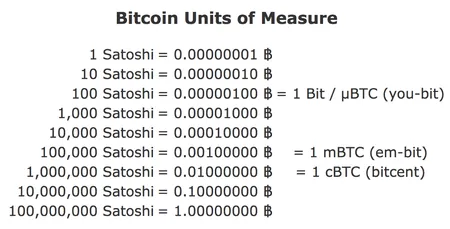

Difference 2: Decimal units of account

Another thing is the representation of the total and circulating supply of cryptocurrencies. So with which decimal unit of account a market cap is calculated. As the name implies cryptocurrencies are about currencies not stocks. Shares to my knowledge have no smaller units of account or let's say no name for it. Cryptocurrencies and also Fiat money such € or $ however do have this. Namely € - and $ cents ..

For example Bitcoin has the following decimal units of account:

So again a "characteristic" which rather speaks for the fact that the marketplace for crypto currencies is more similar to foreign exchange trading than a marketplace for trading with shares. And do foreign currencies have a market cap? In any case I didn't find such a key figure in Forex. So why market cap's as a measure for digital assets that are more like currencies?

Difference 3: Mixed asset salad

This means although many crypto currencies don't track the use case of a currency or as a payment instrument their market cap's are compared with those of real crypto currencies, the so-called "currency tokens", and are ranked and traded against each other. And for the so-called "currency tokens" market cap's are taken as an index, which is not the case in the field of foreign currency trading.

And that a cryptocurrency can not reach a certain price in a timely manner, is then, as already mentioned so often, justified with the market cap. By comparing the market caps of different crypto currencies.

Mostly, the orientation for the max. growth for a crypto currency is the market cap of the largest cryptocurrency Bitcoin, used as a yardstick.

However, this doesn't make any sense to me, since each coin / token with its corresponding variable or fixed circulating and total supply has an individual use case compared to other coins / tokens.

Of course, some crypto currencies have no real use case and their tokenization is bullsh**.

That is to say even if the market cap equation helps a key figure for childbirth, one shouldn't compare these indicators of cryptocurrencies among themselves. That would not be like apples with pears, as both are edible fruit, but comparing apples with poisonous berries. Apart from the different size, one is an edible and the other a non-edible fruit and is used only for poisoning etc. So they have different purposes.

In theory, crypto exchanges are a bit like there is only one stock exchange for stocks, currencies and commodities and all would be jumbled together tradeable against each other. However, the large indexes list and trade these assets separately.

So why should for example Bitcoin's market cap and supply compared to Ethereum's market cap and supply be relevant to the respective price growth and vice versa? Both coins mostly have a different use case.

And Bitcoin's recent market cap or ATH (all-time high) is often the max. limit for how high the prices of individual crypto currencies can currently go. And I think this is non sense ...

Conclusion / suggestion for improvement:

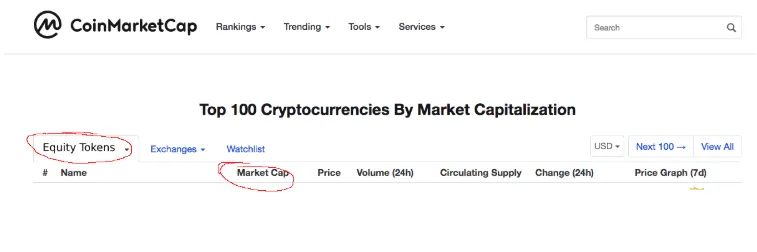

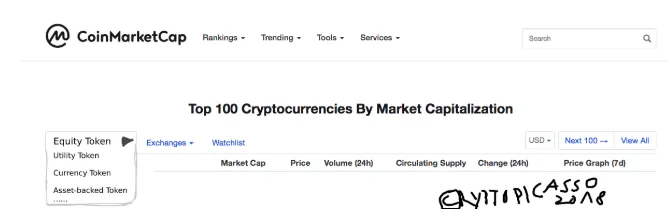

To my mind it would make more sense to first separate real crypto currencies, the currency coins and tokens, from the the market cap ranking, the trading pairs / currency pairs and the trading on the exchanges completely from other crypto assets, like other coin / token types. In other words a complete horizontal distinction.

Vertically to my mind, it also makes sense for all cryptocurrencies (except equity tokens) to remove the market cap as an indicator and replace it with another.

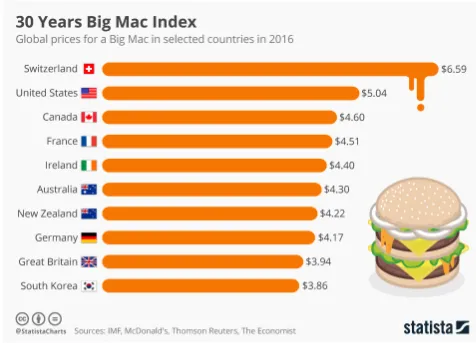

An example of such an key indicator for currency coins / tokens would be something like the so-called "Big Mac Index" for currencies:

Is a currency undervalued or overvalued? There are, of course, numerous economic key figures, [..] But a first indication can also provide a relatively simple indicator: The Big Mac Index! In fact, this is about the Big Mac of McDonald's. The assumption is that an original Big Mac has the same quality worldwide. The Big Mac as the standard burger is absolutely identical worldwide: rolls, meat, lettuce, cucumber, onion, cheese and the Big Mac cheese sauce. Whether you order in Berlin, Sydney or New York ...

The theory of purchasing power parity (PPP) states that in two different currency areas the goods and services converted cost the same in each case. In other words, if there's purchasing power parity and a Big Mac costs $ 5 in the US and $ 2.50 in Europe, then it would be clear where the exchange rate would be: $ 2 per euro. Only then there would be purchasing power parity: Because 5 US dollars would be 2.50 euros, and for both amounts one could buy a Big Mac.

In practice, however, there are often significant deviations from the theory of purchasing power parity, as shown for example in 2015. Consider the dollar-converted prices in a local currency that a Big Mac costs in each country:

The conclusion: According to the "Big Mac Index", the euro is slightly undervalued against the US dollar while the Swiss franc is clearly overvalued. Also the Russian ruble (which lost significantly ground in 2015) is undervalued.

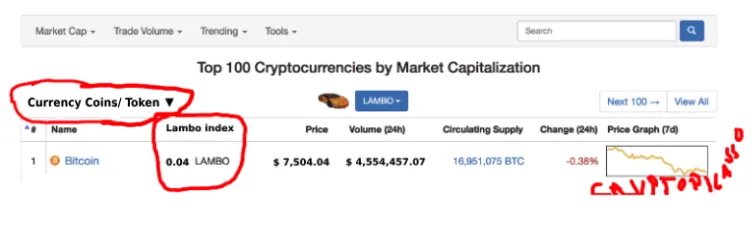

Ironically and probably unconsciously Coinmarketcap had accidentally and temporarily introduced some sort of such an index on April 1: Lambos (short for Lamborghinis)

The Lambo is probably not quite the best index but it would maybe be a start in the right direction.

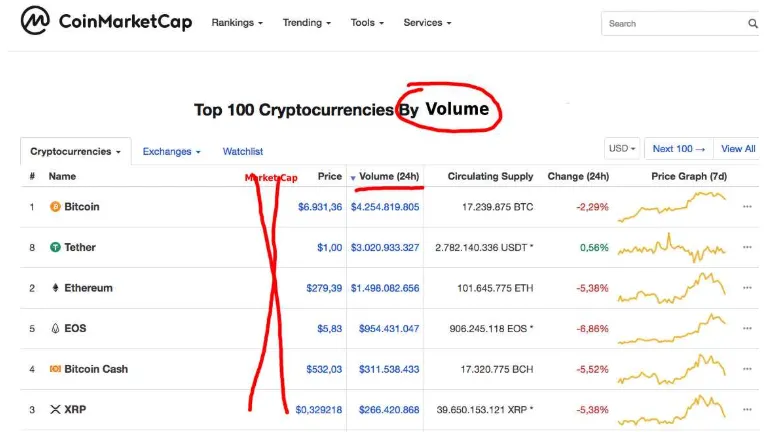

If you want to compare and rank all cryptocurrencies I think it makes sense to remove the market cap completely and start ranking them by maybe volume:

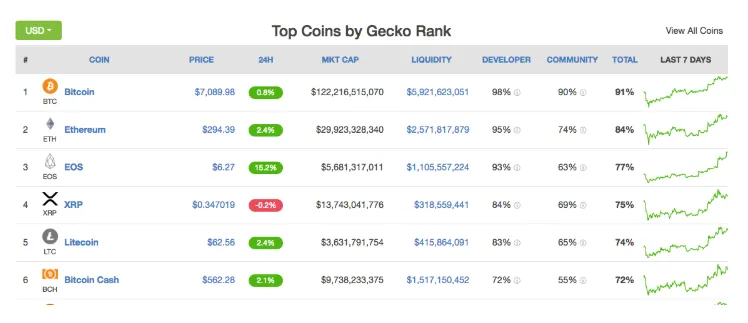

While this is not just about the size of the cryptocurrencies but still a a little better is the ranking system on coingecko.com. Here coins / tokens are ranked after a "total grade" in which many factors are incorporated. Like among others the (partly nonsense) market cap:

Difference 4: Market capitalization of many cryptocurrencies! == Value of the company behind the cryptocurrency

Many think that once they have cryptocurrencies, as in stocks they own a corresponding stake in the company. But that is also mostly wrong and depends on the type of coin / token they have. Only so-called "equity tokens" pursue the similar use case as shares. Unfortunately, as already said, these equity coins / tokens are mixed with other tokens when ranking the market cap, such as currency tokens or asset-backed tokens.

The value of a company can be estimated in several ways. Both through the market capitalization and through other values such as initial licensing or priced prototypes, etc. .. One who wants to know the value of a company behind a cryptocurrency, can not simply consider the market capitalization of its cryptocurrency.

For example, Ripple (XRP) currently has a market cap of approximately $ 14 billion (as of August 2018). Behind the crypto currency is Ripple however is the actual company Ripple Labs and their value is not $ 14 billion. Only all XRP coins together have a valuation of $ 14 billion. That's a difference.

Difference 5: Currency coins / tokens themselves have no intrinsic value

Stocks represent company shares. Let's say companies in turn have an intrinsic value through prototypes, products, licenses, etc. or for example the employees. Consequently, equities also have an intrinsic value in addition to the face value as they are bond to them.

So if all cryptocurrencies that are not equity tokens don't represent shares in the company behind the cryptocurrency that is centrally owned, this means that e.g. currency coins / tokens have no direct intrinsic value.

But what does their market cap actually represent then? Somehow nothing again.

That in turn would mean that there is actually no "real" fundamental analysis for currency coins / tokens. Because they have no fundamental value that can be analyzed if they are not shares in anything.

Edit !!:

I believe that people only are willed to assign an intrinsic value to something if it represents something tangible for them. Assuming this is true, bitcoin as a cryptocurrency would also have an intrinsic value, because bitcoin is based on the payment network Bitcoin which represents a huge intrinsic value! But maybe it has no fundamental value in theory? Excited so see feedback to this topic here.

Here's a good video with Eric Vorhees: click me

Difference 6: Exchange regulations

Ever heard of a coin called UCash? After all, it was one of the top 25 crypto currencies in the world based on market capitalization. Higher than Stratis, OmiseGo and Zcash. If something is placed in the top 25 like UCash all at once, people are asking for mainstream media coverage, a growing user base and significant acceptance. As it turned out, UCash is an outlier whose rise is proof that you can not judge coins by their capitalization.

[…]

As anyone who has a shallow knowledge of market capitalization metrics knows, playing the system is extremely easy. Take a shitcoin with 200 billion coins and a shit exchange listing. Sell a coin for $ 1 and immediately the capitalization is higher than Bitcoin's. The same trick that drove Dentacoin to 21st place in the crypto currency ranking some time ago worked for UCash as well. The stock market on which it trades, BTC-Alpha, is a dubious Russian website registered in the UK, with 600 telegram followers, fewer than 2,000 Twitter followers and a logo demolished by Maestro. However, since it is listed on Coinmarketcap, it can be included in the "official" ranking system of crypto.

There are 325 billion Dentacoins in circulation and 8.6 billion UCash, which explains why they managed to artificially climb that high. Whether or not UCash was the result of a pump and dump is irrelevant; On low-liquidity stock exchanges like BTC Alpha, every whale and every coin is extremely volatile.

Coinmarketcap's extensive range of AltCoins often provides enjoyable reading, especially when filtered by percentage. One great performer in the past, based on this metric, was the Unity ingot UNY, which once jumped 3,600%, though it's only available on a tiny exchange like UCash. Although UCash and Unity Ingot are extremes, they illustrate why one should never judge a coin by its market capitalization alone.

You see, using the market cap or ranking as an indicator of whether a coin / token is successful or legit is bullshit because:

High circ. supply + listing on an Shit exchange = high market cap = high ranking

(As with Aha! Moment 1)

Aha! Moment 2:

Instead of creating a coin / token with a high supply or raising the circ. supply afterwards one can also simply create a coin / token, list it on a shit exchange and initiate an extreme issuing price there. Once someone pays the money, the coin / token is also credited with that value. And that can be made by the project itself very well with minimal capital investment. The effect of a high market cap would be the same. This of course also applies to existing coins / tokens, but here one needs more capital to push the price high later.

Fallacy 2: Market cap! == invested capital

Another misconception related to the previous example: Ripple Labs has also not received or collected US $ 14 billion! The market capitalization doesn't say that the current value of all XRP coins / tokens in total has been deposited at Ripple Labs at any time. 2 examples illustrate this quite well:

Example 1 Source

Let's say that a coin is being given away for early investors. The number of coins is limited to 1,000. 10 people buy shares of 100 coins each for $1/coin. Now the coins are available at an exchange. But only one early investor is selling them. The other 9 are hodling their 900.

The coins AVAILABLE for trading (100) are bought and sold for some time. More and more people want to buy one for themselves.

Over time the price goes up to 1,000 Dollars.

Market Cap has reached $1,000,000 (1,000 coins x $1,000).

People have not invested that amount of money!

9 people bought 900 coins for $900, the remaining 100 coins were sold for the total amount of $100,000.

Example 2 Source

Imagine me and Jimmy have made Applecoins. I have 6 applecoins and Jimmy has 5 (total supply is 11 applecoins). Now Tom wants to buy 1 applecoin from us for 1 dollar. So the total money inflow is 1 dollar into our applecoin system. But now we have applecoin marketcap at 11 dollars. Now we decide to make an ICO. We sell all Applecoins that we have (10) at 2 USD per coin. Now the marketcap is 22. After our coin hits an exchange 5% of coins that were distributed are sold at 50 USD. Now the marketcap is 550 USD. Eventhough the total money inflow was only 46 USD (because 5% of 10 coins is 0.5 and it's sold for 25 USD (50 USD per coin), the initial 1 USD and then the ICO 20 USD. So, to reiterate, you don't need to have an inflow of 2 billion dollars to increase marketcap by 2 bln.

Regarding the capital invested in crypto currency and the market cap you have to account that over the years e.g. many $ BTC were mined and then minted. So there are $ BTC in circulation, in which no fiat money was directly invested, but only indirectly through electricity and hardware costs. However, they are included in the market cap, because they have the same price as any other $ BTC.

The whole thing also works the other way around with a dip. If the price of a coin / token goes extremely low, it may be that much of the total invested capital "disappears" over the period of the discount price.

Edits

03.09.2018 - A good note from a friend:

"The volume is probably even easier to influence than the market cap, a few trading bots that trade a coin / token daily, and you have a high volume on it. And the volume does not indicate what value the market allocates the project. "

"I think the market cap is an easily understandable indicator of how over- or undervalued a project is .. If I see that EOS' is currently priced at $ 5 billion or ETH even with $ 28 billion words are failing me. The projects have so far not proven that their technology is good for more than cryptokitties (and even that inadequately) and yet they are worth a sizeable amount of money. The market cap helps one putting a project in perspective, and here it actually does its job quite well, so I would not write it down so nonsense. "

"The market capitalization gives a first and simple overview of the size of the project, of course you can manipulate it here, but I think that is limited at the" top projects ". If you evaluate projects using indexes, it gets confusing because indexes can often be laid out in one direction or another and are therefore less manageable. As far as the euro is concerned, you can already quote a market cap because the money supply and the price are visible. And I totally agree with your last point. Comparing XMR with IOTA does not make sense, but I believe that insight is increasingly gaining ground."

Conclusion:

My big question is, is there a better and, in my opinion, more accurate measure than the Market Cap, which reflects the value of a crypto project and its cryptocurrency that the market assigns to both? And that shows if a project is over- or undervalued? And which is then still suitable for a comparison of cryptocurrencies with each other?

Nullius in verba iurare.

Found spelling errors may be retained.

Please excuse mistakes, German native

Follow:

Instagram: cryptovinz