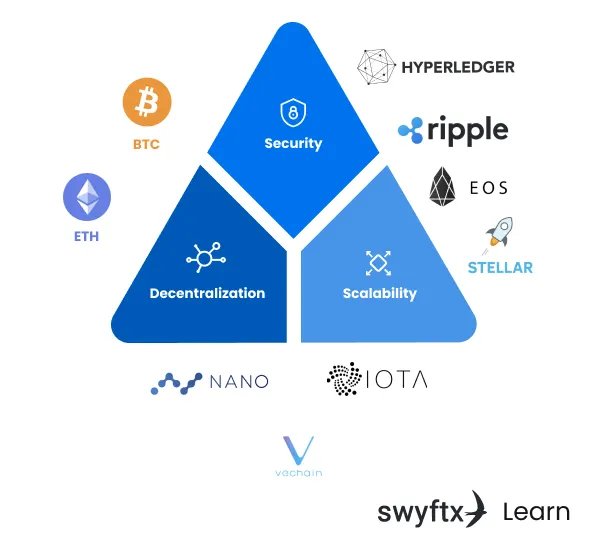

Remember the "blockchain trilemma"? The apparently unsolvable conundrum of "security" - "decentralization" and "scalability"? We've seen and continue to see much hand-wringing over this topic which is also a good backdrop against which to "sell" a new blockchain.

Because Bitcoin and Ethereum are widely credited to having solved for security and decentralization at the expense of scalability, many modern blockchains and almost all DAGs come to the market claiming to have solved for scalability. The reason none of them has overtaken either bitcoin or ethereum is that it soon becomes apparent that they did so at the exepense of decentralization (blockchains) or security (DAGs) ... or both (scams) ...

I was watching the 2018 MIT class taught by no other than Gary Gensler, today's Chairman of the SEC (and currently waging something approaching legal war against the crypto industry), who back then was a Senior lecturer at the MIT.

Early in the very first class he compares the Depositary Trust and Clearing Corporation (DTCC, the central securities depositary in the US) and its 30 000 transactions per second, and VISA's 20 000 - 70 000 transactions per second with the measly 7 tx/s of Bitcoin

And it was at this moment that it dawned on me: the "scalability trilemma" can't be solved ... because it's the wrong problem to try to solve with a blockchain. As a matter of fact, it's an obsolete problem, which either has already been solved (in a certain sense) or worse, shouldn't be solved at all!.

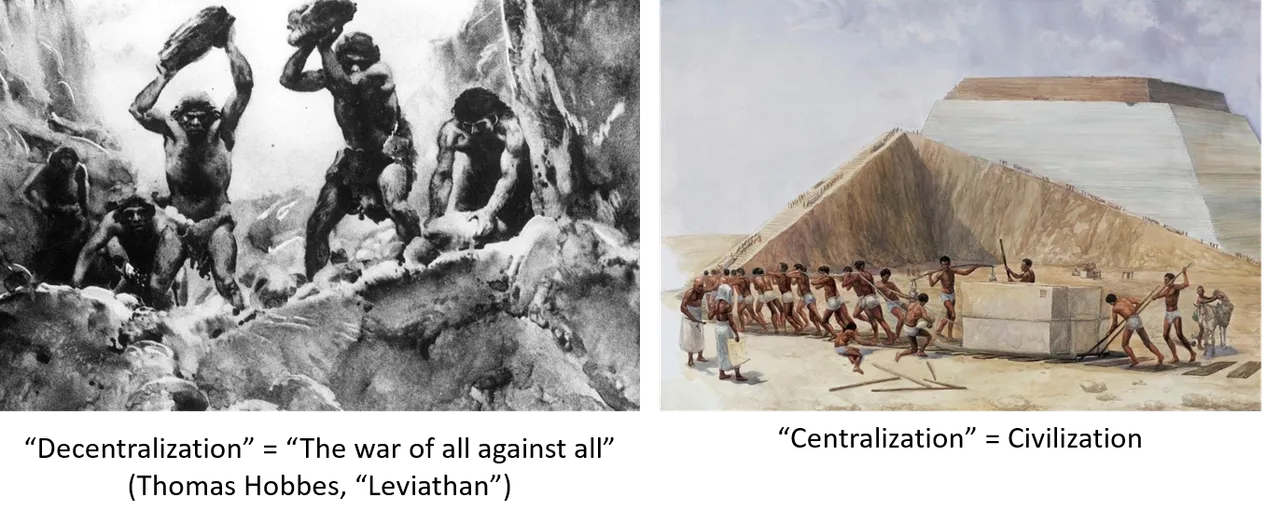

Our centralizing mind setting

Indeed, this scalability problem is the product of our minds not being able to fully embrace the decentralized way of thinking, and it serves to illustrate how important, how integral and essential centralization is to our societies. At this point, I would like to invite you to read (or re-read) one of my older posts, Understanding blockchain's social impact

In it I remind readers that what the blockchain enthusiasts praise today and hold as one of the greatest qualities of such a technology, "decentralization", was present for centuries in the thoughts of philosophers and seen mostly not as solution but rather as a serious problem. For Thomas Hobbes, what we currently celebrate as "decentralized" or "self sovereign" was the "state of nature", a state of "war of all against all". Against such unappealing situation, Hobbes advocated an authoritarian, centralizing State, synonymous with progress and civilization.

Thomas Hobbes, Leviathan, Chapter XIII

It is simply stating the obvious that we reached the current level of civilization thanks to centralization. And so we are rightfully indebted to it, to the point where we cannot really conceive, at least not without considerable effort, of a decentralized arrangement.

DTCC, VISA and ... what?

See, although I've long sensed it wasn't fair to compare Bitcoin with VISA, the insidious fallacy of the "scalability" topic only became clear to me now, in the year of the Lord 2023, watching Gary Gensler talk about ... the DTCC - the epitome of a centralizing body. And although VISA is not quite the monopoly the DTCC is, it's still part of a VERY priviledged duopoly with Mastercard.

They bloody need 100 000 tx/s, because ALL the transactions HAVE to pass through them! That is the very definition of centralization, and precisely the principle blockchains have been co-opted to fight (or at least mitigate).

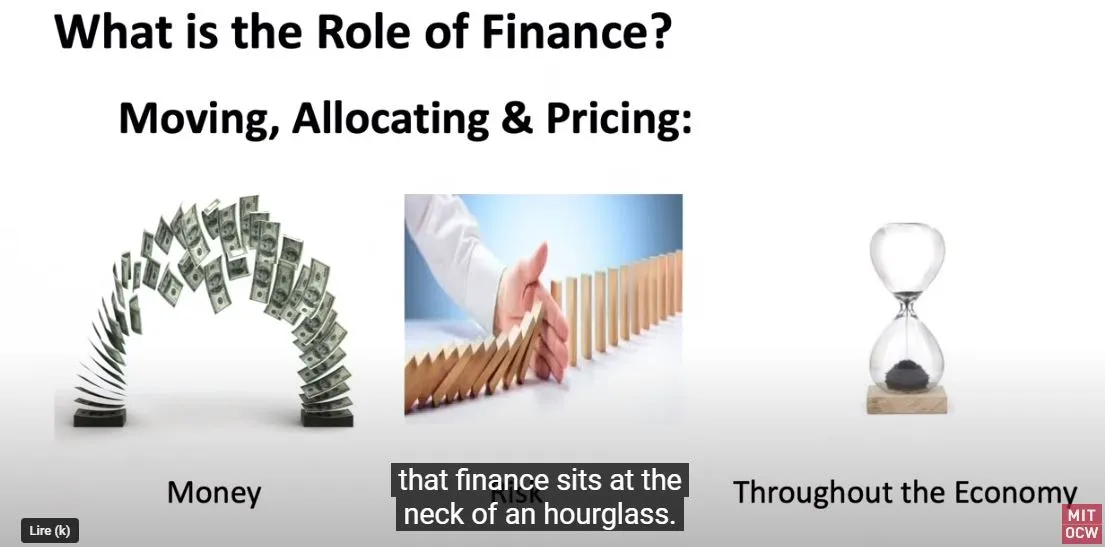

Coming back to Gary Gensler 2018 class at MIT - these financial intermediaries, DTCC, VISA and others, they "sit at the neck of an hourglass, and it's why they collect so much economic rents from society"

"Economic rents" are the evil to be fought against in every economist's book, be them of the "Karl Marx" hue or "Frederik Hayek" / "Ludwig von Mises" hue or any nuance in between.

Saying that Bitcoin, or Ethereum or any other blockchain for that matter, need to be able to scale to tens of thousands of tx/s is akin to saying "The king is dead, long live the king!".

It is akin to saying "We claim to be fighting for justice and equity, but what we really fight for is to replace the existing powerful elites ... with us! What we really are after, is collecting the rents they are collecting now!"

It's basically acknowledging that we are at best able to see a centralizer replaced by another centralizer, but are fully unable to picture a different, decentralized, more just and more equitable system!

I know at this point the "cognitive disonnance" will strike, and all the bitcoin maxis (especially them), crypto bros and blockchain enthusiasts will intensely loathe me for putting them in front of an inconvenient truth. But while preaching "decentralization", what they truly want, is to replace the current "central power" with a new one, a different one which they imagine better (mostly because they would be part of it).

Centralization is strong with us

In a previous article dedicated to Ethereum I was observing that, for all its talk of "decentralization", the Ethereum blockchain itself was in fact an "über centralizer". And it does so from its mission statement: "The World's computer". Why would the world have only one computer (the Ethereum blockchain)? Why is that a good goal to aim for? Thanks to its programmability, the underlying narrative of Ethereum is that everything could, ultimately, be connected to it.

Is there anyone who seriously thinks about this and deems it a desirable outcome? What would that do of the people who are "ETH-rich"? What would that outcome make of the people who were left not holding any ETH?

But Ethereum is only the most famous illustration of our limitations: because we survived all these millenia thanks to "generally well-done centralization", we cannot seriously envision any "end game" other than dominated by "the blockchain / cryptocurrency to rule them all"

The cryptoverse is the solution

I argue that Bitcoin doesn't need more than 7 tx/s. Neither does Ethereum or any other blockchain. Heck, we should be wary of any blockchain that achieves scalability on the scale of VISA or the DTCC!. Because then, it would have the power of the "dark side" (for those prefering a "Star Wars" analogy), the power of "the one ring to rule them all"(for those who prefer a "Lord of the Rings" analogy). The temptation to replace the monopoly of yesterday would be too great to resist.

A single cryptocurrency might be technically able to replace the current centralized fiat system (if it manages its scalability) but would not be any better (and might actually end up even worse) than the current centralized and, for many, corrupt system in place.

What needs to be stressed is that the true rift is not between "fiat currency" and "cryptocurrencies", but between "a single currency" and "multiple, competing currencies"

It follows that the solution to this conundrum is ... multiple currencies - what I use to call "the cryptoverse". What a truly multipolar world might be able to sustain, most realistically, is a healthy mix between "government-sponsored" fiat and "community-backed" crypto

If we are serious about addressing the shortcomings and propensity of centralizers to abuse power, it follows that the best we can hope for is a wealth of not-able-to-scale blockchains, none of which acquires the network power which today's tech-platforms such as Facebook or Google enjoy.

And the measure of success is that, by that time, both VISA and the DTCC, regardless of the capability and throughput of their systems, would not have to process more than 7 tx/s.

Thus the "scalability" issue would be forever put to rest and forgotten as a "problem" best left unsolved.