It is developed by Joe DiNapoli. It is one of the best supplements to the major trading indicators, such as Fibo levels.

It can be used as an independent trading instrument.

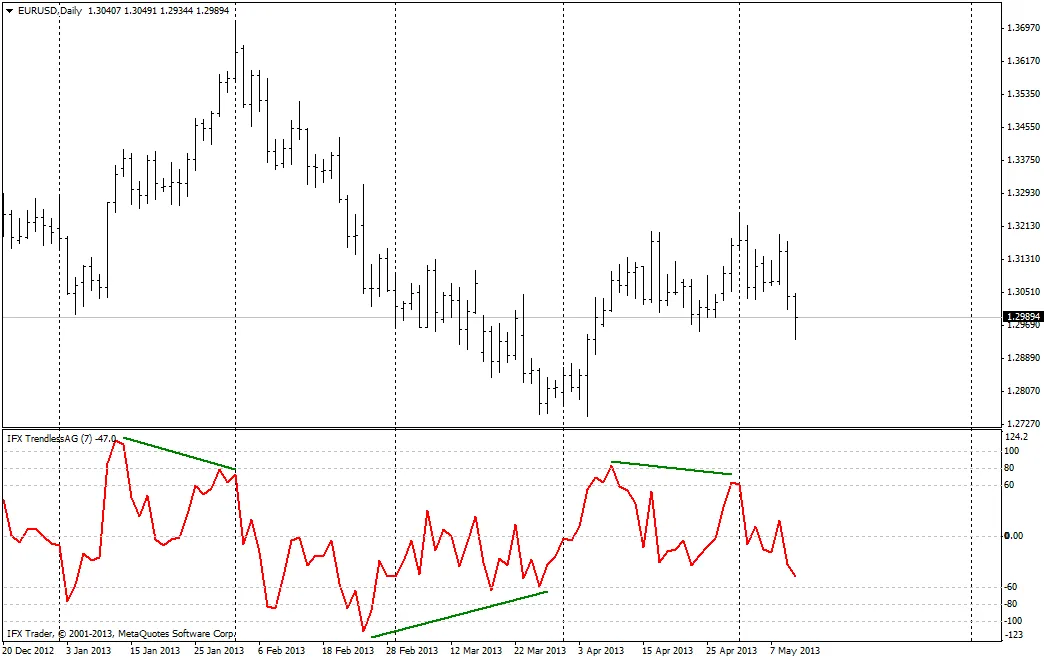

the Trendless indicator may be used as a tool to close the deals. If the indicator reaches the overbought levels in the range 70 to 100%, the trade should be closed. When the overbought level is reached, the price may slow down or reverse.

The indicator may be used as a filter for the opening of a trade on the financial market. If the signal of a deal opening emerges when the Trendless indicator is above the level of the level of +65%, then it is not recommended to open a deal at all, as the price may experience indefinite price fluctuations.

The Trendless oscillator may be used as an indicator of accumulation of volatility and then the price jerk. If the indicator is near the level of 0% for a long time, then very strong accumulation is forming on the market, as the result, it will lead to a price jerk. One should use such situations in trade, as indicating the timing actual for a deal.

Ref: instaforex