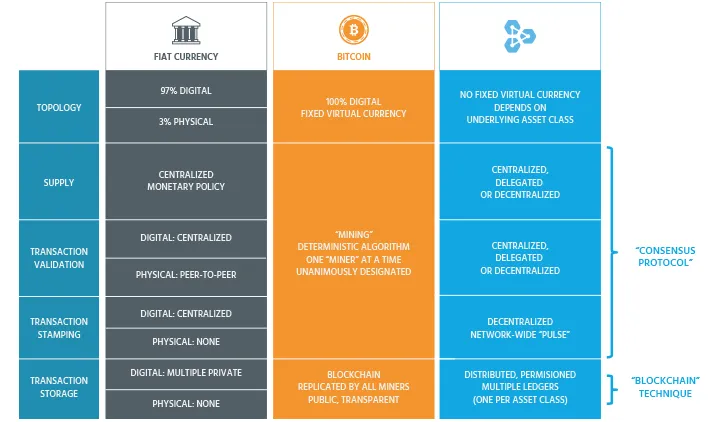

AXenS is the most forward thinking B2B platform for Distributed Supply Chain Finance (DSCF) and Distributed Trade Services (DTS). We enable the automation of global trade transactions, we manage large numbers of business partners and documents, and we ensure that businesses always comply with constantly changing international legal regulations.

AXenS runs on an enterprise-grade Blockchain Technology to support global trade activities with the tools needed to participate in the most highly-available and highly-scalable network where logistical and supply chain services, financial and insurance services, government agencies and customs authorities can inter- operate and collaborate in the most secure way.

AXenS alleviates costly delays and financial risks involved with imports and exports, thus enabling businesses of all sizes to react quickly to business opportunities.

AXens is a Joint venture between Assefa Swaye Capital Management, a global commodities trading company and XNotes, an award winning blockchain transaction technology firm.

AXENS SOLUTIONS

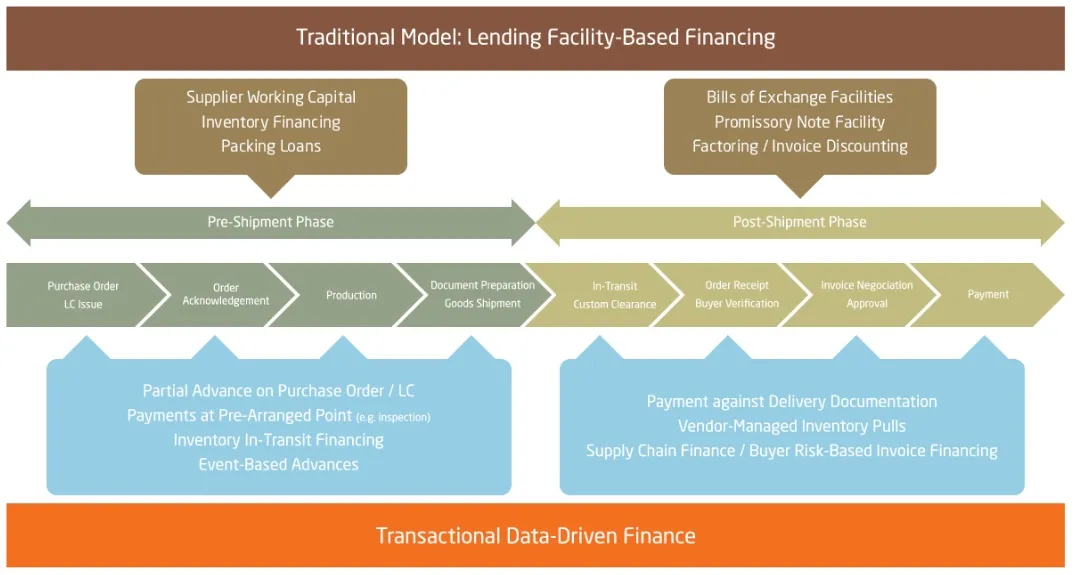

Transactional Data-Driven Financing

AXenS closely aligns the physical and financial supply chain. Through the automation and digitization of the supply chain process through Xnotes enterprise-grade blockchain technology, it will allow greater collaboration between parties to a financial transaction. This allows initiatives where financing is triggered by events in the physical supply chain.

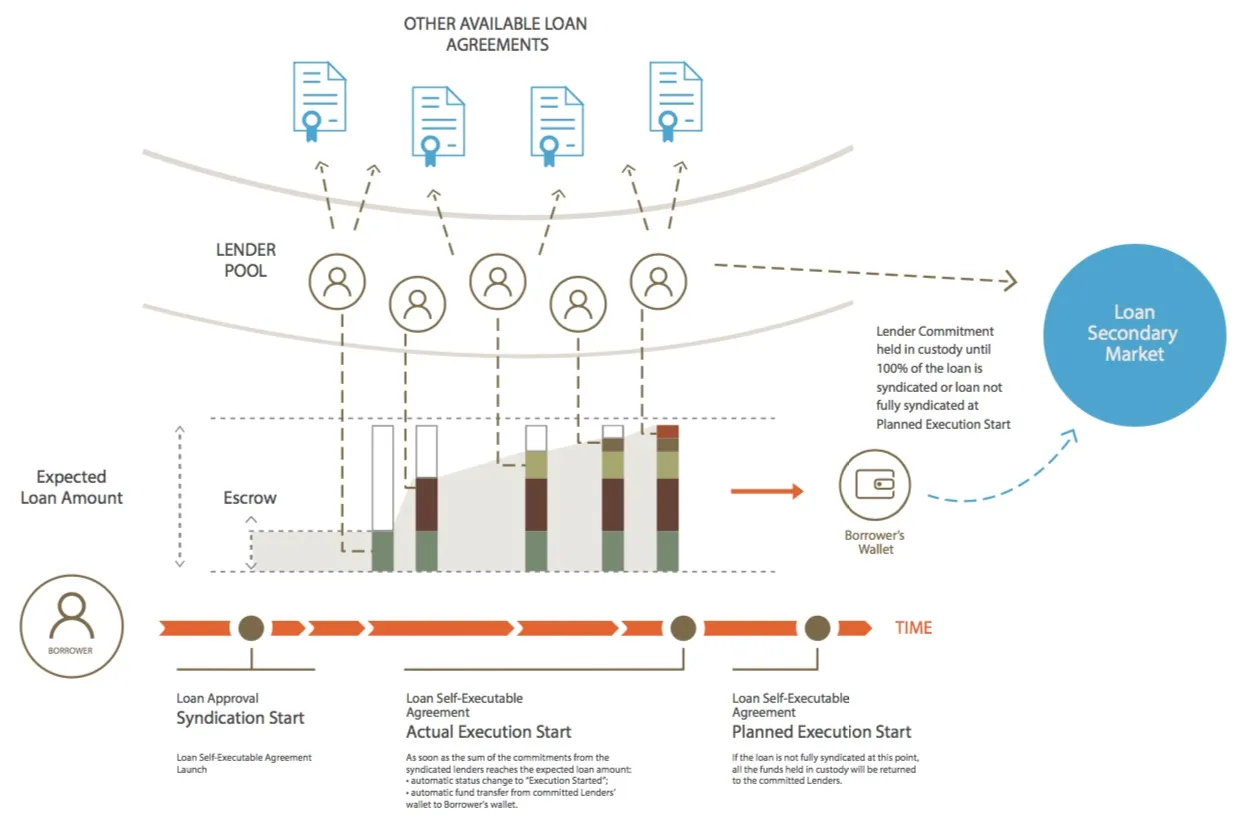

Secondary Loan Marketplace

Companies can also opt to sell the loans on their book, receiving their money quicker.The look through into the characteristics of the loan is made that much easier through a common ecosystem and the blockchain framework, allowing immediate granular visibility to secondary market participants:

- Term sheet of the Loan

- Full details of the counterparties involved in the underlying transaction.

- Status of transaction

Loan Syndication

Syndication of loans across multiple lenders. While this type of transaction is usually done for large deals, across different banks at prohibitive cost - the Platform will allow lenders to come together to service an SME. As such, each lender will have a reduced exposure and (riskier) borrowers will have a better chance of getting funded.

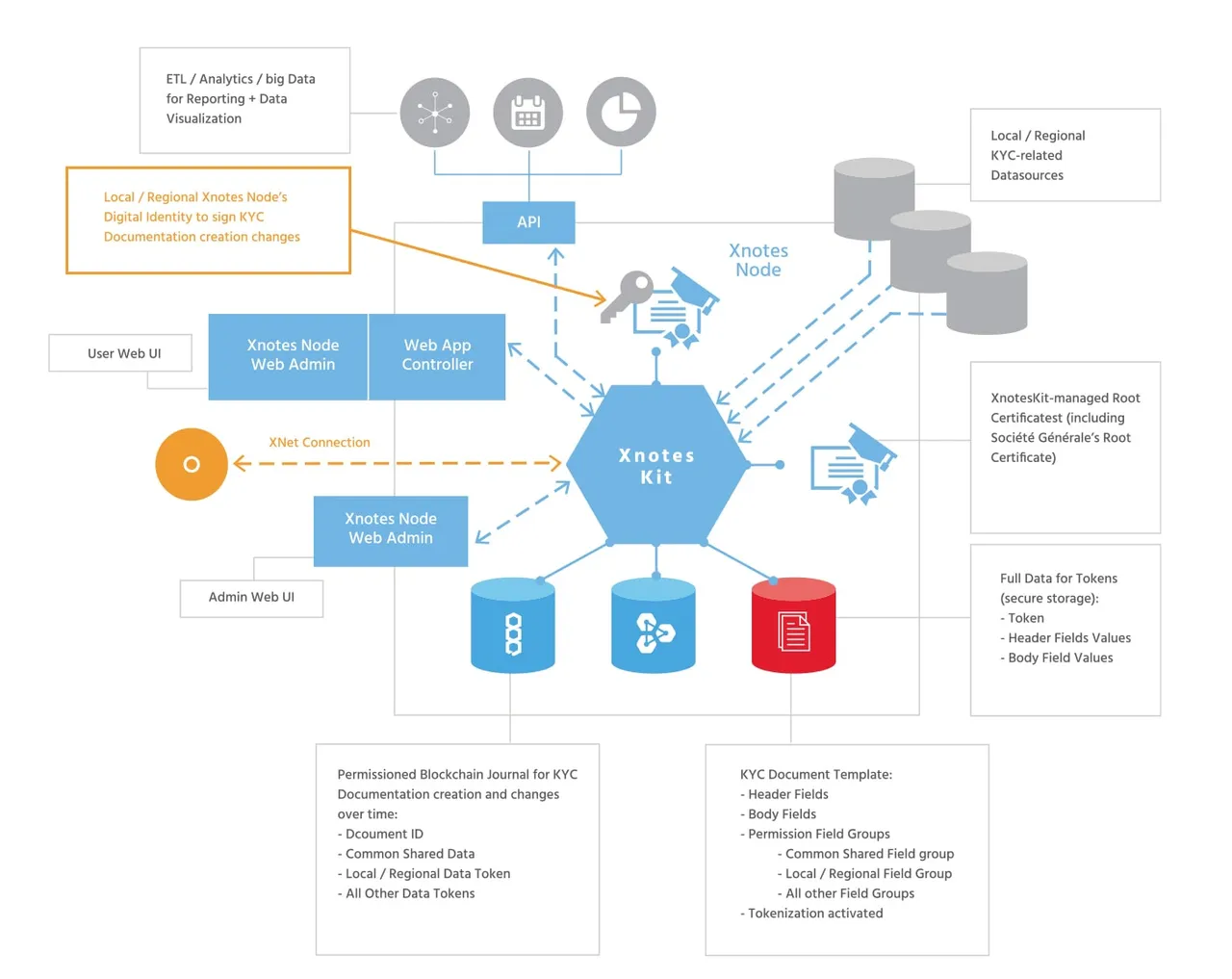

KYC / AML

AXenS will enable users and partners to assess the risks inherent to supply chain finance by implementing Know Your Customer (KYC) / Anti- Money Laundry (AML) onboarding processes and deal due diligence. Not only will AXenS verification processes be regulation-compliant but they will also be designed to keep the blockchain-based financing processes streamlined.

This collection of data pertaining to individuals, companies and deals will be verified and periodically updated by multiple trusted parties, which include AXenS. The records will be made persistently incorruptible and non-repudiable on the enterprise blockchain with privacy control. These records will specifically be used in AXenS deal rating system.

AXS ICO

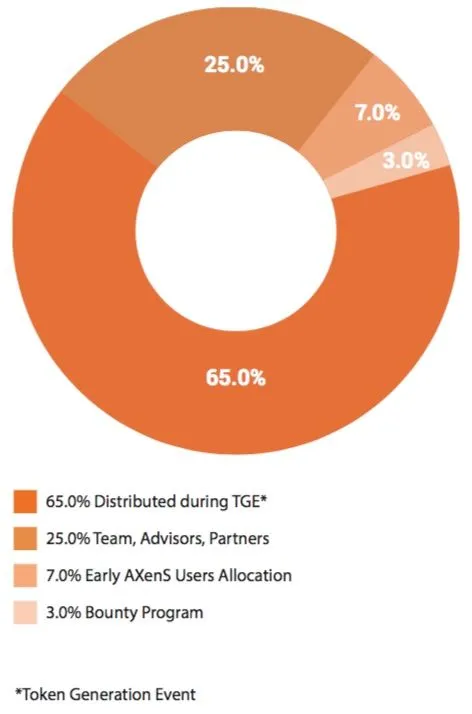

TOKEN ALLOCATION

TOKEN ALLOCATION

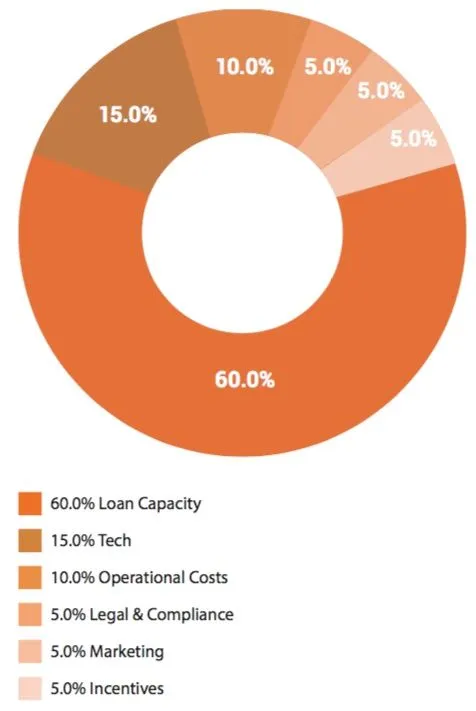

USE OF FUNDS

TOKEN INFORMATION

Token Name AXenS Token

Symbol AXS

Technology XNotes

ICO Platform Stellar

Value Precision 10-8 (0.00000001)

Denominations N/A (non-discrete)

Initial Issuance 100,000,000 AXS tokens

Price 1 AXS = 0.5 USD

(or equivalent in other token and/or FIAT)

Hard Cap 50,000,000 USD

Currency Accepted XLM, ETH, BTC & FIAT

AXS - TOKEN

The ability to systematically secure peer-to-peer financing deals over time and execute instant transfers and sanctions is AXenS’ key advantage. This is only possible if the blockchain-secured network is trusted to control the processing of the funds. To address this fundamental requirement, AXenS is introducing AXS, a crypto-token that will circulate among the stakeholders as the primary underlying medium of exchange for financing deals and trade services. AXS will also make it possible to tokenize credits, which will enable further financial trading opportunities.

REVENUE MODEL

AXenS’ Supply Chain Finance business will profit from multiple sources of revenue:

Interest on loans charged when the platform acts as a lender

Spread on loan charged by other lenders

Spread in the secondary market

Spread when the platform acts as a primary off-taker for a supplier, and buyers

Higher than expected recovery rates on collateral liquidation on any defaults

Provision of insurance

Referral and arrangement with service providers on platform (logistics, war insurance, etc....)

Subscription-based services.

Hence we can observe:

For the most part the platform revenue sources are agnostic to price or volatile commodities and other products

traded, as it captures its revenue from fixed feesRevenue is easily visible and has huge operational leverage with volume

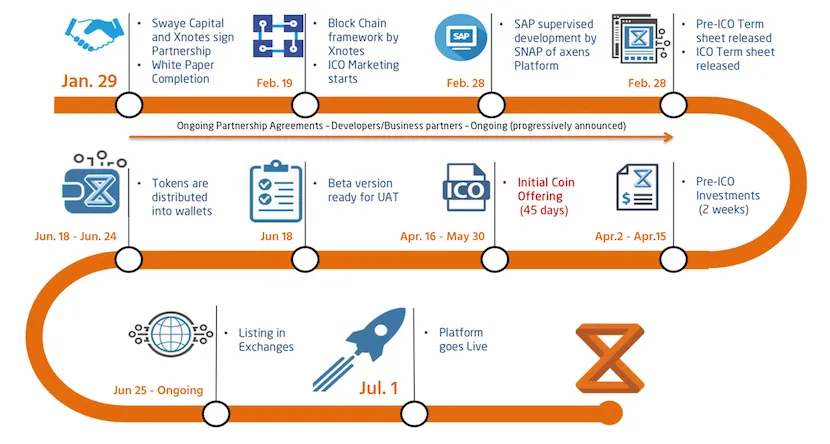

Roadmam

AXenS Bounty Campaign

https://bitcointalk.org/index.php?topic=3063527.0

Welcome to the AXenS bounty campaign! We are in the midst of launching all our 7 bounty campaigns. Stay tuned!

There are 1,500,000 AXS (equivalent to USD 750,000) available in the bounty (1.5% of the total number of AXS tokens).

Overall Rules:

- Individuals can only enter each bounty program once only. Those who enter in with more than one account will be disqualified immediately.

- You may not change your payment address after submission.

- AXenS reserves the right to change these terms and conditions at any time without prior notice.

LINKS:

Whitepape: https://www.axens.io/downloads/AXenS_Whitepaper.pdf

LinkedIn: https://www.linkedin.com/company/axens.io/

Twitter: https://twitter.com/AXenS_io

Facebook: https://www.facebook.com/AXenS.io/

Instagram: https://www.instagram.com/axens_io/

YouTube: https://www.youtube.com/channel/UCQCBhUnR4AL9WyaINkrAabw

Reddit: https://www.reddit.com/r/AXenS/

Medium: https://medium.com/@axensaxs

BitcoinTalk: https://bitcointalk.org/index.php?topic=3063527

Telegram News Channel: http://t.me/axens_io

Telegram Chat Channel: http://t.me/axens_chat

=========================================================

https://bitcointalk.org/index.php?action=profile;u=1716487