}

Please note that this is a copy of my Medium article from Dec 9:

https://tyszq.medium.com/maximizing-profit-in-the-upcoming-btc-bull-run-78c3307a825e

I recently noticed that it's impossible to check edit history for Medium articles. I don't want anyone to accuse me of some type of manipulation, and that's why Im switching to Hive for more transparency. As I plan to do a monthly updates starting from February, I will continue my writing here.

I decided to write this piece in order to systemise my own investment strategy. Making it public open it to the criticism and perhaps inspire someone. The main point of this strategy is maximizing profit, while not taking too much risk and minimizing the amount of trades. Not investment advice.

Ideal portfolio

Let’s start from my own portfolio, which as for today is ~38k USD, and consists of only 13% Bitcoin.

Why only 13% BTC??

Given all the indicators and data that we have, it’s very clear that we are on the edge BTC breaking ATH, and a start of parabolic bullrun, which is most likely to end somewhere at the end of 2021. Taking into consideration how alts behave in such an environment, I’m left no doubt that a portfolio consisting mostly of altcoins will be the best choice.

I believe that another altseason have already started, and we currently see the first stage of it. Just like in the last market cycle, most altcoins are totally bottomed in /BTC price, and relatively low in USD. Last altseason started when BTC settled around new ATH. Today’s market situation is literally all the same.

My portfolio looks as follows (08.12.2020):

I’m looking into redesigning this portfolio a little in the upcoming month or two.

- I’m going to slightly diversify EOS, which means buying more HT and maybe smaller sums of some smaller, more random alts.

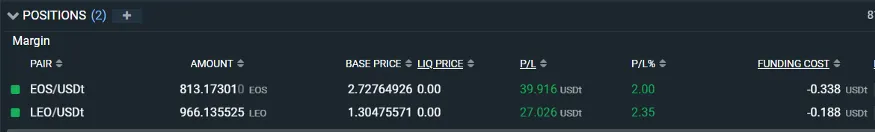

- I’m going to sell at least half of the LEO tokens. Although I see it as a really safe bet, it is actually way too stable to hold in an altseason, and could lower potential gains dramatically. For the rest that I’ll hold, I also have a long position to higher the return.

I’m actually the most bullish on HT given how undervalued it is compared to biggest exchange tokens: LEO and BNB. With ~1,2 monthly deflation rate, which will easily jump above 3% when volume starts catching up, it’s just doomed to moon much more than any other altcoin out there.

However, I still see potential risks in holding exchange tokens, which are completely dependent on centralized businesses. They, at least in theory, could be closed or molested by authorities any time. More or less decentralized cryptocurrencies simply don’t hold that risk.

Why so much EOS?

I’ve been passionate about EOS for a very long time, I know a lot about it and how it might behave. I’m confident that it’s price will go up significantly with the whole market. I also believe that block.one can generate some strong pumping news along the way, as it’s the biggest crypto foundation that exists.

Some additional information:

- My EOS and HT are staked, generating some tiny extra profits. Some of BTC is also on Bitfinex funding.

- I’m holding a relatively small (not sure if that’s accurate for the questionable size of my portfolio) EOS long position, which not only will generate some bonus cash, but more importantly, will keep me focused on the prices and overall market position. I’ll probably try to lower it’s size at the first local top.

I understand that I will probably not pick the best possible alts, there are just too many of them. Picking top gainers is rather a matter of luck. I’m also not emotionally attached to any of my assets, and I will not hesitate to sell one when the time comes. No, I won’t hold a certain altcoin to death because I believe it will change the world :)

Altcoin prices

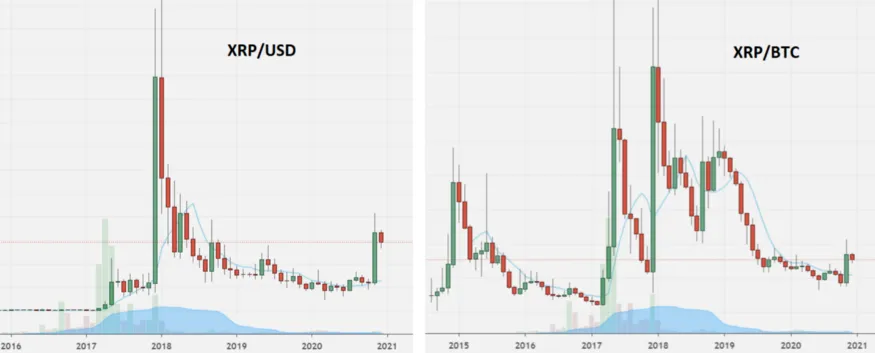

The most crucial aspect of investing in alts is not looking at it’s USD price, but rather BTC price* and alts price relative to BTC. This gives us a much better understanding of altcoin prices.

*It’s important to understand that by “BTC price” I don’t mean just BTC value expressed in USD, because the price itself doesn’t tell you much. Here I mean dozens of indicators that will tell in which point of market cycle BTC is, and where is it likely moving next.

As BTC can be wrapped in a lot of models, has dozens of indicators and it’s on-chain data is widely used and analyzed, we can more or less value it. What I mean is, alts are much harder to value in terms of USD price, and that’s why it seems wise to not focus on it. Altcoins will always make their moves based on what BTC does. As last cycle showed us very specifically, it’s much better to focus on BTC and on which point of the cycle it currently is, rather than on ALT/USD price.

Is your super-duper changing the world altcoin at ATH in USD but still looking super juicy with some extra potential 20000% gains? If BTC is totally overbought, with Mayer Multiple close to 4, it doesn’t matter. If BTC corrects, your shit alt will correct even further. — something to keep in mind.

And hey! After the last cycle we also have a lot more data, which will certainly help us find the most optimal entry and exit points. Even simply having more reference points on the chart is helpful.

“It comes and goes in waves” — Lewis Capaldi

As we already know, looking at altcoin prices in relation to BTC price (and BTC “price” itself) is the key. Let’s now take a look at ALTS/BTC price behavior over the last bull run. It looks like all major alts were essentially trading in a few waves.

Yes, I know that this pattern may not be the case ever again, but I think it’s important to study it and look for potential similarities in the upcoming run. Let’s take a look at some of the major alts:

As we can see, all of them had a 3 clear waves (not as clear on ETH chart tho) on /BTC chart. This actually applies to almost every somehow meaningful altcoin on the market, that had the opportunity to be alive before the bull run started.

So there is 1st wave — that starts the parabolic movement, 2nd — that sets the alt USD value at ATH and is a BTC/USD ATH in the same time, and third — dead cat bounce or whatever they call it.

I especially wanted to highlight DOGE and LTC, as those are one of the oldest altcoins on the market, that have been through such bull season 2 times already. I also believe that those alts are great indicators for the whole altcoin market. Three waves both times. Coincidence?

In this bull run, I’m expecting such a pattern to appear again, and I’m looking for at least 2 strong longterm waves.

But even if the whole pattern was to repeat 1:1, I wouldn’t try to trade those waves to USD. After studying it for a while, I came to a conclusion that it doesn’t make much sense. Firstly, altcoin prices may dip just a little in USD, and then continue to go up even while correcting to BTC. Second, timing the wave is nearly impossible.

But what might be a good idea, is converting at least some portion of alts to BTC on the “first wave”. When exactly? Say my alt is rapidly approaching it’s ATH on /BTC with the first wave, and is near top levels from last cycle. USD price is already decent as well, and BTC is certainly getting locally overbought. Converting some alts to BTC might be not so stupid.

And then? If this scenario plays out correctly, you can buy back more of your alts on the wave going down. If not, you still sold some of your alts for BTC at decent prices. Not so bad, huh?

And all if this pattern plays out, of course. And of course, selling should be done gradually.

Getting out

OK. My profits are looking solid. It’s nearly Dec 2021. Market is already starting to look a little overbought. Bitcoin is all around the media and all my friends and family are asking which altcoin is the best to buy.

It’s probably time to get out. But how? Just sell everything all at once for USDt?

Let’s break down the best getting-out strategy.

First rule: Don’t try to sell the top at all cost. Got it? Ok, next.

Get out of the market gradually. Nobody can tell the exact top price levels. Human emotions (which drive the market) are unpredictable. Getting out of the market gradually, and always holding that at least ~10% of your initial stash, will give you an opportunity to sell at least some of it at the top. Remember that in the last cycle, some altcoin prices went just totally out of the scale. Any “rational” investor would sell them at least weeks, probably months before the top.

If your portfolio is 100% alts right now, or close to 100%, start selling relatively early. You don’t wanna sell everything too early, but you don’t wanna get dumped hard on your bags either, right?

What to sell for?

I’ll get back to the LEO token right now. If you are not familiar with it at this point, you should be.

LEO is a Bitfinex exchange token. What makes it so significant is it’s buyback & burn, which is provided from 27% of Bitfinex gross revenues, bought from the market 24/7 and burned every single hour. It benefits from high market volatility and volume. It’s also the most stable altcoin that exists.

Remember March Covid dump? When everything fell for ~60%? The biggets panic in crypto market history. LEO dumped fucking 4%, because of the buyback buying pressure. How is it different from HT, and why HT is exposed to much hugher volatility? Because of the volume. LEO volume is really low, and sometimes over 50% of it comes from buyback alone. But let’s not get into specifics, it’s not an article about LEO. However, it’s 08.12.2020, 10:50 PM, and that’s a very typical picture these days.

Let’s get back to the topic. I am planning to separate my mysterious getting out plan into 3 stages.

First stage — where I will be selling alts for around 50% BTC, 35% LEO and 15% stablecoins (ideally diversified)

Second stage — where I will be selling alts for 20% BTC, 50% LEO and 30% stable.

Third stage — where I will be selling all BTC I have left and rest of my alts for 70% stable and 30% LEO.

Timing of the stages and actual structure of them is not something that I can specify at this point. But this is more or less what I’m planning to do. I’m not getting out to fiat at this point to avoid taxation.

The amount of LEO I want to hold is also a matter of debate. I’m actually 95% sure that LEO will continue going up, even when the whole market will blow up after the very market cycle top. That will happen because of tremendous trading volume at the time. It’s also likely that people will realize that LEO is the only coin holding up, and we’ll see another wave from people rushing to buy it. So maybe holding more LEO and gradually selling them as the volume goes down is a better idea? This actually might make a lot of sense. It sounds kinda too good, but I don’t wanna put everything on one card as well.

What then?

I know that this goes beyond the “next BTC bull run”, but I also wanted to highlight some quick ideas how to profit when the market will be going down.

- Short BTC. When? The most important indicator that I will be looking at is Bitcoin NVT ratio. Just look how accurate it was in spotting the best places for macro shorts in the last 2 cycles. When the indicator goes significantly higher than the sell signal line, it’s pretty much a certain short, which I will hold until it touches the buy signal (yellow line).

2. Long BTC dominance, which is going up significantly in a bear market. Plain and simple. In the last bear market, it was +91% from the bottom to the top.

Lengthening cycles

There is a theory of “lengthenning cycles”, strogly supported by many reasonable figures, saying that every BTC cycle is longer than another (along with diminishing returns). By this theory, BTC will hit the top of this cycle somewhere around the end of 2022. In this scenario, Dec 2021 is just a local top.

So what if this actually was to happen? If this turns out to be true, it will probably be visible in advance. Market cycle will be stretching, which will be possible to see on the on-chain data and other metrics. Strategy stays more or less the same, just more stretched in time.

Summary

- First thing is definitely making your portfolio suitable and exposed to a bull market. Portfolio consisting of established alts, but also exposed to high volatility will be the best option. Having an additional long position will help in keeping close attention to the market.

- Don’t forget to sell your alts for BTC when they reach historic top levels. If you feel really confident, you can buy them back on the ALT/BTC correction.

- Do everything gradually. As well as when swinging between alts and BTC on the /likely to happen/ first wave, and when getting out of the market.

- Diversify your portfolio when getting out of the market. Make sure you hold LEO and at least 2 different stablecoins.

- When the time comes, short BTC and long BTC dominance.