}

It's 01.06.2021 and the price of Bitcoin is 36k US dollars. Last month turned out to be absolutely brutal. Bitcoin currently sits at -44% from ATH, after very strong and unexpected crash.

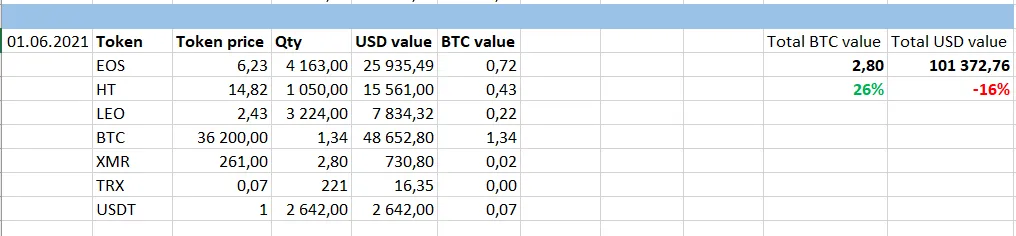

Portfolio

Although Bitcoin price fell 33% sine the last update, my portfolio managed to lose only 16% of the value. This happened because of sharp alts rally before the crash. I also managed to exchange a big portion of HT into BTC near the top, which pretty much saved my ass. Since last update, I reduced my Huobi Token holding holdings by 807 HT.

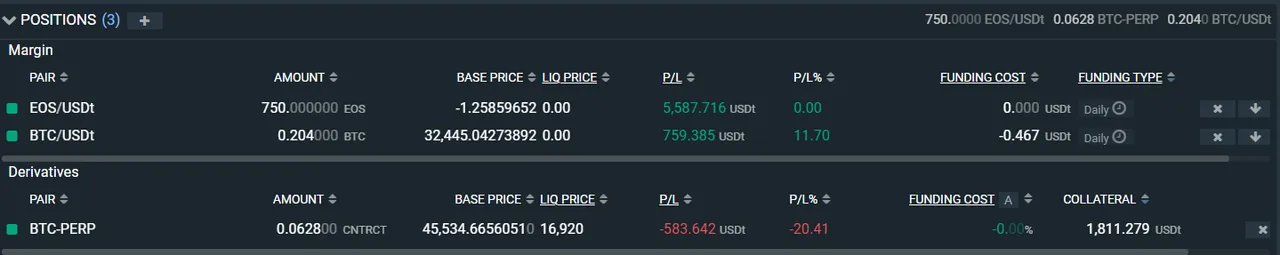

Margin positions update

Since last update, I was entering a long BTC position on Bitfinex perps. I was buying "the dip" several times, but it didn't go so well. Later on I entered another BTC long on margin, at much lower prices. This turned on to play well for now, and makes up for perps losses.

I also increased my EOS long position.

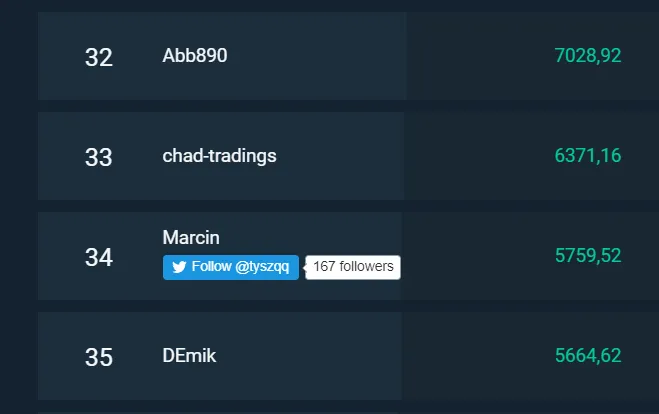

More importantly, I appeared on Bitfinex leaderboard, so anyone can track my margin positions performance now!

Where is the market going now?

That's the key question. Let's talk shortterm for now.

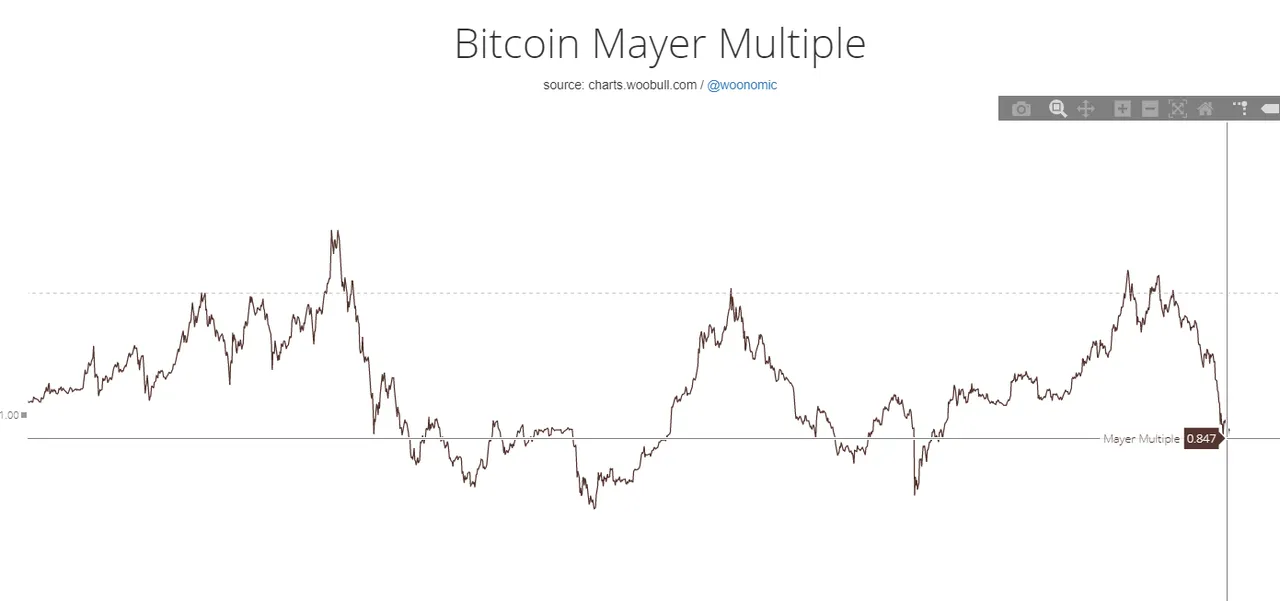

Sentiment is really bad and most of the people expect continiuation of the downtrend. Market is driven by fear. In the same time, every possible indicator and model is showing that Bitcoin is extremely oversold.

Looking at few key indicators:

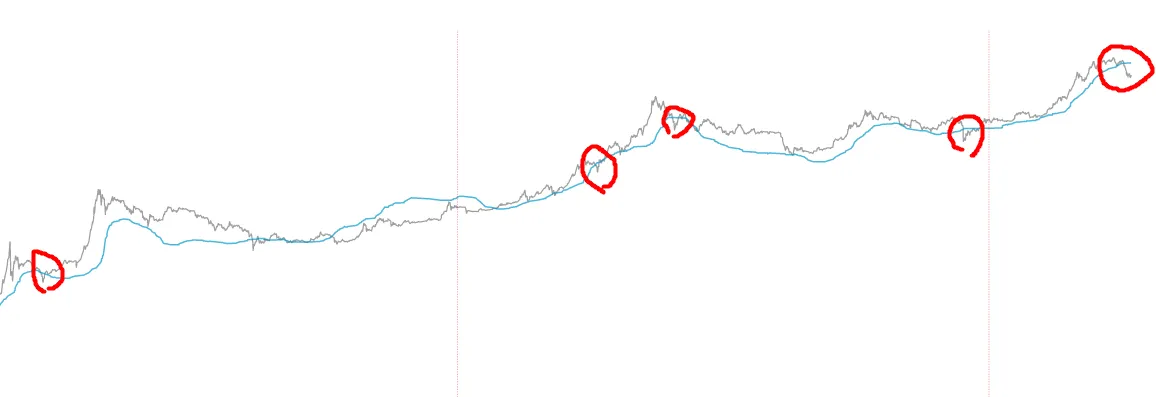

- Mayer multiple extremely low

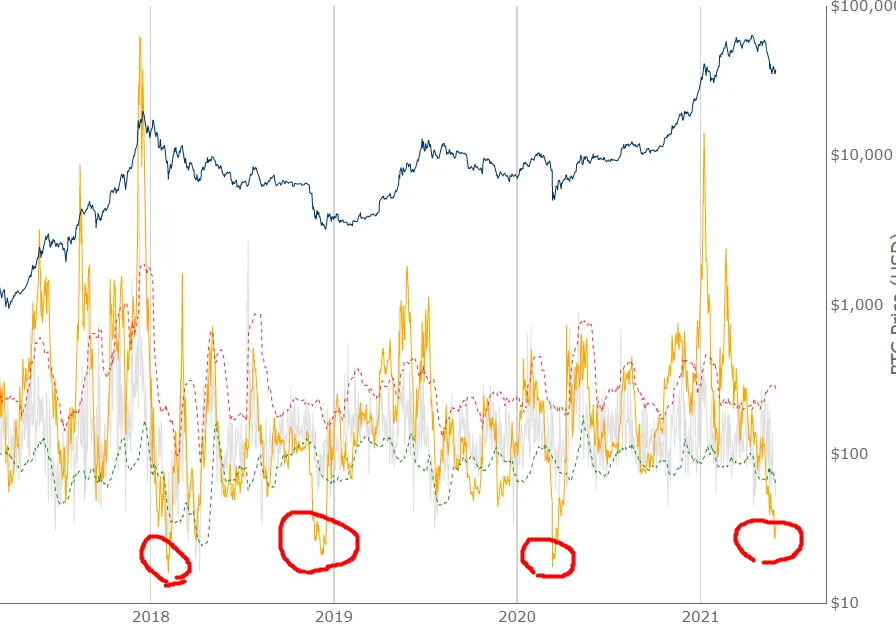

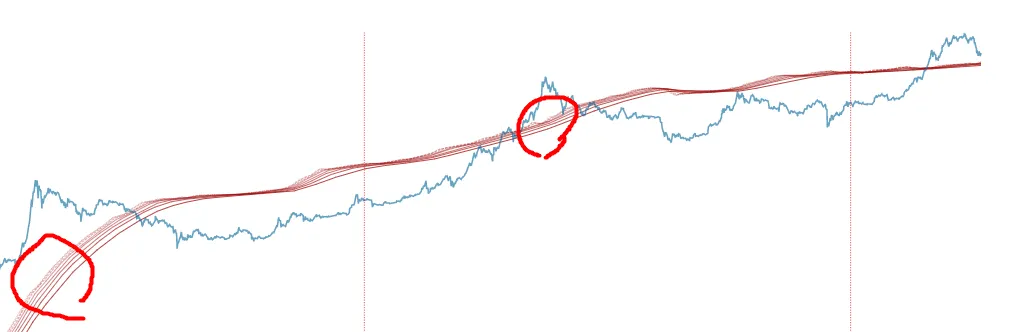

2. Price is signifitantly below the NVT model. So far, such dips ALWAYS resulted in strong price rebound.

3. Active adresses sentiment indicator is extremely low. That's another on-chain indicator that so far pointed market bottoms pretty accuretly.

That said, I'm expecting a strong upwards price action in following weeks with decent short squeeze. Price should break above the NVT model, which is likely to be at ~47k USD. That's when I will close my BTC long and see what to do next.

Is the bull market over?

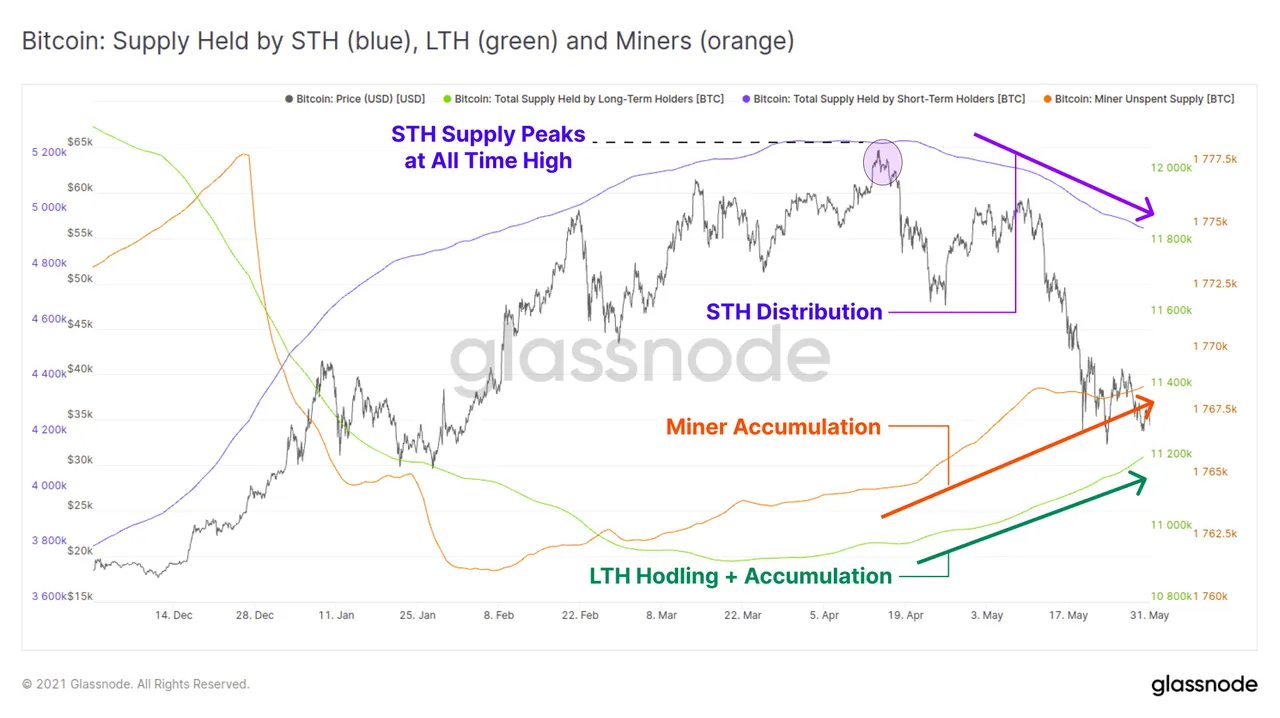

For now, I do not believe the bull market is over, as none of the longterm indicators are signalling so. I think we are in another, final accumulation phase of this bull market and a lot of data could confirm this.

So take a look at few (in my opinion) most important longterm indicators:

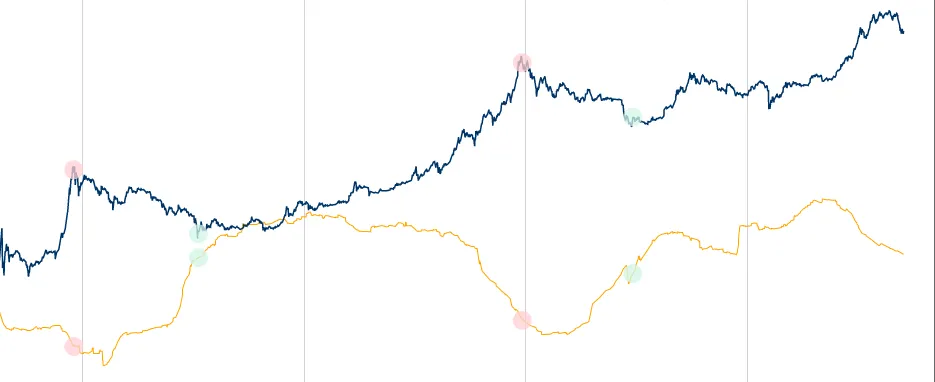

- The 1+ HODL wave. The wave is still pretty high, which indicates very longterm holders aren't interested in selling at these prices. Wave stopping the downward action (similar to the 2013 bull market) would be a pretty clear confirmation that the bull market isn't over.

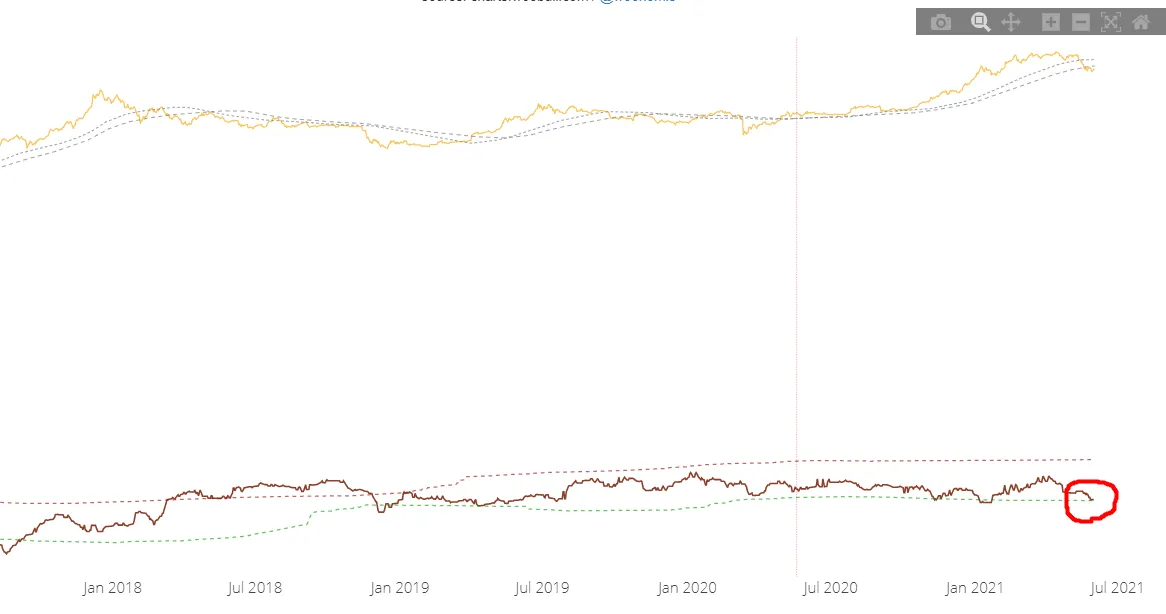

2. RHODL ratio - one of the most accurate indicators when it comes to spotting market tops. It's still at relatively low level. That's another confirmation that longterm holders aren't selling.

3. Difficulty ribbon still very much compressed, which is a sign of accumulation.

4. NVT ratio is really low, indicating that Bitcoin is really cheap compared to it's on-chain activity. It's nearly touching the buy signal.

I think that next month should determine whether we are going to see continuation of the bull run or not. Still, shortterm looks extremely bullish.

My key mistake

Now I see that I should have been reducing my portfolio over the course of last 2 months. Unfortunately, the greed made me blind to longterm holders and whales distribution, along with weakening market momentum. That's another lesson for the future.

Let's see how June unfolds!