}

Edit 10 minutes after posting - miscalculated my BTC holdings (took into consideration withdrawal from Huobi to Ledger only, instead of whole Ledger balance). Feel free to verify post changes and calculate comparing to previous post.

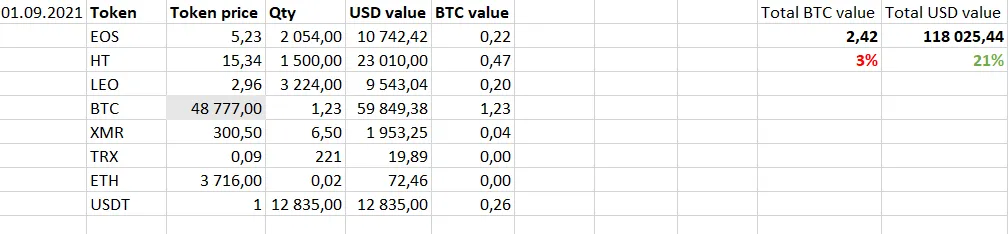

Today is 01.09.2021 and the price of BTC sits at 48,7k USD. Since the last post, Bitcoin gained +16% on a really solid rally.

Portfolio

USD value of my portfolio increased 21%, while BTC value decreased another 3%.

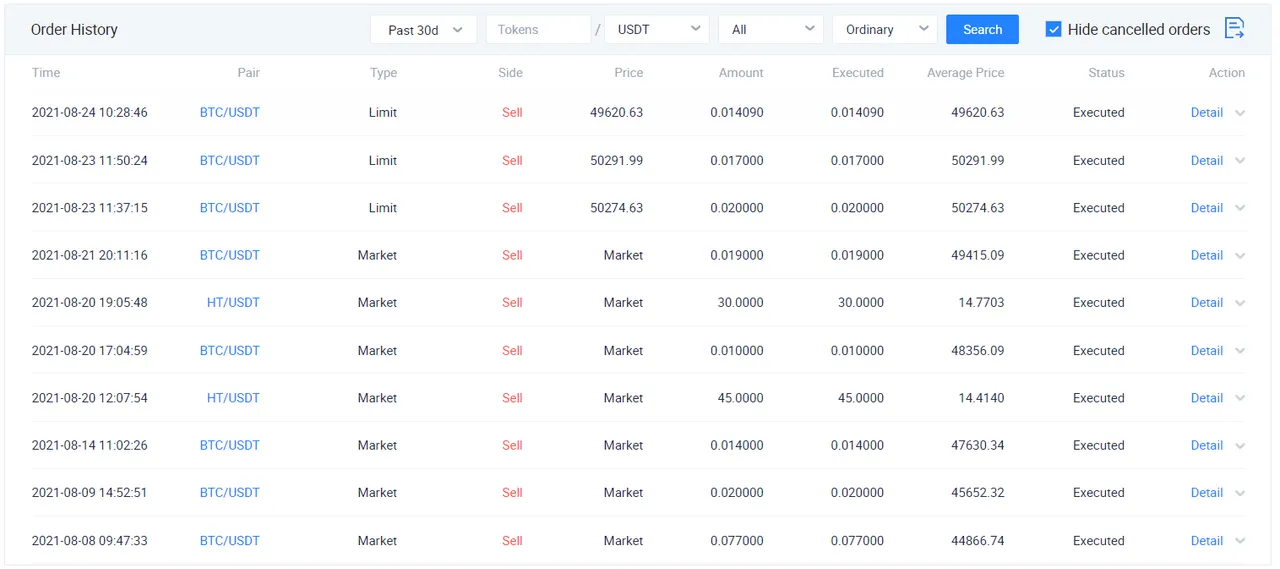

Taking first profits

As you can see, my USDT holdings increased. I decided to finally start taking first profits on the recent rally, in 45-50k/BTC range. This resulted in realising around 9% of my portfolio at the time. I was selling BTC and a little bit of HT.

During last few months, I did sell some of my holdings for USDT a couple times (mostly HT, if not only), but I always reinvested those back later. This time, I'm not planning to reinvest anytime soon.

Reducing HT position

Another change in my portfolio was a reduction of HT holdings, which will continue in the future. I finally realized why Huobi Token always had such a low valuation compared to other exchange tokens - because of uncertain political situation. In reality, China can shut down exchanges trading in the country at any point in time, which is a huge risk. I know that Huobi Global is a global exchange, however still, around 35% of Huobi users come from China. Of course, "be greedy when others are fearful" does stand (and so far worked for me really well), but I no longer feel comfortable holding a HT position of this size.

That's why I decided to reduce my position drastically, to a maximum of 500 HT, which I already have on cold storage. For now, I've been exchanging to BTC only, but I'm likely to diversify into other alts. I'm especially looking into buying FTT (FTX exchange token).

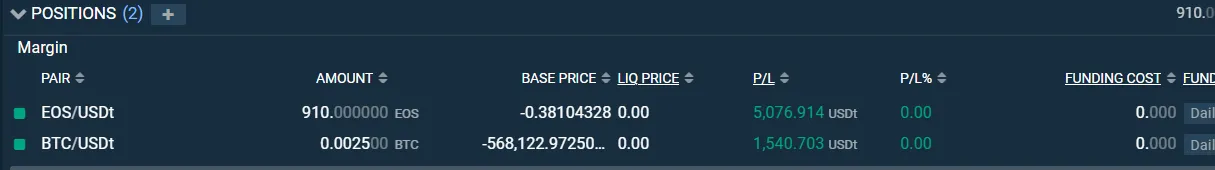

Margin positions update

BTC perp closed on profit btw :>

Are we in a supercycle?

In the initial post outlining the strategy, I wrote the following:

So what if this actually was to happen? If this turns out to be true, it will probably be visible in advance. Market cycle will be stretching, which will be possible to see on the on-chain data and other metrics. Strategy stays more or less the same, just more stretched in time.

Although I wasn't mentioning supercycle specifically (rather lenghtening cycles theory), it's kinda similar thing, as the supercycle is obviously longer than 4 year cycle.

Some on-chain analysts that I follow started mentioning the possibility of BTC breaking out of 4 year cycles.

And to be honest, I would not be surprised if this happens. 4 year cycle is already a meme, and every pleb entering the market knows about it. That's why there is no way it's happening. So what about it? Well, I guess nothing

¯\_(ツ)_/¯

It just sounds really cool, you know? Supercycle.. SUPERCYCLE.

For now, I feel like we are in a "hodl zone" and another shortterm move is really hard to predict. I think that shortterm I'm more bearish than bullish, but longterm speaks for itself. SEND IT