Week 36 - Sept 5 Investment Moves

- Current US market

- Sept 5 investment moves

- Money Invested va Money Spent

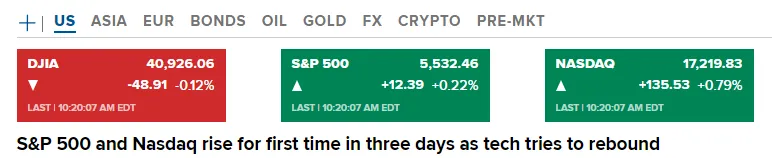

Current US market as of 10:20 am (EST)

US markets are split. The Nasdaq is up, but the Dow and SP500 are mostly flat.

Sept is off to a rough start, but how the month ends is what counts. I was able to adjust many of my PUT credit spreads downward for premium (a credit). I did adjust Visa because that was hit $280 a share and I needed to up my covered call by $5 strike price. I believe there will be plenty of more opportunities for me to make over the next 5 years to better position myself for retirement.

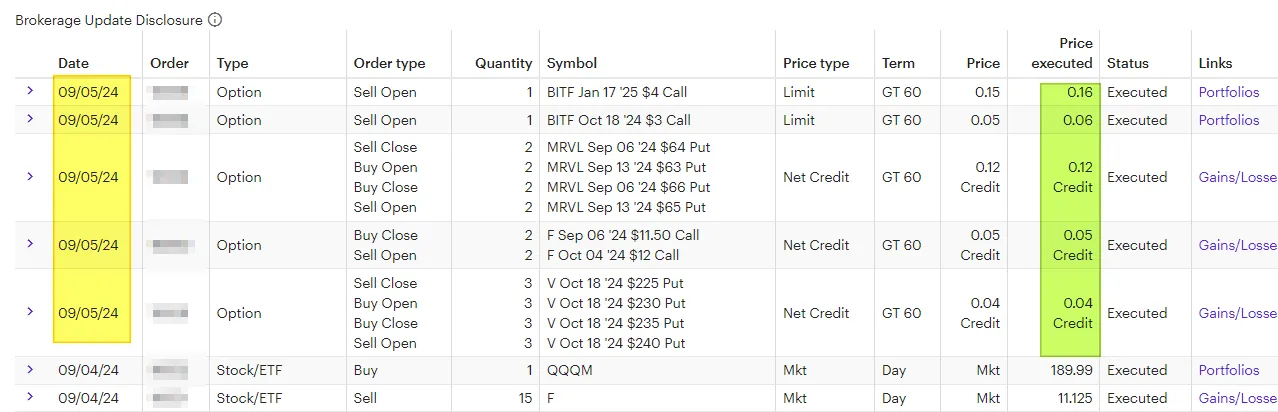

Sept 5 investment moves

Here are my trades as of 10:20 am (EST).

Most social media traders do not post their moves within an hour. These are the trades and adjustments I made to my options. I added BITF covered call today.

Money Invested va Money Spent

The money that I invest is spent on buying assets that grow in the future. The dividends I get and the capital appreciation will increase my wealth.

If I spent my money on shoes, steak dinners at Longhorn Steakhouse, a shining widget I used for one year before replacing it with a newer widget, I wouldn't have any money left over to INVEST.

Phases:

- Reduce Debt.

- Accumulate assets -> 25x - 30x yearly expenses.

- At some point, move assets into passive income.

- When monthly income from a passive source is 1.5x greater than W-2 (or day job), you can consider living off your assets.

Have a profitable day!