What a time to be alive for chronic traders!

A few weeks ago with pure luck and not entirely sure how I landed on the web page of a new exchange – Cobinhood. It is advertised as an exchange with 0 fees.

Zero fee caught my eyes, because that small 0,25% over time become 2,5%, 5%, 15% and so on. So I thought to check it out.

Cobinhood is the next generation cryptocurrency exchange platform that features ZERO transaction fees and ZERO cut on margin funding interest earnings. It provides cryptocurrency trading, margin trading/funding, futures trading, and ICO Underwriting Services. It guarantees 100% reserve for cryptocurrency deposit.

So what does that mean?

The top 30 cryptocurrency exchanges, on average, charge a 0.2% fee for both makers and takers, which can significantly reduce the profit margins of traders.

Cobinhood aims to offer zero fee environment for trading.

But how will Cobinhood make money to sustain its infrastructure and to cover its operating costs?

They intend to provide margin trading loans with up to 10x leverage. And the loans will be subjected to interest rate.

Also, in 2018, they will launch ICO underwriting service, and will charge a certain percentage of the tokens that is underwritten by them.

Basically you can trade with 0 fees, but as soon as you use margin trading you will pay interest on the borrowed capital.

We designed our exchange platform to process more than one million orders per second, offering a “true” real-time trading with no transaction limits.

That’s what they say. Also I found in the whitepaper that they intend to move towards a decentralized model in the future.

The exchange seems interesting.

What caught my attention besides the 0 fees was the fact that they will have a review team that will go through all the ICOs and they will facilitate ICO investing and will list the tokens right after the ICOs, providing much needed liquidity. Currently you have to wait months until the ICO token makes its way to an exchange. Cobinhood intends to solve that by listing them right away.

But why do they need that COB token I asked myself. All sounds good to me without it. And I found that it will give some privileges to its users. For example, it will give a 50% discount on margin trading using COB instead of BTC or Fiat. The underwriting service will undoubtedly be connected to Cob as well. And their CEO said in an interview that in the future there will be more privileges to Cob holders, what privileges? I guess we’ll have to wait and see.

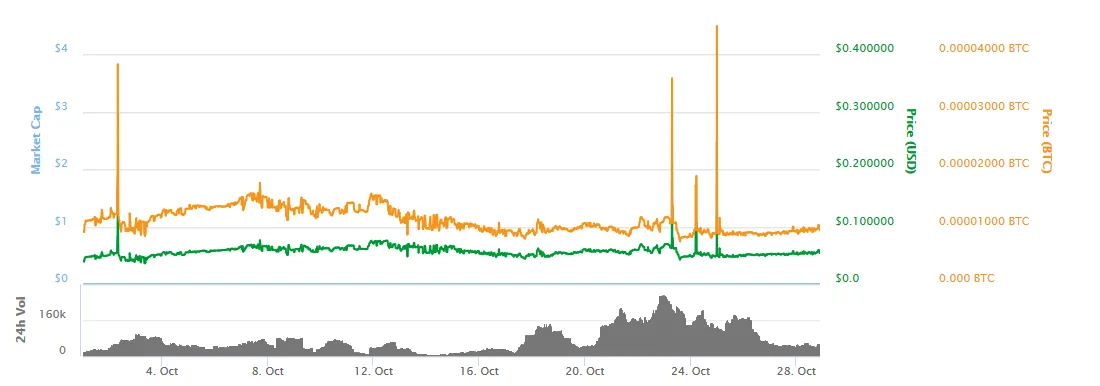

The ICO price of COB what around $0.040. Now is currently trading at around $0.054. It seems like it didn’t explode yet, and I’m not necessarily implying that it will. There is a chance that it might even go to 0. This is crypto after all. You’ll have to do your own research and decide if a project is worth it or not. My mission here was just to bring it to your attention.

What’s my take on it? I like the idea of zero fee trades. Cob token might actually be ignored. But I believe Cob might increase in value if the exchange gains traction. So I don’t mind throwing something at it and poke it with a stick to see if it will moon. Either way I hope to recoup my investment by saving on fees if things go south. But I think that will not be the case.

The exchange will be launched this November.

Bellow is the roadmap.

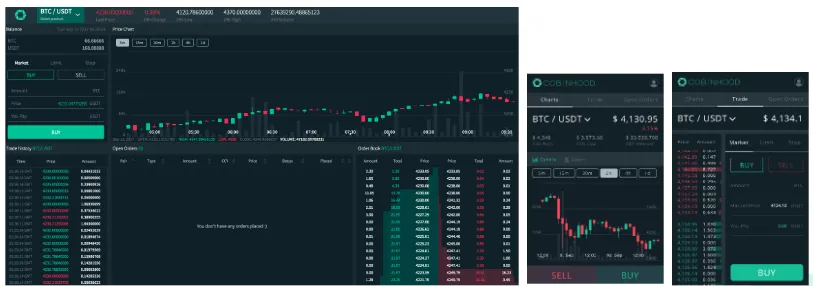

And here is their trading interface. Looks nice, I hope functionally it won't be another "Kraken".

And here is the site where all the pictures and most of the info came from - Cobinhood

Best of luck, fellow Steemians!