As this cryptocurrency bear market continues, many have started to wonder… when will the bottom happen? A common saying in the trading world is “Trend is your friend until it's not.”

Over the past week, Bitcoin has risen around 15% from $3700 to $4200. While this by no means signifies a bottom, it's one of the largest signs of strength we’ve seen in a while. Bitcoin is typically the leading cryptocurrency in terms of price action, so this large move followed by an altcoin rally would be a fantastic sign.

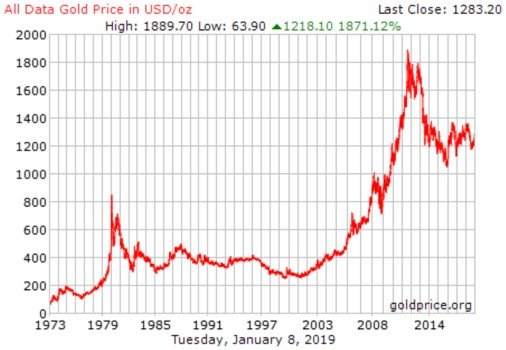

Market bottoms can take a long time to happen. Below is a historical chart of gold vs the US dollar over time. Look familiar? It should, as Bitcoin and the entirety of the cryptocurrency market have done this pattern several times over. Gold’s price spike in the 1980s took over 20 years to completely bottom out before reaching much higher highs.

As you can see in gold’s case, catching the exact market bottom can be extremely difficult. They can take a long time, and when they do occur, they are typically quick and violent. There are a few ways you can apply this knowledge to the current cryptocurrency market. We already see some smart traders doing this now by looking at the order book on several large exchanges.

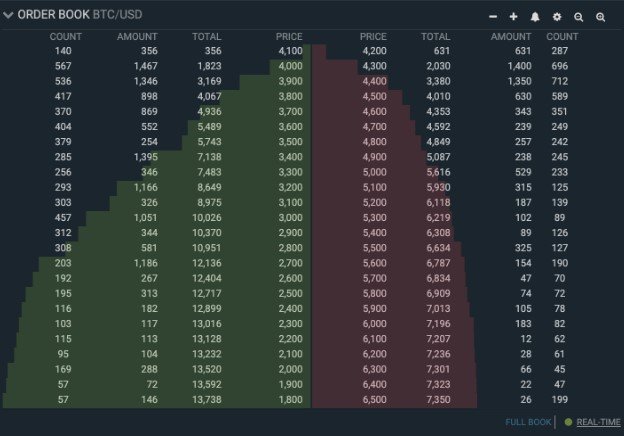

Here we have the Bitfinex BTC/USD order book. Behind the text, there is a helpful illustration showing the “depth” of the buying and selling on Bitfinex. Take a look at how many orders are around the $2,700 to $2,800 area. This should provide an enormous amount of support should the price fall to that area.

When the exact bottom happens, it will most likely be quick. A good way to prepare would be by placing some low orders. Worst case scenario, they don’t get filled and Bitcoin continues to rise! Overall, one of the best ways to get the asset of your choice for the best price is to cost average in. Trading can be extremely difficult and is not for everyone.

Do you think the bottom is in for cryptocurrencies? Let us know in the comment section below.

Disclaimer: This article is not meant to constitute trading or investment advice. Take caution when performing trades and always do your own due diligence.